S&P 500, FOMC, Dollar, USDJPY, EURUSD, Yields and Recession Talking Points:

- The Market Perspective: USDJPY Bearish Below 141.50; Gold Bearish Below 1,680

- After the FOMC’s hearty rate hike and a mix of divergent monetary policy actions by major central banks on Thursday the Dow finds itself on the cliff of a ‘technical bear market’

- Through the end of this week, the top fundamental focus will be on economic growth and ‘recession fears’ with the release of September PMIs

Dow Edges Towards Technical ‘Bear Market’ Again as Deep Fundamental Concerns Arise

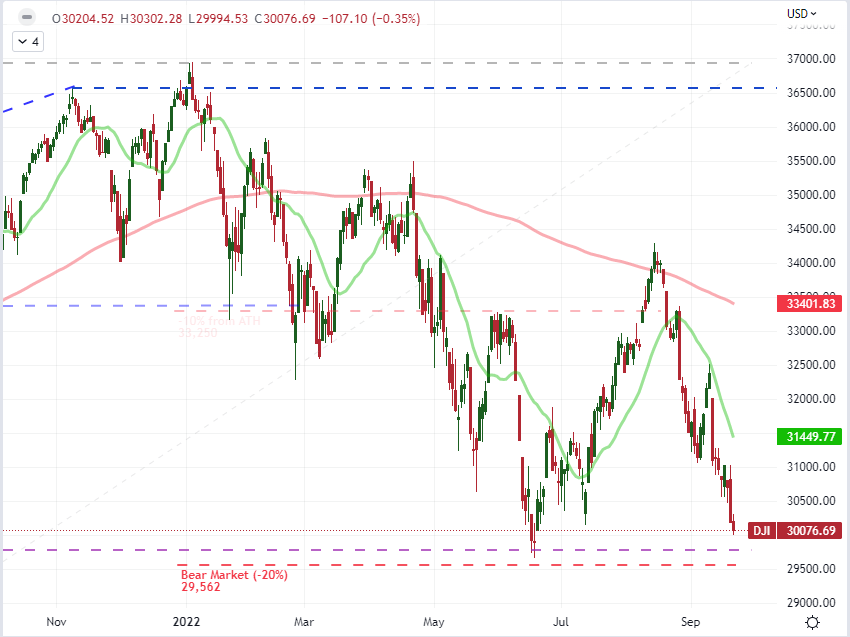

In the landslide of risk assets through mid-June, a number of key benchmarks registered technical ‘bear market’ designation. One very prominent exception was the Dow Jones Industrial Average which managed to reverse course before subducting the 29,562 level that represents a 20 percent correction from all-time highs (the loose definition). With this past session’s New York close, the index is once again within 2 percent of that prominent technical milestone with serious fundamental pressure through aggressive actions by central banks tightening the financial constraints and an outlook of economic trouble on the near horizon. Is there enough momentum to the market’s slide to push this benchmark over the proverbial cliff? Are the September PMIs – as timely proxies to GDP – charged enough to urge a break? And have we shifted definitively into ‘fall trade’ to gain traction on trends? Traders will be watching closely.

Chart of Dow Jones Industrial Average with 20 and 100-Day SMAs (Daily)

