EUR/USD Price, Chart, and Analysis

- Fundamentals and technicals look weak.

- The next ECB policy meeting is over a month away.

The ECB raised all three of its policy rates by 75 basis points at the September 8 central bank meeting, steadying the single currency in the short-term, but with a host of other central banks hiking aggressively since then, including the Federal Reserve, the Euro is back under pressure.

Inflation in the Euro Zone remains excessively high while growth is slumping and interest rates need to be moved higher, according to ECB board member Isabel Schnabel. This acknowledgement of the single block’s economic situation, held by many, will likely mean that the ECB will look at another 75 basis point hike at its next meeting in October. The problem is that this meeting is at the end of the month, October 27, and this leaves the single currency at the mercy of the market for another month, and markets are not being kind to the Euro at the present time. Hawkish talk by ECB members will not be enough to defend the Euro against a rampant US dollar, and with little in the way of solid support on the charts, the pair have only one way to go.

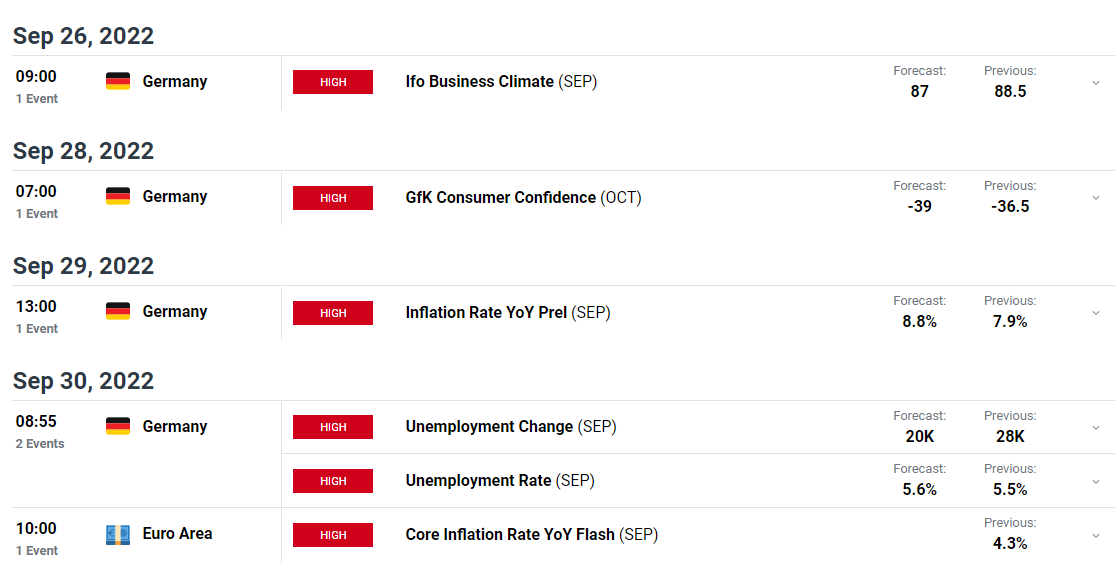

Next week there are a few important German economic releases that need to be closely followed. The IFO business climate and GfK consumer confidence releases are expected to move even lower, adding pressure on the single currency, while the preliminary September inflation release may see price pressures jump to a fresh multi-decade high.

