Talking Points:

- Speculative positioning has been climbing consistently for 16 months and broadly for the past 9 years

- Eventually, the disparity between price and value will collapse - which is most likely to occur amid risk aversion

- After years of stimulus, a collapse in market returns and rampant speculative appetite; what assets are still havens?

Do you want to keep bearings on the top fundamental themes - including risk trends - moving the markets? Join my weekly Fundamental Trading webinar on Mondays. Have trading, market or strategy questions? Ask them at the Tuesday Trading Q&A. Sign up for these and other webinars on the DailyFX Webinar Calendar page.

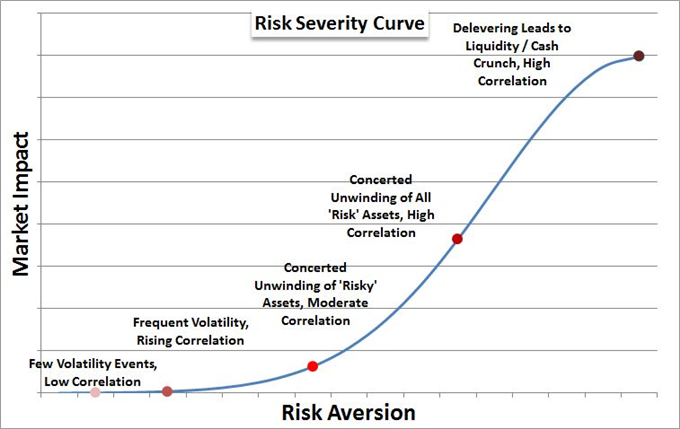

It may seem inconceivable that risk trends will eventually reverse course following years of persistent advance. Yet, it is inevitable in a normally functioning market that the speculative tide eventually rolls out. Whether this happens tomorrow, a month from now or even a year out; it is never too early to establish a plan for such an scenario. Yet, the price entry, exit, risk management rules and other particulars of a precise trade depend greatly on the circumstances of the market at the time of the turn. Yet, there are certain aspects that we can account for now in order to be better prepared for that future. Since we have already discussed the fundamental arguments for the markets being far overpriced as well as the reasoning for why it can stretch even further into 'overbought' territory, we turn our focus on a different aspect to this equation: the sensitivity of various assets to the mood reversal.

One of the most familiar benchmarks for sentiment is the S&P 500. This US equity index has championed the 'risk on' that has unfolded in the years of recovery following the Great Financial Crisis nadir in early 2009. As stubborn as the stock leader is steeped in complacency, it will no doubt crack under genuine pressure on speculative appetite. A tumble in the US stock market and subsequent surge in the VIX Volatility Index are heavily anticipated, but other high-profile assets may find their connections substantially changed through time and circumstance. Gold for example may not respond as many anticipate to a falter in risk appetite. Historically, gold has played a clear roll as a safe haven. In fact, it was considered a means for holding up economies when currencies collapse. That connection to traditional currency is where this connection may run afoul of its traditional roll. A look back at the metal's performance around the height of the financial crisis, shows it didn't follow the path most would have anticipated for such a development. The operative motivation through 2011 was not risk aversion but a need to diversify away from traditional currency. If we were to see a withdrawal from risk, it is likely that speculative access would likely shake lose.

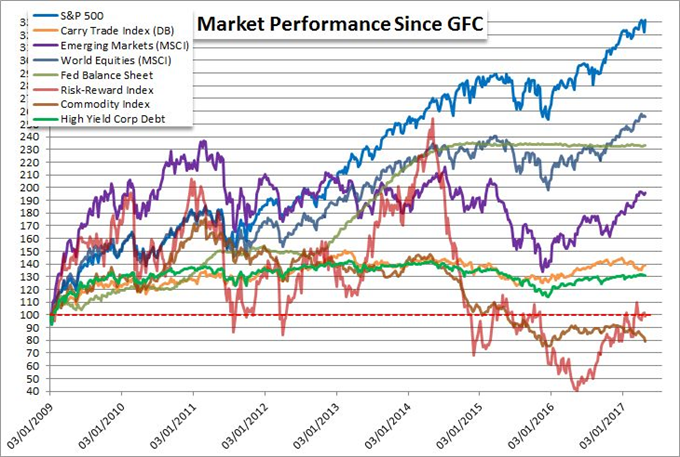

Another standard bearer of the speculative disparity that could alter its alignment are the currencies on opposite ends of the carry spectrum. For the Australian and New Zealand Dollar, a speculative drain on assets may not pose a route for these typical 'high risk, high return' currencies. Typically, these 'high dividend' trades of the market would be a clear chopping block item; however, neither currency is expensive. Furthermore, in the event of a managed slide in sentiment, the market will still seek out returns among highly-rated markets. The AUD and NZD certainly do qualify. In the meantime, risk aversion can also push the Yen. The label of a 'safe haven' is explicitly misplaced on the Yen. When markets slide, there can arise a need to shift to more practiced metrics. Yet familiarity does not equate to safety. Capital does not flee to Japan disproportionality in the event of fear; rather the long, carry position built on borrowed Yen funds would find considerable deleveraging. That said, carry trade has lagged general risk positioning for years, which in turn may indicate there is plenty of further growth capacity moving forward. We discuss the unusual developments in the broader financial system these past years that have shaken up the traditional routes of safety. We take a look at US equity indexes, volatility measures, gold, Dollar, Yen and even Bitcion in today's Strategy Video.

To receive John’s analysis directly via email, please SIGN UP HERE