EUR/USD News and Analysis

- Hawks favour more hikes but divisions within the ECB may soon appear

- EUR/USD key technical levels assessed and analysed. Countertrend price action to start the week

- Drop off in scheduled event risk in Europe and the US this week apart from Powell testimony

- The analysis in this article makes use of chart patterns and key support and resistance levels. For more information visit our comprehensive education library

Hawks Favour More Hikes but Divisions within the ECB May Soon Appear

Isabel Schnabel and Peter Kazimir, hawks within the ECB’s ranks, have communicated their preference to see more rate hikes before witnessing a peak in interest rates. Schnabel opted for an approach that risks doing too much as opposed to doing too little, substantiating that it is trickier to tame inflation once it has become entrenched in the economy.

On the other side of the debate is well known dove and ECB Chief economist, Philip Lane, who suggested that one more hike in July is most likely appropriate while refusing to commit to the same outcome in the following meeting – stating a preference for a data dependent approach.

EUR/USD Key Technical Levels Assessed and Analysed

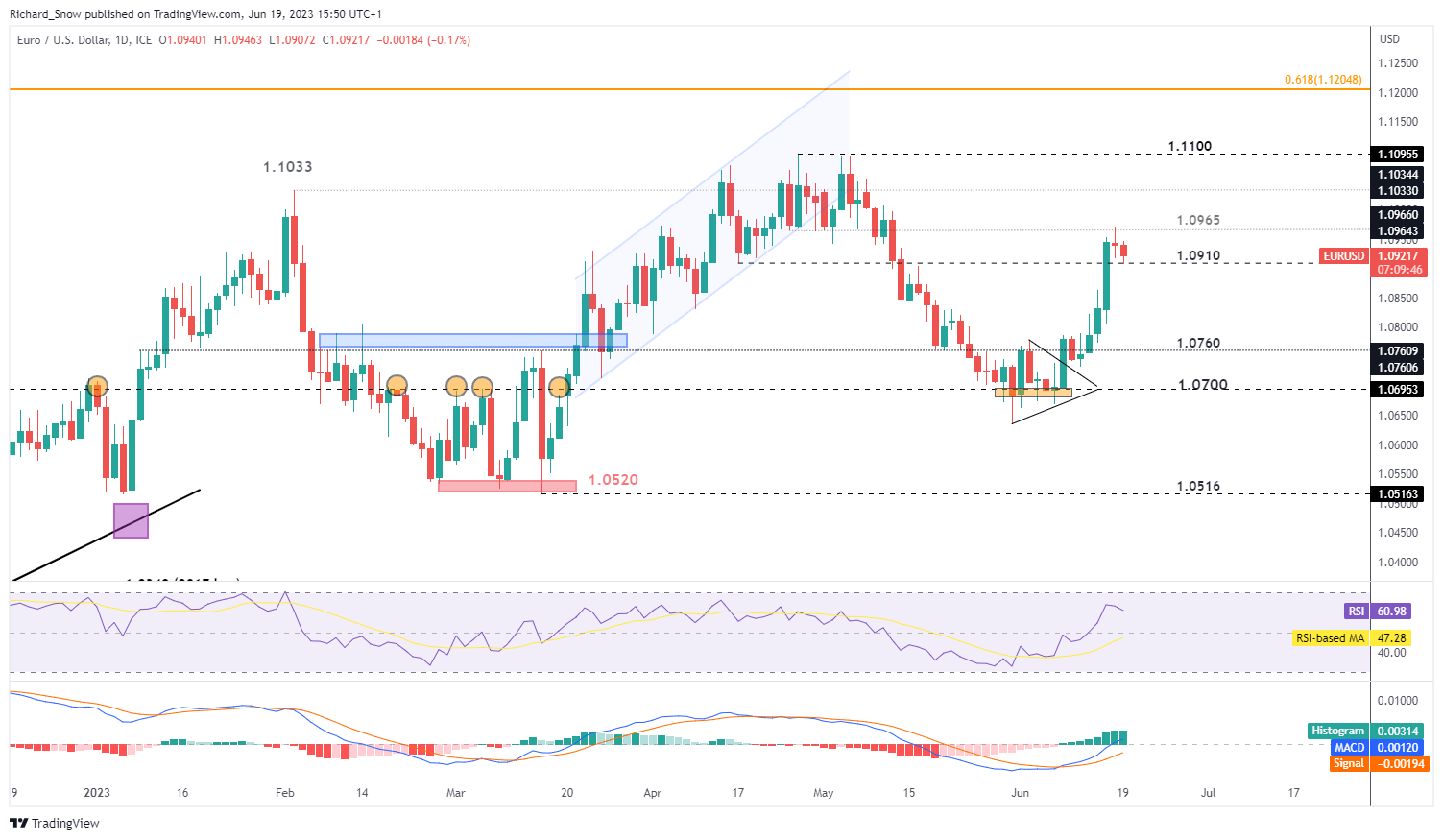

EUR/USD has enjoyed a massive week to the upside last week, rising just short of 200 basis points. Despite a confusing ECB press conference, the overall message from the ECB remained in tightening mode, while US bond markets appear at odds with the hawkish Fed policy statement and economic projections.

