Pre-NFP Price Action Setups Across the US Dollar

It’s already been a busy week and tomorrow brings a big item on the economic calendar with the release of US and Canadian jobs at 8:30 AM ET. Non-Farm Payrolls is expected to print at +185k and, as usual, this number is very unpredictable as is the market reaction that usually follows. In this webinar, I looked at setups in the aftermath of this morning’s European Central Bank rate decision, in which the ECB cut growth forecasts, delayed rate hike expectations and announced another fresh round of TLTRO’s.

Forex Talking Points:

- If you’re looking to improve your trading approach, our Traits of Successful Traders research could help. This is based on research derived from actual results from real traders, and this is available to any trader completely free-of-charge.

- If you’re looking for a primer on the FX market, we can help. To get a ground-up explanation behind the Forex market, please click here to access our New to FX Trading Guide.

If you’d like to sign up for our webinars, we host an event on Tuesday and Thursday, each of which can be accessed from the below links:

Tuesday: Tuesday, 1PM ET

Thursday: Thursday 1PM ET

EURUSD Tests 18-Month Lows After ECB Announces Fresh Stimulus

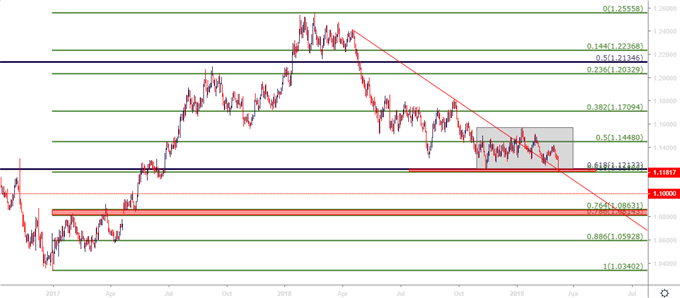

The prime item of excitement across markets today was the ECB announcement of a fresh round of TLTRO’s. This comes in stark contrast to the bank’s move just a few months ago when the ECB announced that they would be exiting their QE program. Since then – European data hasn’t been very encouraging, and this morning saw the ECB cut growth forecasts while kicking rate hike expectations further out into the future. While previously expecting 2019 growth at around 1.7%, the ECB is now looking for 1.1% growth this year; and after saying that they were expecting on rates staying at current levels through ‘the summer of 2019,’ the ECB is now looking at that prospect lasting ‘through the end of 2019.’

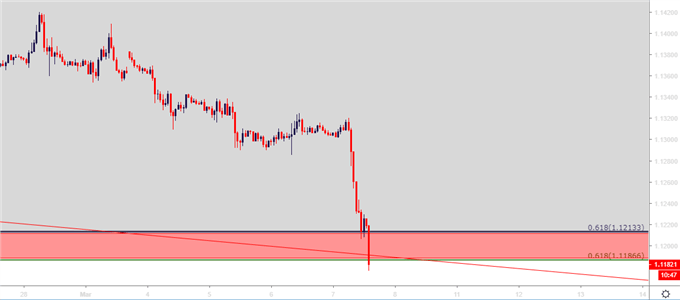

On a short-term basis, EURUSD put in a bearish move to run down towards a long-term support zone that runs from 1.1187-1.1212. But, on a longer-term basis, bears had prime opportunity to really push prices lower today and price action remains near range support…. And tomorrow brings Non-Farm Payrolls out of the United States, so there is certainly scope for more USD volatility.

EURUSD Hourly Price Chart

The big question: Will tomorrow’s NFP finally provide bears the ammunition they need to take-out the 1.1212 level, breaking the range that’s been in-place since November of last year?

EURUSD Daily Price Chart

EURJPY as an Option for Euro Bears

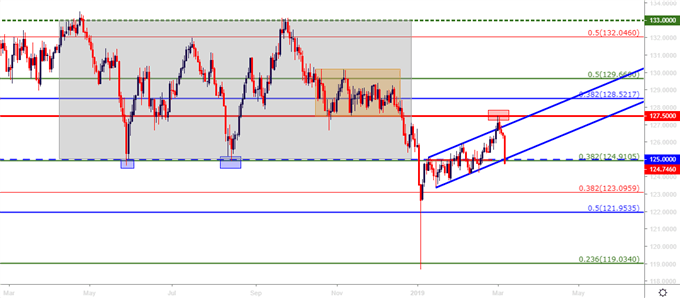

While EURUSD is confounded by a very strong US Dollar nearing a key area of resistance, EURJPY may offer some interest to those looking for short-side strategies on the Euro. A traditionally volatile pairing, EURJPY spent the bulk of last year in a range-bound state, seeing that compression tighten through Q4 until an outsized breakout began to show a couple of weeks ahead of year-end.

