EUR/USD ANALYSIS

- EZ and German PMI numbers exceed expectations but was not enough to deter a dwindling euro.

- The move towards parity could come quicker than expected with upcoming U.S. releases.

EURO FUNDAMENTAL BACKDROP

German PMI’s laid the pathway for eurozone data (see economic calendar below) which beat estimates on both services and manufacturing prints. Although the region remains in contractionary territory, the rate of decline was slower than predicted due to softer inflationary forces impacting input prices with regards to the manufacturing sector leading to moderated selling prices.

Trade Smarter - Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

EUR/USD ECONOMIC CALENDAR

Source: DailyFX economic calendar

Unfortunately for the euro, the data beat was not enough to deter the bearish sentiment around the euro including recessionary risks as well as the inability by ECB hawks to support a 75bps interest rate hike in the next meeting. The day ahead should provide more volatility for EUR/USD with U.S. data taking center stage.

TECHNICAL ANALYSIS

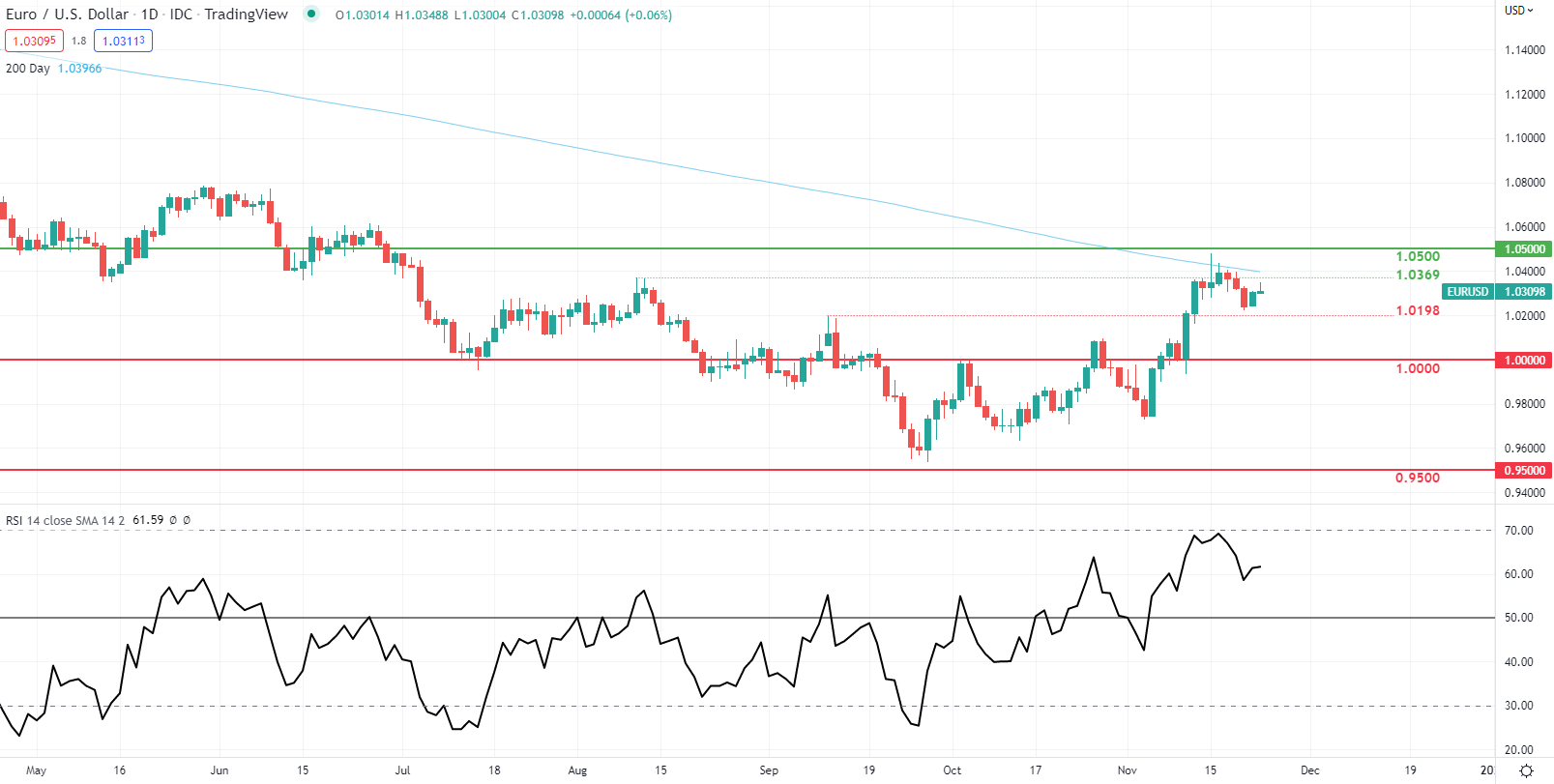

EUR/USD DAILY CHART

Chart prepared by Warren Venketas, IG

EUR/USD price action responded negatively to the aforementioned PMI data and currently resembles a long upper wick on the daily candle which could point to subsequent weakness should the candle close in this fashion.

Resistance levels:

- 1.0500

- 1.0369

Support levels:

- 1.0198

IG CLIENT SENTIMENT DATA: MIXED

IGCS shows retail traders are currently SHORT on EUR/USD, with 56% of traders currently holding long positions (as of this writing). At DailyFX we typically take a contrarian view to crowd sentiment but due to recent changes in long and short positioning, we favor a short-term cautious bias.

Contact and followWarrenon Twitter:@WVenketas