For all market-moving economic releases and events, see the DailyFX Calendar

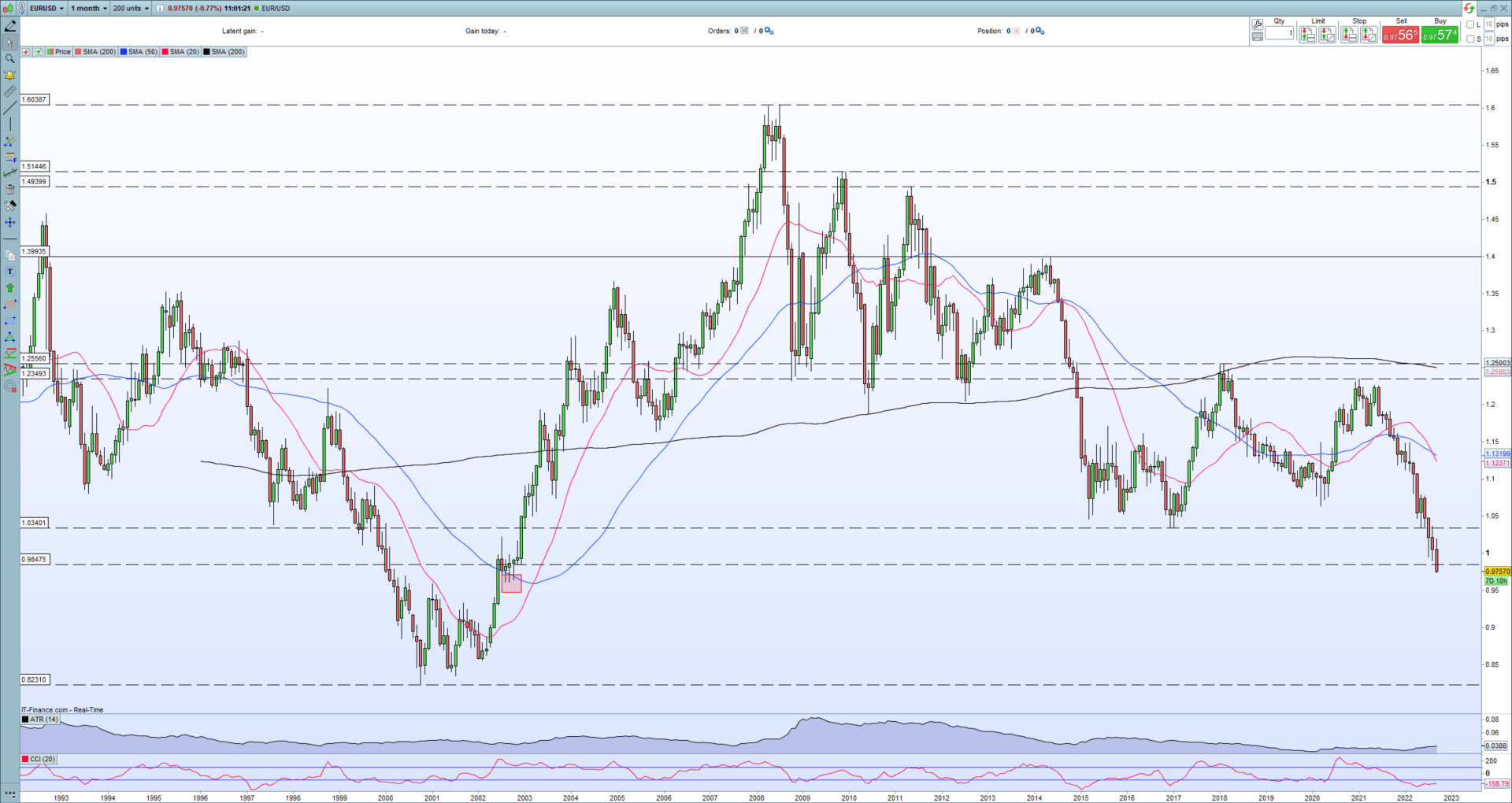

The monthly EUR/USD chart highlights the one-way nature of the pair since June 2021 when a high of 1.2280 was posted. Important support at 1.0340 was broken with ease this time around, while parity (1.0000) offered some short-term support but eventually succumbed. A small cluster of old lows around the 0.9600 area may offer some semblance of support but with the pair stuck in a strong downward trend any support may prove fleeting. The September high of 1.0200 is unlikely to be tested in the short- to medium-term.

EUR/USD Monthly Price Chart September 23, 2022

Retail trader data show 74.31% of traders are net-long with the ratio of traders long to short at 2.89 to 1.The number of traders net-long is 0.41% higher than yesterday and 19.77% higher from last week, while the number of traders net-short is 9.90% higher than yesterday and 35.05% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests EUR/USD prices may continue to fall. Positioning is less net-long than yesterday but more net-long from last week. The combination of current sentiment and recent changes gives us a further mixed EUR/USD trading bias.

| Change in | Longs | Shorts | OI |

| Daily | -1% | -4% | -3% |

| Weekly | 4% | -10% | -5% |

What is your view on the EURO – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.