Talking Points:

- An escalation of heated language between the United States and North Korea has led to global concerns over financial stability

- Strong correlation across markets reflects a market-wide shift in risk trends, but conviction is still open to the winds

- Should full-tilt fear seize the financial system what makes the better safe haven: Bitcoin; Yen; Dollar; Treasuries or Other?

How will risk trends develop moving forward and what measures should we monitor to track its progress? Join the Fundamental Trading webinar Monday to find out. Have trading, market or strategy questions? Ask them at Tuesday's Q&A. Sign up on the DailyFX webinar calendar.

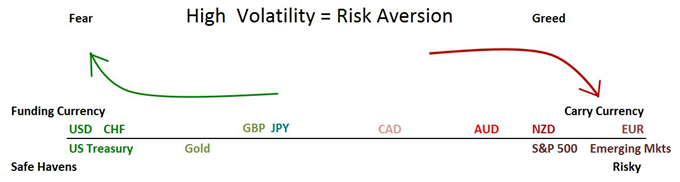

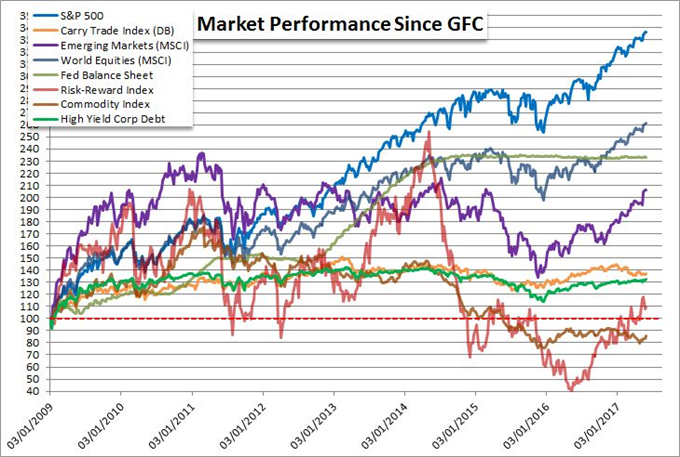

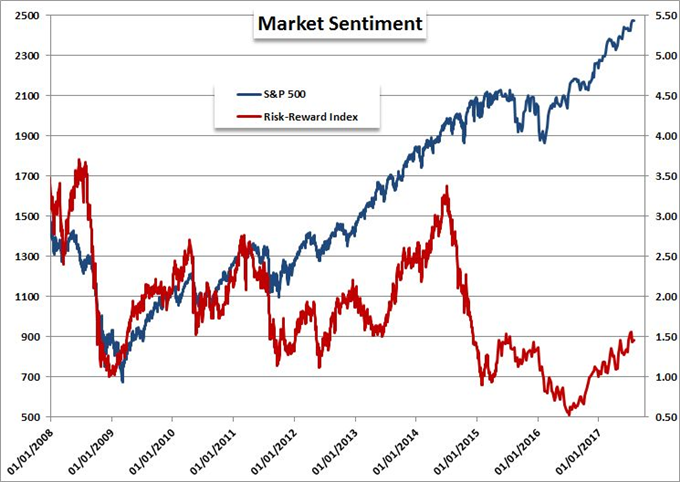

If the markets start to melt down on an escalation of the tensions between North Korea and the United States - or really any serious catalyst - where should traders and investors seek refuge? That is not as clear an answer as some would think. Not all havens are equally poised to benefit in a flight from risk - especially following years of speculative excess that has substantially warped the financial norms. We have seen massive stimulus programs turn some of the stalwarts of the system (like sovereign debt) into outright speculative assets. The rise of new financial products have given access to what were once simple barometers (volatility gauges like the VIX) or inaccessible corners of the market previously only navigated by the most experienced and highly capitalized (emerging markets).

On the risky side of the equation, the at-risk assets seem to be relatively straightforward. As the saying goes when sentiment collapses, correlations go to one. It is impossible to escape the gravity of absolute risk aversion that sees investors divest in all assets dependent on quiet and reach for yield. Despite the reach though, there are those that are due to suffer more. Those markets that have leaned in one direction through the past months and years and have utilized leverage in one form or another to gain altitude stand to lose the most ground. Among the most over bought of the assets on the standard spectrum are equities. The US equity indexes in particular - including the S&P 500 and Dow Jones Industrial Average - have climbed exceptionally high over the years. How those assets on the opposite end of the spectrum react after years of exceptional quiet and escalating exposure depends on the motivation and scale of the slump. The threat of North Korea and/or the US launching an attack possess a distinct threat to the world as growth, stability and liquidity come into immediate focus. What ultimately turns the market to the event horizon of a market collapse are the conditions that have eroded from underneath the speculative reach - not the catalyst itself.

How intense a collapse in sentiment becomes is crucial for escalating certain markets from casual trade target to full-fledged haven. Having grown exceptionally popular these past months, Bitcoin would be among the more dubious outlets for safety. While it may be able to avoid capital controls and stimulus recharge that would follow a financial crisis, it is exceptionally volatile. This speculative trait alone will undermine a sense of stability when it is most necessary. Equally dubious in its role at the safety end of the spectrum is the Japanese Yen. Very early carry trade has helped to sink the Yen (lifting crosses) which would in turn necessitate a reversal of trend as sentiment faltered. The more traditional understand of the Dollar as a haven would need to be put against the currency's appeal as the lead carry owing to the Fed's early policy reversal. In an absolute liquidity seizure, there are no questions asked before capital flees to the Greenback's harbor. In more restrained risk aversion, it is unclear whether the Dollar retreats as its carry advantage bleeds off. The same dichotomy would apply to Treasuries bolstered by the Fed and other targeted policy efforts. Despite the skews behind the system and over-leveraged exposure, Gold and the Swiss Franc could prove the ideal interim safe outlet. We discuss the important consideration of full risk aversion with its ideal outlets of safety in this weekend Strategy Video.

To receive John’s analysis directly via email, please SIGN UP HERE