GOLD PRICES OUTLOOK:

- Gold prices (XAU/USD) sink at the start of the week, punished by rising U.S. Treasury yields and improving market mood

- Stabilizing sentiment may undermine precious metals in the coming days, but the medium-term outlook remains bullish

- This article looks at key XAU/USD technical levels to watch this week

Most Read: Nasdaq 100 Price Outlook - SVB Sale Soothes Markets, Risk Sentiment

Gold prices retreated on Monday, punished by rising U.S. Treasury yields and lower safe-haven demand. In early afternoon trading, the yellow metal (XAU/USD) was down about 1.5% to $1,955, slightly above its session’s low of $1,945.

The market mood, while still cautious, was more positive following news that First Citizens Bancshares agreed to acquire large parts of the bankrupt Silicon Valley Bank from the Federal Deposit Insurance Corporation, a move that could help reduce elevated uncertainty in the banking system.

Media reports that U.S. authorities will expand the emergency lending program currently in place to support troubled lenders in need of liquidity also helped calm nerves on Wall Street, limiting appetite for defensive positions.

While stabilizing sentiment may cap gold's near-term upside, there are looming tailwinds on the horizon for precious metals. For instance, the increased likelihood of the U.S. economy entering a recession in the second half of the year on the back of tighter credit conditions should be seen as a bullish catalyst in the medium term.

| Change in | Longs | Shorts | OI |

| Daily | 1% | -3% | -1% |

| Weekly | 2% | -8% | -2% |

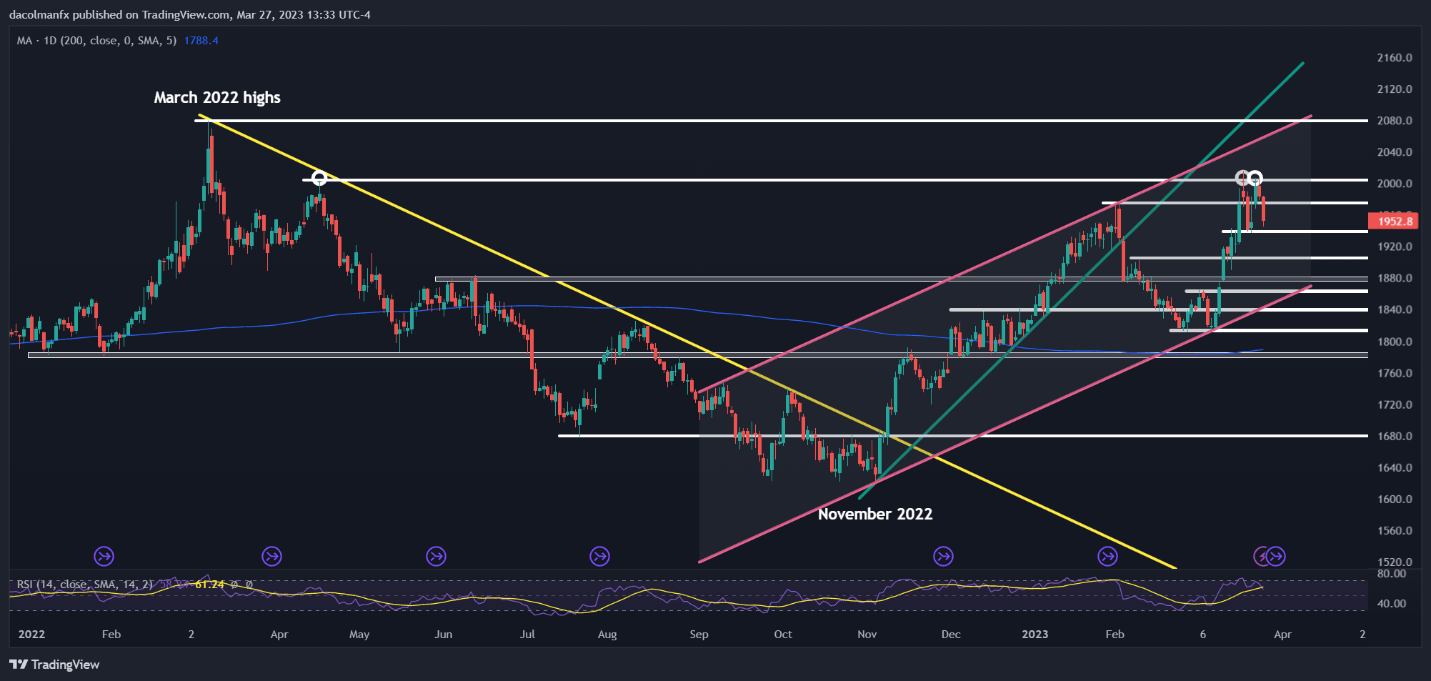

In terms of technical analysis, gold prices have failed to clear the $2,000/$2,005 area despite several breakout attempts, with sellers pouncing and triggering a reversal at every opportunity in recent days, signaling that bulls may be bailing, at least for now.

Given that bullish momentum is presenting clear signs of exhaustion, XAU/USD could run a little lower before bottoming out, with initial support at $1,940, followed by $1,905. On further weakness, the next downside target appears at $1,880.

Conversely, if bulls regain decisively control of the market and spark a solid rebound, technical resistance can be seen near $1,975, and $2,000/$2,005 thereafter. If gold manages to climb above these technical barriers in a decisive fashion, we could see a move towards $2,050 in short order.

GOLD PRICES TECHNICAL CHART