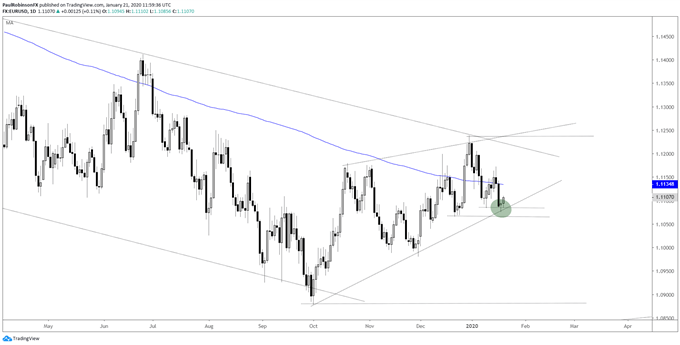

EUR/USD is trying to lift off support via a trend-line off the October low and low created last week. The pattern has been for swings to be faded, the recent down-move counts as a swing, so it would be in-line with the Euro’s character these days to rally a bit. The 11200 area could present problematic as it is near a trend-line that recently turned the Euro lower.

EUR/USD Daily Chart (trying to lift off support)

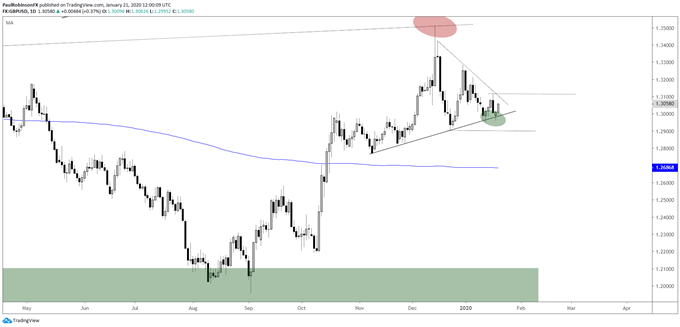

GBP/USD is once again trying to gain its footing off a familiar angle of support, via the line running up from November. We were just there a week-ago. As long as this line holds then so does a neutral to bullish outlook. Price action is wedging pretty quickly towards a make-or-break point. A breakout to the upside would be in-line with the intermediate trend. A break below the aforementioned line could be an explosive one given its budding importance. It’s a wait-and-see game at the moment, but that looks set to change very soon.

GBP/USD Daily Chart (strong support, price wedging up)

Gold reversing like it did a couple of weeks back suggested it was exhausted and due for a digestion phase tilting price neutral to down. Today’s small shot higher and reversal appear to be a failed rally attempt that will lead to a leg lower. It might not be an aggressive sell-off, but one that could lead to $30 or more of room for traders to operate with. Keep an eye on 1536, then the trend-line off the May pivot.

Gold Daily Chart (looking for weakness from here)

For all the charts we looked at, check out the video above…

Resources for Index & Commodity Traders

Whether you are a new or an experienced trader, DailyFX has several resources available to help you; indicator for tracking trader sentiment, quarterly trading forecasts, analytical and educational webinars held daily, and trading guides to help you improve trading performance.

We also have a series of guides for those looking to trade specific markets, such as the S&P 500, Dow, DAX, gold, silver, crude oil, and copper.

---Written by Paul Robinson, Market Analyst

You can follow Paul on Twitter at @PaulRobinsonFX