XAU/USD, CPI, Fed, Technical Analysis - Briefing:

- Gold prices trade optimistic before highly anticipated US CPI

- An elevated core reading would likely keep the Fed hawkish

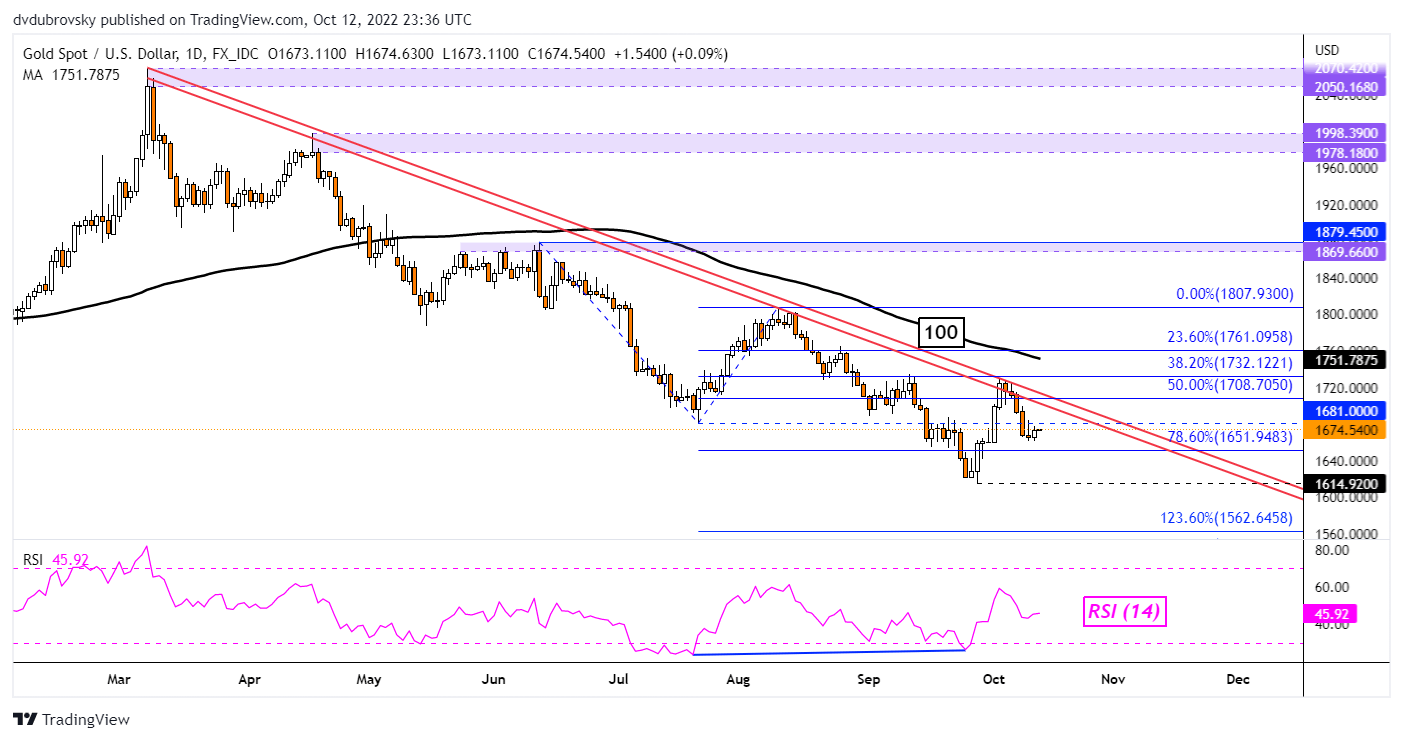

- XAU/USD key falling trendline from March was reinforced

Gold prices aimed slightly higher over the past 24 hours, seeing most of the boost from Wednesday’s Wall Street trading session. There, the minutes from the September FOMC monetary policy announcement showed that ‘several’ members saw a need to calibrate tightening to mitigate risks. Aside from that, there was not much of a surprise. The same story goes, further policy hikes are likely in the cards.

What is going to be more important than the FOMC minutes is Thursday’s US inflation report. The headline rate of inflation is seen weakening from 8.3% y/y to 8.1%. More worryingly for the Fed, the core gauge, which strips out volatile food and energy prices, is seen climbing from 6.3% to 6.5%. A key source of this push is likely coming from rising rents, which is contributing to the largest weight of the metric - housing.

Looking at the Citi Economic Surprise index tracking the US, the gauge has been climbing since June. This has been increasingly suggesting that economists have been underestimating the health and vigor of the economy. As such, this may open the door to another upside surprise in the data. That will likely not bode well for gold.

A 75-basis point Fed rate hike is largely priced in for November, followed by another 50 in December. A strong inflation print could boost the latter to 75. That may in turn boost the US Dollar and Treasury yields. For anti-fiat gold prices, that would likely spell disaster. With that in mind, what are key technical levels to watch ahead of the US CPI report?

Gold Technical Analysis

In the event of a downward path ahead, the September low at 1614 is a key suspect for support. Confirming a breakout under this price could open the door to downtrend resumption, as well as the lowest point since March 2020. On the flip side, a push higher places the focus on the falling trendline from March. The latter could reinstate the dominant downside focus.

XAU/USD Daily Chart

Chart Created Using TradingView

--- Written by Daniel Dubrovsky, Strategist for DailyFX.com

To contact Daniel, use the comments section below or@ddubrovskyFXon Twitter