Chart Created on Tradingview Platform

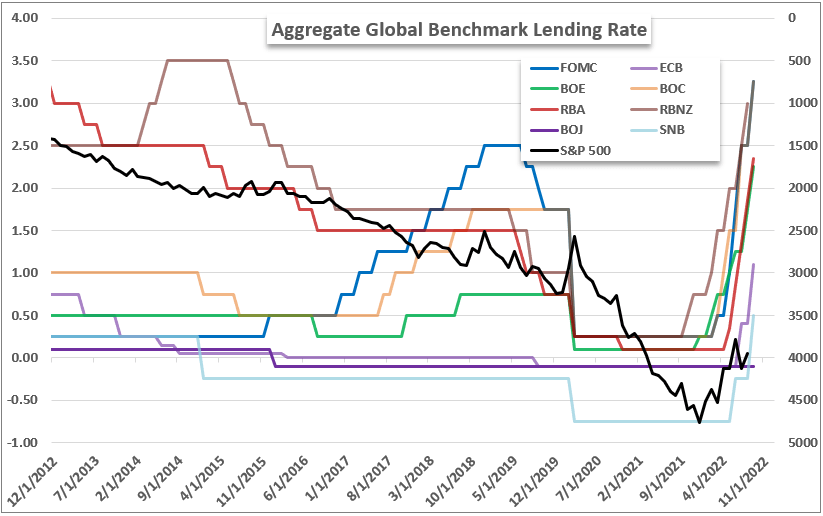

For those that blacked out from global macro news for two day, we have found ourselves back on the ‘risk off’ trajectory in large part due to the Federal Reserve and its major peers committing to their inflation fight. Historically, interest rates are far from the peaks before the Great Financial Crisis (pre-2008), but the markets have essentially adapted to the exceptional accommodation maintained over the interim years. A perpetually low natural yield pushed investors into riskier positions and a serious of short-term swoons in the capital markets fended off by policy authorities supported a sense of automated support for risk takers. That is clearly being put to the test now with the warnings issued by central bankers. However, I don’t believe the implications of personal responsibility for risk exposure is fully appreciated. The realization is dawning slowly.

Chart of S&P Overlaid with Aggregate Major Central Banks Balance Sheets (Monthly)

Chart Created by John Kicklighter

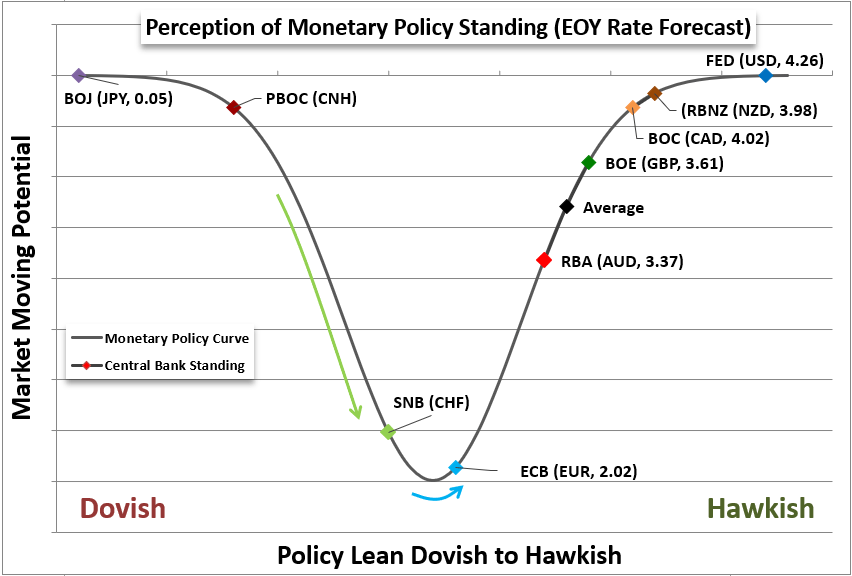

The BOJ and Intervention Push USDJPY, SNB Marks the Biggest Policy Swing

Looking back over the past 24 hours, there have been a number of remarkable central bank updates – even excluding the FOMC decision. The Bank of England’s (BOE) decision to hike 50bps was perhaps the most restrained event, but that didn’t prevent the Cable’s (GBPUSD) slide to fresh multi-decade lows. That seems more on the dimension of the dimension of growth given that the MPC warned that the UK may already be in a recession, while the Fed has danced around the forecast. A step up was the Turkish Central Bank which has broken from Western monetary policy convention with a surprise 100bp rate cut despite an 80 percent-plus inflation rate. USDTRY has pushed to fresh record highs in response. On the opposite extreme, the Swiss Franc hiked 75bps points as expected – pushing the yield back into positive terrtory – and adding fundamental weight to EURCHF record low drive.

Chart of Relative Monetary Policy Standings Among Major Central Banks

Chart Created by John Kicklighter

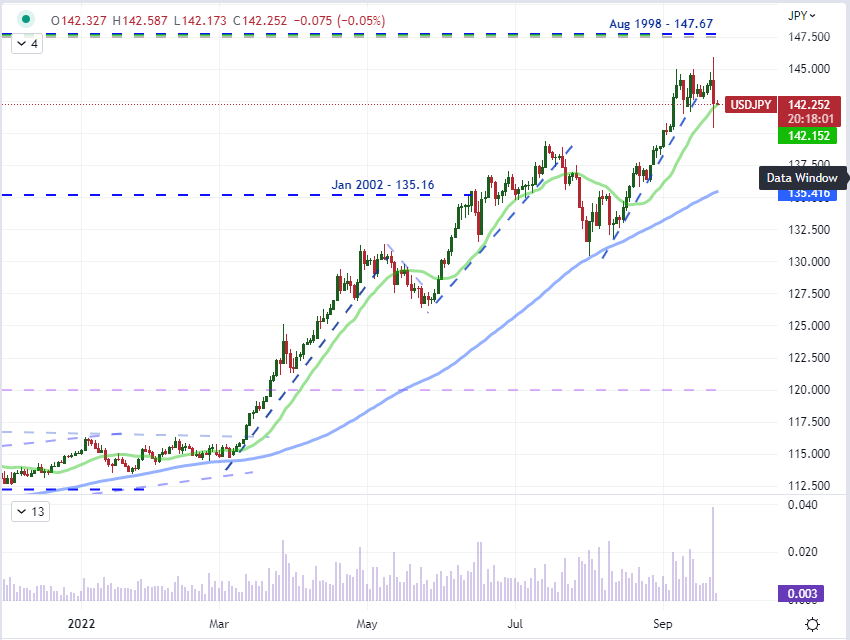

Of all the major – and emerging – central bank rate decisions, the Bank of Japan’s (BOJ) policy decision still stands out to me as the most exceptional. As expected, the group maintained its extremely accommodative stance to fully break from its largest counterparts. That naturally creates a problematic feedback look where capital continues to flee Japan due to the problematic carry, but the added recognition that the support is not stoking meaningful economic lift is only compounding its problems. USDJPY and the Yen crosses naturally pushed higher in response, so the Ministry of Finance had to finally step in. I took a poll earlier this month asking participants what they believe the probability of intervention on behalf of the Yen was, and it was remarkably close to 50/50. Well, they announced an effort to by the Japanese Yen (sell the Dollar) this past session. It was an abrupt response, but history suggests it is unlikely to last without more systemic changes.

Chart of USDJPY with 20 and 100-Day SMAs and 1-Day Historical Range (Daily)

Chart Created on Tradingview Platform

For Friday: Data on the Progress Towards Recession

Looking ahead to the final 24 hours of trade this week, there is serious event risk to contribute to underlying trends. While inflation is a principal central bank concern, the markets seem more worried about the rate hikes themselves. I am focused further long the fundamental road to the ultimate influence on economic output. While unrelentingly extreme inflation may be a greater problem altogether, an outright and broad recession is a close second problem. We seem to be going down this road with measures like the US 10-year / 2-year Treasury yield spread (the ‘2-10 spread’) pushing the most extreme inversion in decades. Despite the signs and warnings, though, it doesn’t seem that the market is on full alert. That could change quickly.

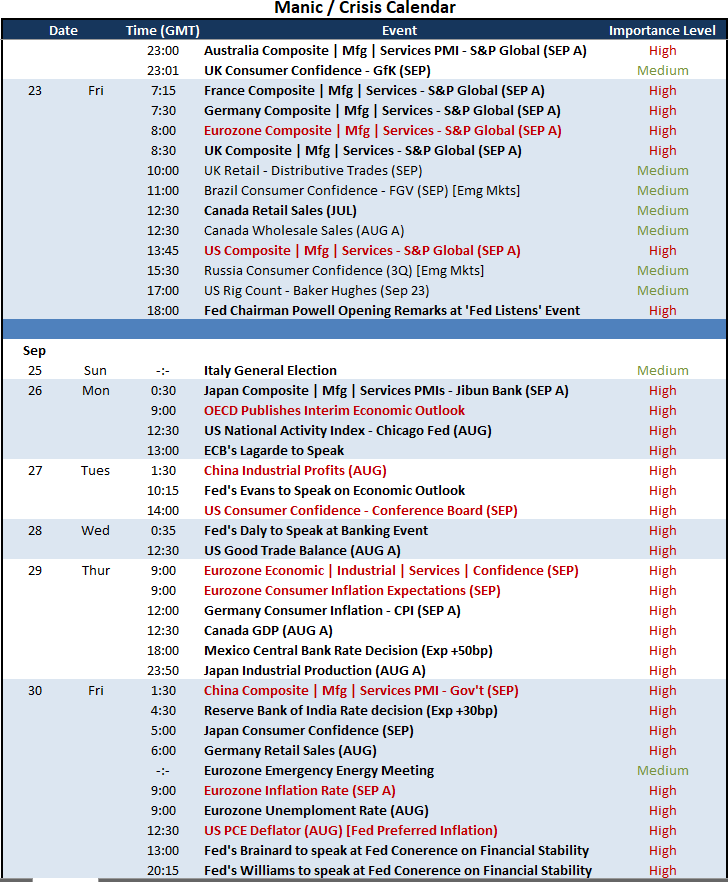

Critical Macro Event Risk on Global Economic Calendar for Friday and Next Week

Calendar Created by John Kicklighter

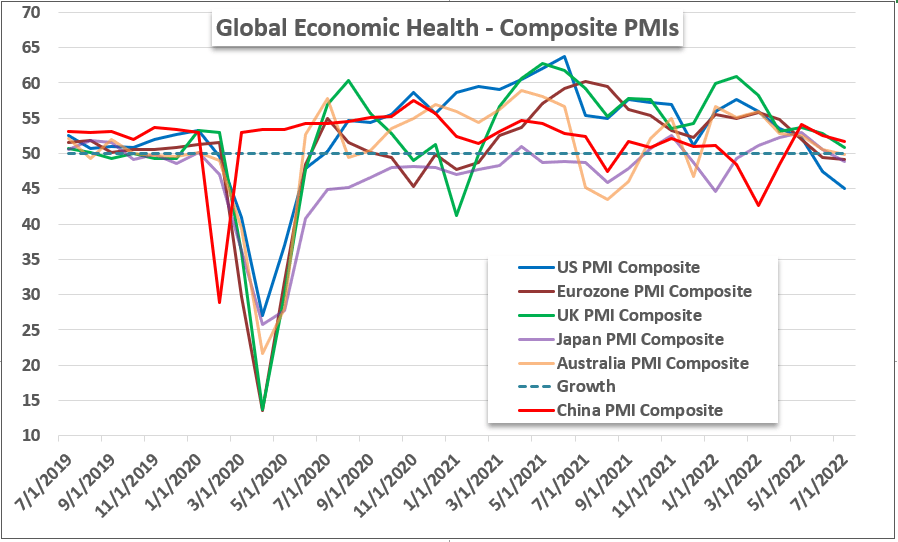

Through Friday trade, my top focus will be on the run of data that could best be described as a timely update on GDP for some of the largest economies in the world: the September PMIs. While we will have to wait for the Japanese and Chinese readings until next week; what is due Friday includes Australia, the Eurozone, Germany, France, the United Kingdom and the United States. That is a significant overview of the global economy. As it stands, these major economies have seen their measures trend lower for a few months with the US and Eurozone posting very notable readings that align to contraction (below 50) this past month. Relief now could go a long way for worry, but further pain has a ready transmission to a frayed nerve.

Chart of Composite PMI Measures for Major Economies (Monthly)

Chart Made by John Kicklighter with Data from S&P Global