Market Week Ahead: Gold Tests $2k, GBP/USD, EUR/USD Pop, USD Sags

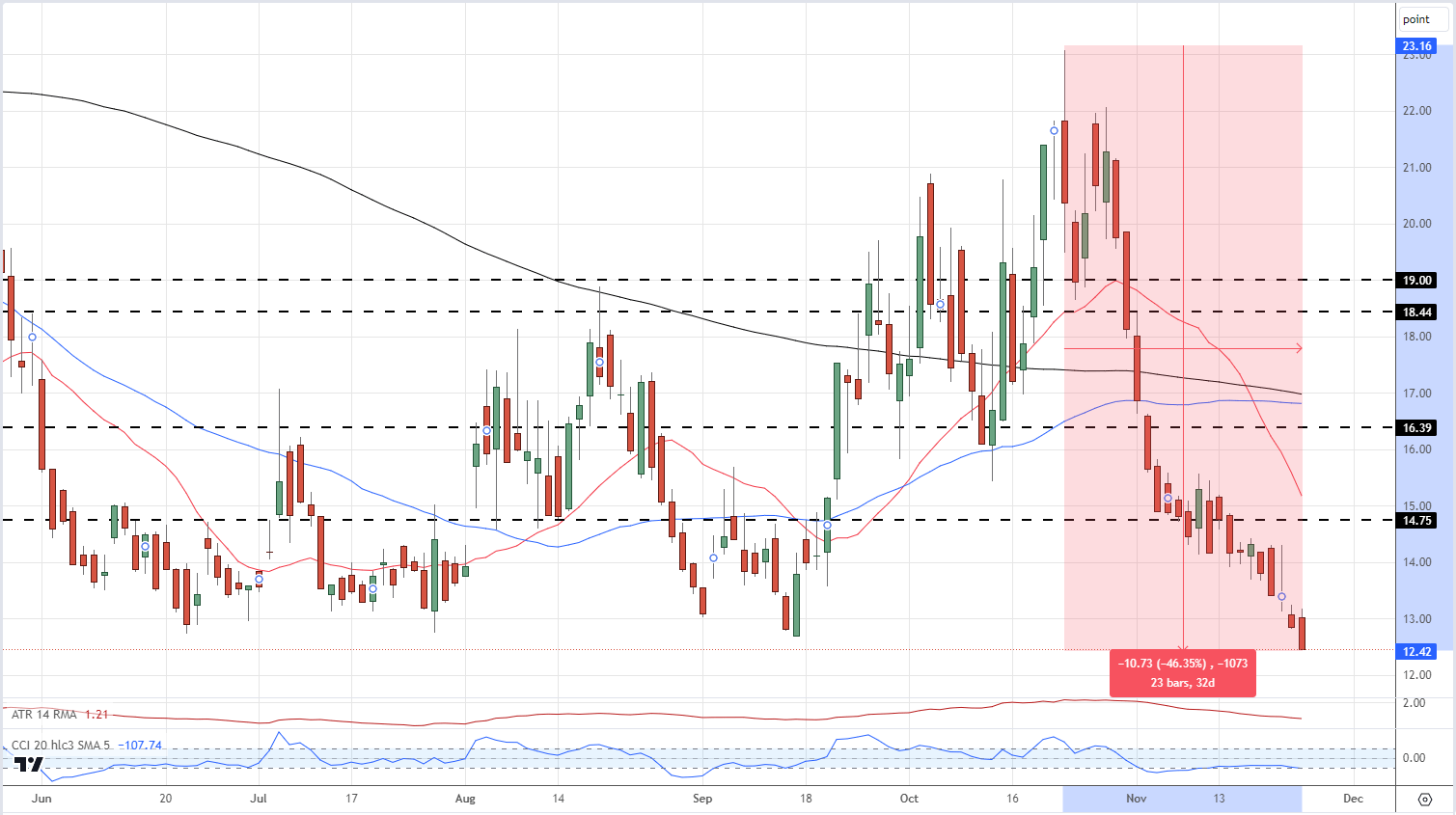

Markets remain risk-on with a range of US equity markets posting fresh multi-month highs. The VIX ‘fear gauge’ is at lows last seen at the start of 2020 and has fallen in excess of 46% from its late-October spike high. The growing feeling that interest rates have peaked around the globe is fueling the feel-good feeling and with rate cuts expected at the end of Q2 2024, the move higher may have more to go in the coming months.

