Gold, XAU/USD, US Dollar, Jobs, Fed, Crude Oil, USD/JPY - Talking Points

- Gold found some support today after wilting overnight

- The US Dollar resumed strengthening yesterday after solid data

- If the markets understand the Fed correctly, will that drive XAU/USD?

The gold price took a beating overnight after the US Dollar catapulted higher on jobs data revealing a tight labour market.

After making a seven-month peak on Wednesday at US$ 1,865, it pulled back to a low of US$ 1,825 yesterday. The precious metal has consolidated near US$ 1,840 so far today

US Dollar moves have dominated trading in many markets this week with wild swings seen in many currency pairs.

Perceptions of where the Federal Reserve is headed with its rates path continue to be the focus after the ADP national employment report showed 235k jobs were added in December rather than the 150k anticipated.

The robust data could suggest that the Fed may have more work to do regarding price stability. Today’s non-farm payroll figures might provide further volatility.

Fed speakers Esther George and Raphael Bostic maintained the hawkish mantra, but James Bullard wound back on his previously uber-hawkish language.

Wall Street finished its cash session lower on the prospect of tighter monetary policy for longer than previously thought. Futures are pointing to a steady start to their day.

The main APAC stock indices have chalked up modest gains and most currency pairs have made up modest ground against the US Dollar. USD/JPY is an exception, trading slightly higher.

Crude has edged up on the day with the WTI futures contract is near US$ 74.50 bbl and the Brent contract being a touch above US$ 79.50 bbl.

Aside from non-farm payrolls, Euro-wide CPI will be released as well as Canadian employment data.

The full economic calendar can be viewed here.

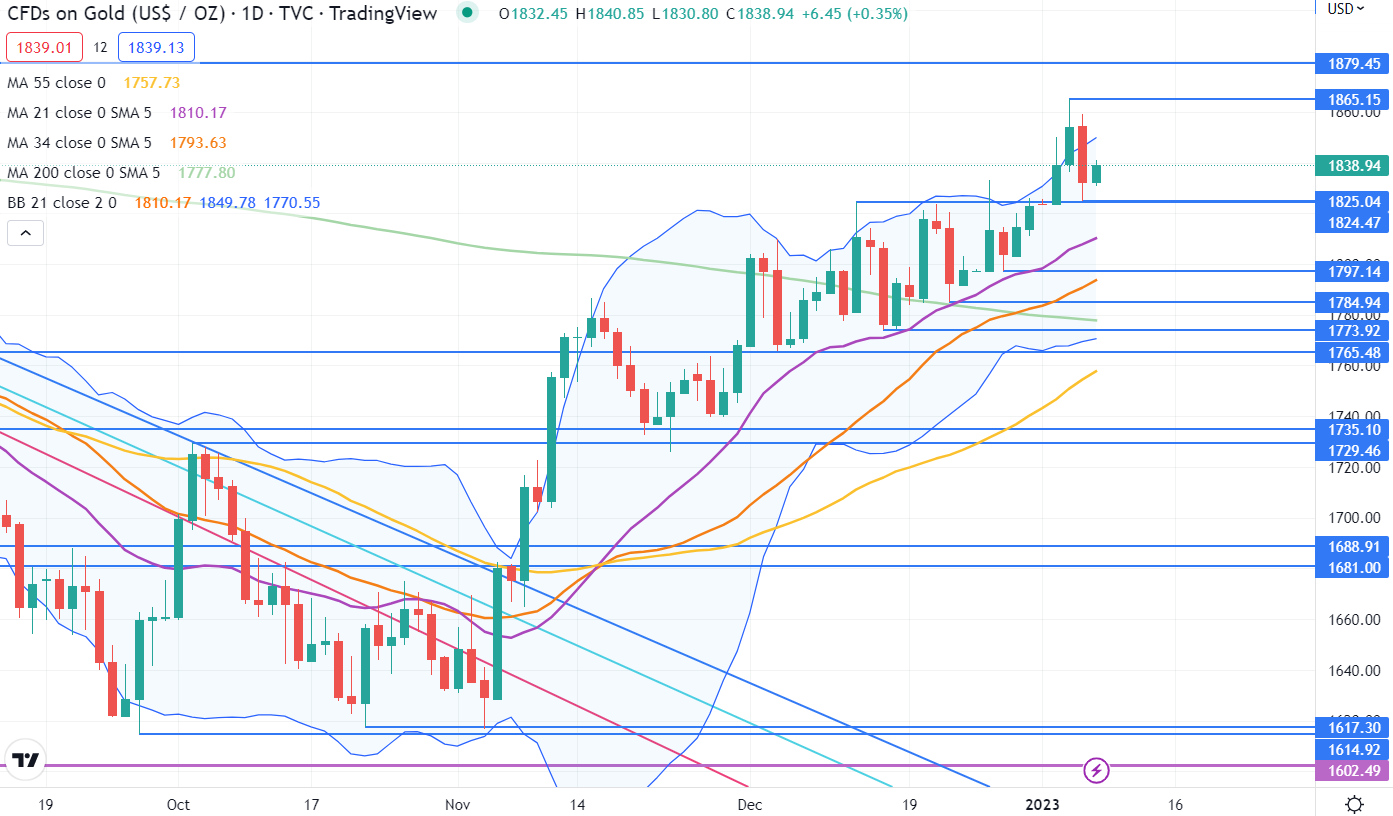

GOLD TECHNICAL ANALYSIS

After making a peak at 1,865 two days ago, gold made a low of 1,825 yesterday, which was also a breakpoint level.

That level may continue to provide support ahead of prior lows at 1,797, and 1,785.

The last few trading days also saw the price above the upper band of the 21-day simple moving average (SMA) based Bollinger Band.

It has since moved back inside the band and this might indicate a pause in bullish momentum or a potential reversal.

Resistance might be at the previous highs of 1,865 and 1,880.

--- Written by Daniel McCarthy, Strategist for DailyFX.com

Please contact Daniel via @DanMcCathyFX on Twitter