The opening days of 2019 saw a surge of Yen-strength as EURJPY traded below 119.00, even if only temporarily. Since then, the bulk of the time has been spent with the pair recovering as shown in a bear flag formation that was discussed last week.

Friday saw a resistance test at prior range support of 127.50, and since then bears have been back, pushing prices all the way down to the 125.00 support level that came into play twice last year. A downside break through this price keeps the door open for bearish continuation strategies.

EURJPY Daily Price Chart

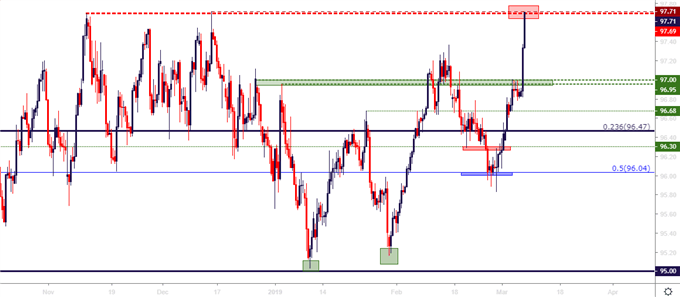

US Dollar Breaks Out in De-Facto Move of Strength

There hasn’t been much bright data out of the US so far today but, nonetheless, the US Dollar is trading at fresh 2019 highs. This is more-likely related to that move in the Euro given the overexposure to EURUSD in DXY; but the US currency is fast-approaching an area of resistance that twice turned around bullish advances last year at 97.71.

US Dollar Daily Price Chart

USDCAD – Canadian Jobs Released at Same Time as NFP

The stage is set for a busy morning in USDCAD as both representative economies are releasing most recent employment numbers at 8:30 AM. USDCAD is in the midst of an interesting scenario at the moment: I had looked at bullish reversals in the pair last Thursday, largely on the basis of a resistance play in Oil. But – as Oil has been stuck in mean-reversion for most of this week, CAD weakness took-over after yesterday’s Bank of Canada rate decision. Prices moved above the 1.3400 level, and buyers have been trepidatious since, making the prospect of bullish continuation strategies a bit more daunting. A pullback to find support at prior areas of resistance like 1.3361-1.3385 or 1.3325 could re-open the door to bullish strategies in the pair.

USDCAD Four-Hour Price Chart

GBPUSD: Wild but, Sticking to the Levels

GBP remains a market vulnerable to headlines as Brexit dynamics will likely continue to drive the waves, and next week brings another chapter with the Tuesday vote. GBPUSD has continued to scale-back the late-February strength, and I had looked at a few levels in the pair on Friday and then again yesterday that remain of note.

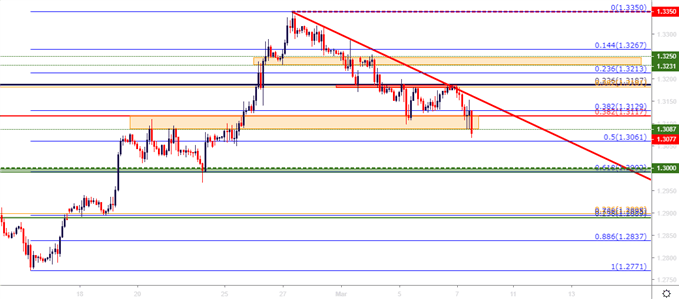

With prices re-testing support at 1.3087-1.3117 after another resistance inflection off of 1.3187, the big item of interest is the 1.3000 psychological level. Just below that at 1.2992 is the 61.8% retracement of that February bullish move, offering a bit of confluence that can remain as support potential in the pair, particularly for those that would like to look at a DXY reversal off of the 97.71 level.

GBPUSD Two-Hour Price Chart

Chart prepared by James Stanley

To read more:

Are you looking for longer-term analysis on the U.S. Dollar? Our DailyFX Forecasts for Q4 have a section for each major currency, and we also offer a plethora of resources on USD-pairs such as EUR/USD, GBP/USD, USD/JPY, AUD/USD. Traders can also stay up with near-term positioning via our IG Client Sentiment Indicator.

Forex Trading Resources

DailyFX offers an abundance of tools, indicators and resources to help traders. For those looking for trading ideas, our IG Client Sentiment shows the positioning of retail traders with actual live trades and positions. Our trading guides bring our DailyFX Quarterly Forecasts and our Top Trading Opportunities; and our real-time news feed has intra-day interactions from the DailyFX team. And if you’re looking for real-time analysis, our DailyFX Webinars offer numerous sessions each week in which you can see how and why we’re looking at what we’re looking at.

If you’re looking for educational information, our New to FX guide is there to help new(er) traders while our Traits of Successful Traders research is built to help sharpen the skill set by focusing on risk and trade management.

--- Written by James Stanley, Strategist for DailyFX.com

Contact and follow James on Twitter: @JStanleyFX