1.0965 appeared to be a stretch too far last week and remains the most immediate level of resistance. Heading into this week, with the US on holiday today in observance of Juneteenth, it appears markets are content with a slight countertrend move although, the true test of this short-term direction will be revealed tomorrow when the US is back online.

Immediate support lies at 1.0910 where a break and hold below this level could see prices trading down towards 1.0760 – the next level of support. For now, the MACD suggests that bullish momentum has not yet been wiped out as bulls may eye bullish continuation plays after assessing the extend of the retracement.

EUR/USD Daily Chart

Source: TradingView, prepared by Richard Snow

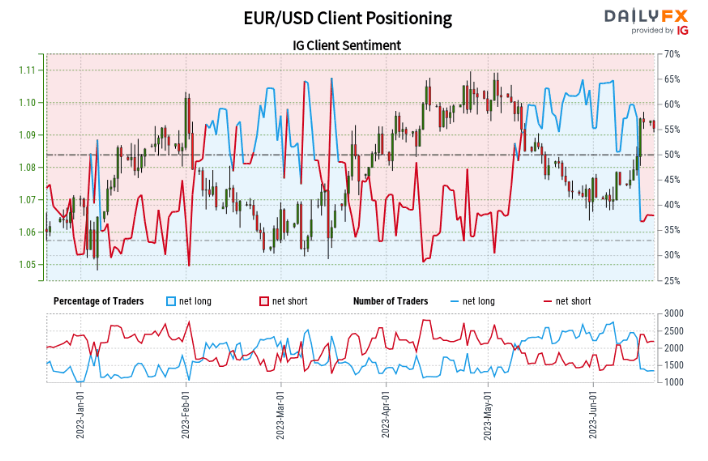

IG Client Sentiment Favors Bullish Continuation Setups after Sentiment Reversal

EUR/USD IG Client Sentiment

Source: IG/DailyFX, prepared by Richard Snow

EUR/USD:Retail trader data shows 38.00% of traders are net-long with the ratio of traders short to long at 1.63 to 1.The number of traders net-long is 4.37% higher than yesterday and 39.12% lower from last week, while the number of traders net-short is 4.45% higher than yesterday and 30.37% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests EUR/USD prices may continue to rise.

Traders are further net-short than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger EUR/USD-bullish contrarian trading outlook.

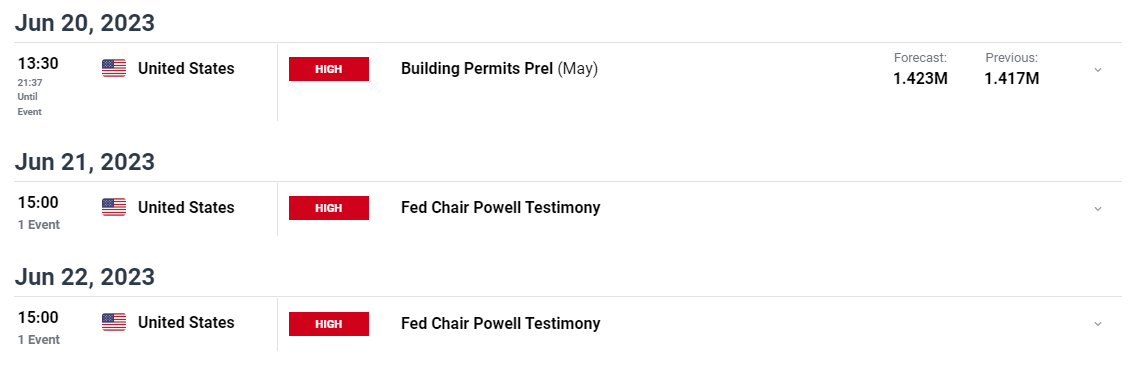

Risk Events for the Week Ahead

Scheduled risk events experience a significant drop-off this week with Jerome Powell’s testimony in front of the US Senate Banking Committee the major event.

Customize and filter live economic data via our DailyFX economic calendar

--- Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX