In today’s webinar we discussed the outlook for the price of gold, and how it continues to be quiet as it works itself further into a developing bull-flag formation. There could be more work on the downside for now, though, before the formation fully forms and officially triggers. At some point it is anticipated to do-so and break through resistance up to 1575 created during the 2011-12 topping process.

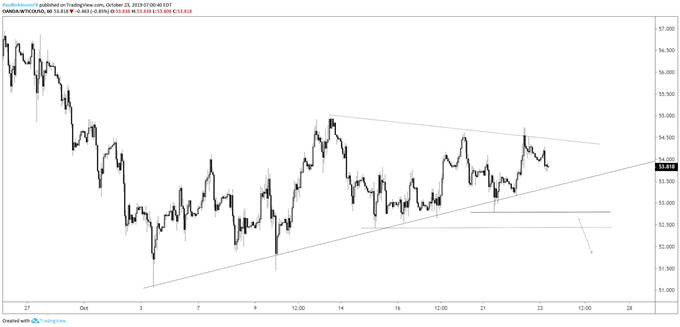

Crude oil is of interest here in the short-term, as it has a pretty clear lower trend-line keeping it support for now. But with the general trading bias negative, this line isn’t seen as holding for much longer. A breakdown could finally get WTI oil down to the 2016 trend-line. Here is one of the oil charts we took a look at in the webinar.

WTI Crude Oil Hourly Chart (Watch lower trend-line support, 52.78)

U.S. stocks continue to bobble around within the confines of a developing wedge formation for the S&P 500 and Dow Jones indices. For now, the outlook is neutral, and we will need to wait for an eventual breakout before getting too excited about either side of the tape.

For the full set of technical details and charts, check out the video above…

Resources for Index & Commodity Traders

Whether you are a new or an experienced trader, DailyFX has several resources available to help you; indicator for tracking trader sentiment, quarterly trading forecasts, analytical and educational webinars held daily, and trading guides to help you improve trading performance.

We also have a series of guides for those looking to trade specific markets, such as the S&P 500, Dow, DAX, gold, silver, crude oil, and copper.

---Written by Paul Robinson, Market Analyst

You can follow Paul on Twitter at @PaulRobinsonFX