GBP/USD Analysis and Charts

- BoE voting patterns and the Quarterly Report key for Sterling.

- Sterling’s upside looks limited.

For all central bank meeting dates. See the DailyFX Central Bank Calendar

Today’s BoE decision (12:00 UK) is expected to see the central bank leaving all policy dials untouched but the MPC may give some hints about when UK monetary policy may change. The nine-member MPC vote in March saw eight members vote to keep rates unchanged and one member in favour of a 25 basis point cut. If other MPC members join Swati Dhingra in voting for a cut, Sterling could slide, in the short-term at least.

The latest Quarterly Report will also be released today and this will include updated forecasts for GDP and inflation for the next three years. UK inflation is seen falling further, and sharply according to Governor Bailey, and next year’s inflation forecast may well fall below the central bank’s 2% target. The short end of the UK gilt market will give a better outlook for rate expectations after the report is released.

For all market-moving economic data and events, see the DailyFX Economic Calendar

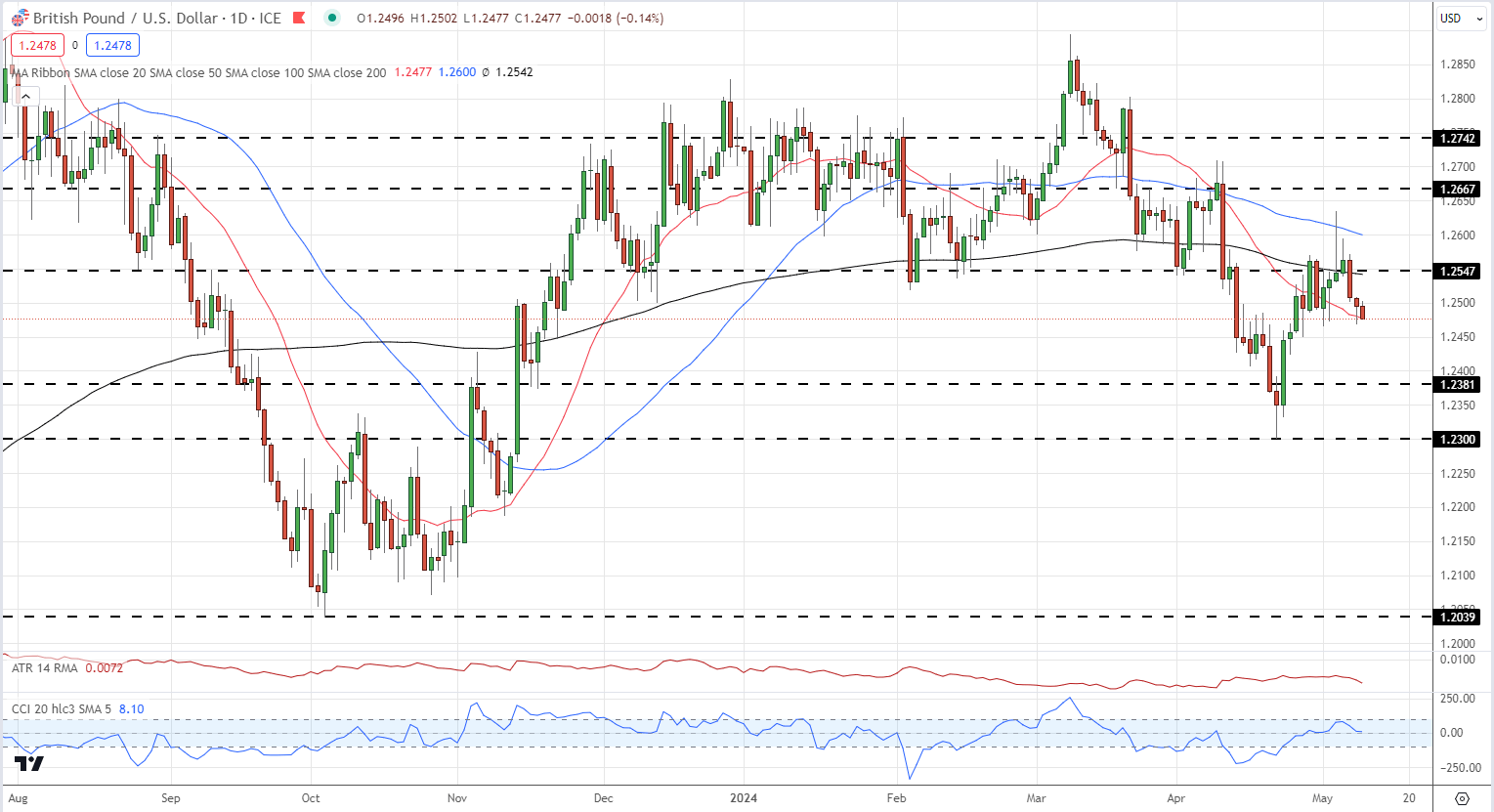

Sterling is likely to slip further unless the BoE unexpectedly takes a hawkish turn, and this could see GBP/USD dipping back below 1.2400. Cable is testing the 20-day sma and a break below would see the pair below all three simple moving averages, giving the market a negative bias. If GBP/USD breaks 1.2400, then 1.2381 comes into view ahead of the multi-month low at 1.2300.

GBP/USD Daily Price Chart

IG Retail data shows 60.77% of traders are net-long with the ratio of traders long to short at 1.55 to 1.The number of traders net-long is 8.88% higher than yesterday and 24.63% higher than last week, while the number of traders net-short is 1.50% lower than yesterday and 5.46% lower than last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests GBP/USD prices may continue to fall.

Download the full report to see how changes in IG Client Sentiment can help your trading decisions:

| Change in | Longs | Shorts | OI |

| Daily | 3% | 2% | 2% |

| Weekly | -33% | 40% | 0% |

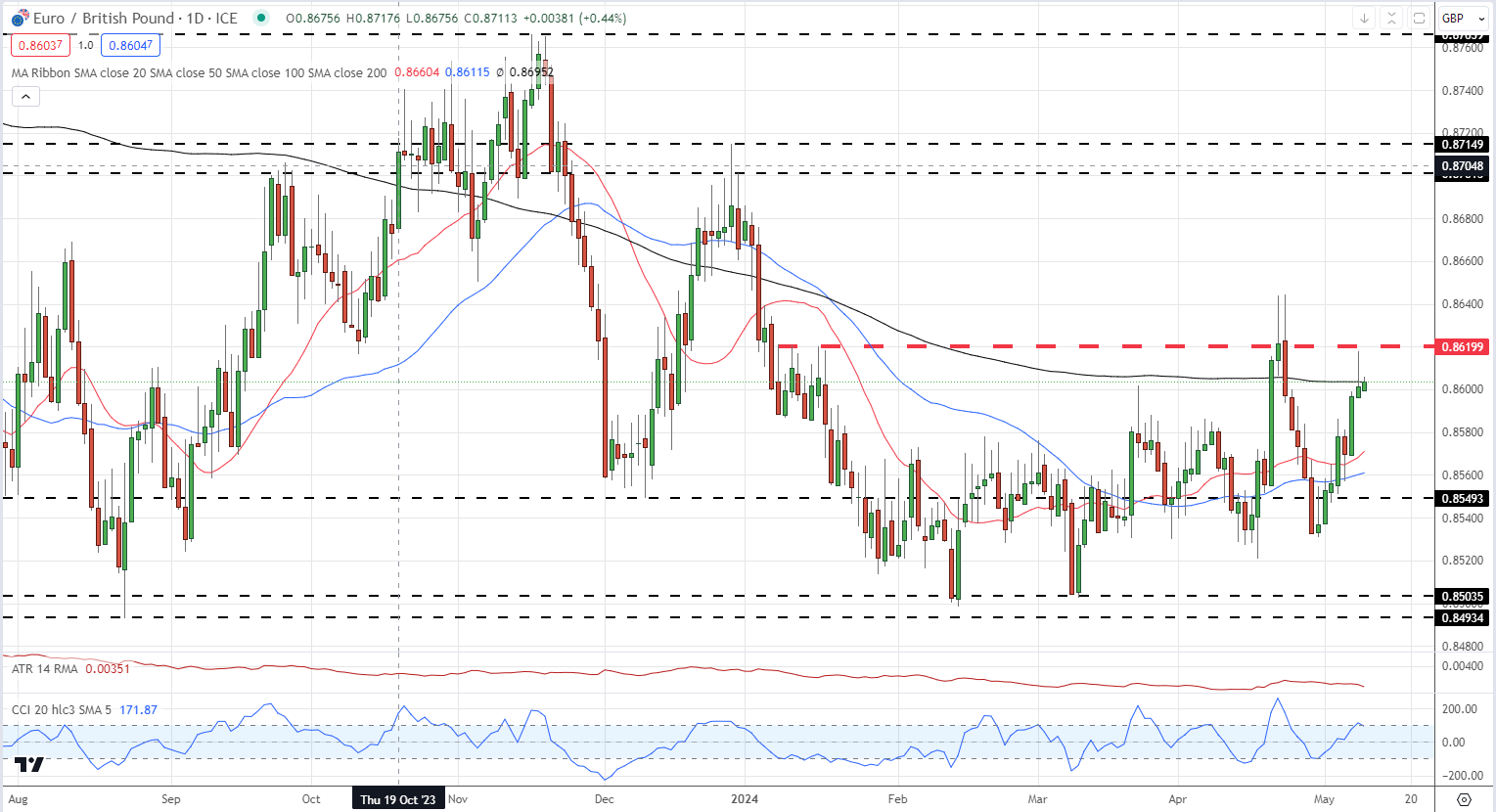

EUR/GBP has been pushing higher, despite the market fully expecting the ECB to start cutting rates in June. EUR/GBP is currently testing the 200-day sma and a break above leaves 0.8620 as the next target. Above here, the late March double-high at 0.8644 comes into play.

EUR/GBP Daily Price Chart

What is your view on the British Pound – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.