Learn How to Trade the Trend with our Complimentary Guide

VIX Daily Chart

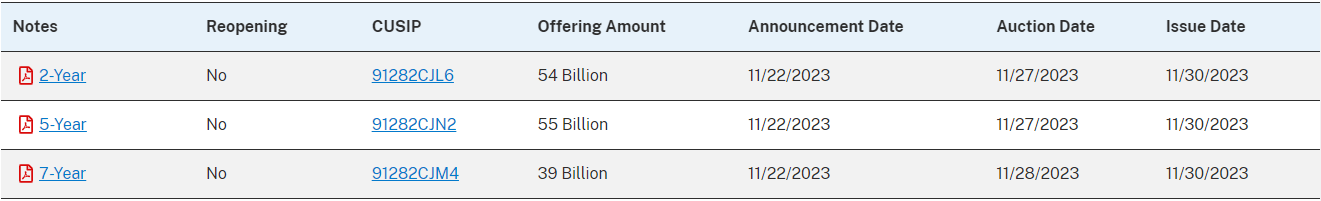

The US dollar remains on the backfoot and is within touching distance of making a fresh multi-month low, despite US Treasury yields edging higher. Next week there is a large sale of 2-, 5-, and 7-year US Treasuries and it seems that the market is pushing for higher yields before the $148 billion of paper hits the street.

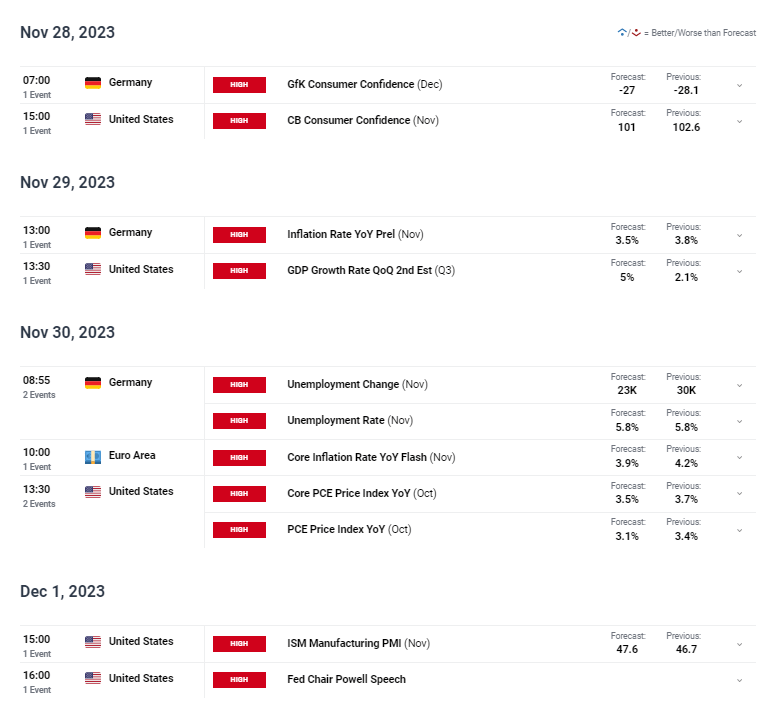

There are a few high-impact economic data releases on the calendar next week with the 2nd look at US GDP and Euro Area and US inflation the standouts. Fed Chair Jerome Powell also speaks at the end of the week.

For all market-moving economic data and events, see the DailyFX Calendar

Technical and Fundamental Forecasts – w/c November 27th

British Pound (GBP) Weekly Forecast: Data and Monetary Policy Align, Doubts Remain

The British Pound is back at highs not seen since early September against the United States Dollar. Indeed, it looks perhaps surprisingly comfortable above $ .1.25 on its twin pillars of monetary support and, as rarely of late, economic data.

Gold (XAU/USD), Silver (XAG/USD) Hold the High Ground as Oil Prices Eye a Recovery

Gold and Silver prices enjoyed a positive week as buyers kept both metals supported with a struggling US Dollar helping as well. Both Gold and Silver threatened a selloff this week, but buyers kept prices steady for the majority of what was a shortened trading week. Looking at Gold though and the failure to find acceptance above the $2000/oz mark could leave the precious metal vulnerable heading into next week.

Euro (EUR) Forecast: EUR/USD and EUR/GBP Week Ahead Outlooks

FX markets have been relatively quiet overall in a holiday-shortened week, with the British Pound the notable exception. The Euro has edged higher against the US dollar, consolidating its recent gains, while the single currency has struggled against the British Pound and is back at lows last seen over two weeks ago.

US Dollar Forecast: Growth and Inflation to Extend the USD Sell-Off?

The dollar has been moving lower, in a similar fashion to US yields and US economic data as the world’s largest economy appears to be feeling the effects of tight financial conditions. Labor data has eased since the October NFP report, retail sales, and CPI data dropped and overall sentiment data has been revised lower too.

USD/JPY Weekly Forecast: BoJ Policy Change Reinforced by Japanese CPI

The Japanese Yen ended the trading week on a muted tone due to the US Thanksgiving Day hangover but Friday held some key information to factor into the Bank of Japan’s (BOJ) analysis. Once again, headline inflation held above 2% whilst beating estimates and remaining above 3%

Trading is all About Confidence - Download our Free Guide to Help You Build your Confidence

All Articles Written by DailyFX Analysts and Strategists