S&P 500, EURUSD and NFP Talking Points

- A big shortfall in NFPs and an ISM service sector slip may have weighed the Dollar a little further, but rate forecasts and risk trends seemed to brush the data off…for now

- The US Labor Day holiday has stood as a historical tipping point for market conditions from doldrums to higher volatility and the only averaged month of S&P 500 losses

- After the liquidity curb on Monday, the week ahead will find a ready focus on monetary policy – both aftermath for Fed speculation as well as the ECB, BOC and RBA

Quiet So Deep, Even a Severe NFPs Miss Wouldn’t Break the Hold

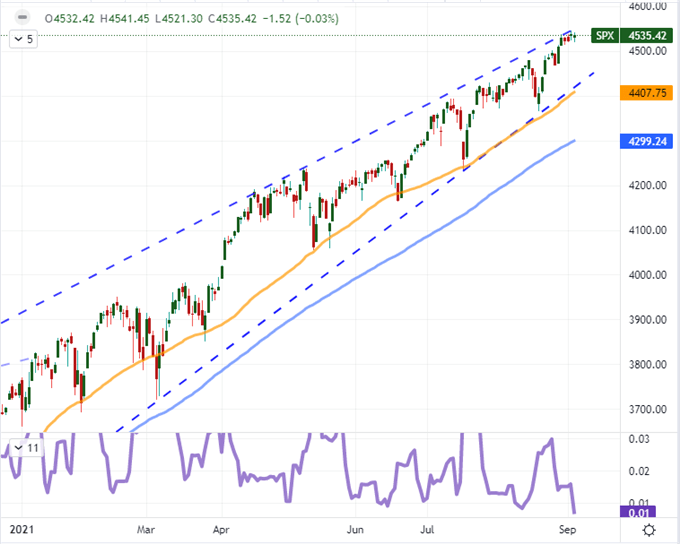

We have closed out the week before the US Labor Day holiday weekend. You don’t have to be an American to appreciate the impending market closure as it historically represents such a drain on liquidity that the global financial system often treats it as the turning point from summer doldrums to active fall trade. This isn’t always the case, but the expectations are well-established and there is little debating the speculative reach for risk assets over the past 18 months – if not the past decade. Anticipation for the liquidity drain seemed a boon for the S&P 500 and similar risk assets to close out this past week. The August nonfarm payrolls (NFPs) offered up a dramatic shortfall on expectations – -515,000 relative to 750,000 consensus, the third largest in modern record – which may earn a few points for a Fed taper delay but does not offset the concern of a quickly cooling economic recovery. Nevertheless, the SPX was once again little moved, rounding out the smallest 5-day historical range since January 2018.

Chart of S&P 500 with 50 and 100-Day SMAs, 5-Day Range (Daily)

Chart Created on Tradingview Platform

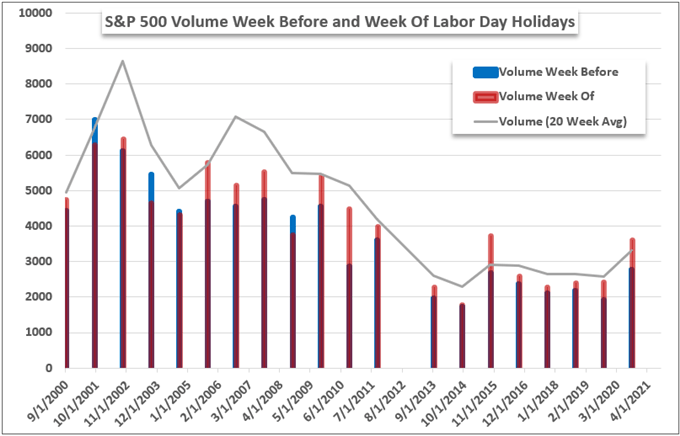

I believe that if we were heading into an extended holiday weekend, the employment report – and ISM service sector report – would have generated a bigger response from US indices and other risk-sensitive assets. Alas, in the hierarchy of market impact, I always place ‘conditions’ over traditional fundamentals and technicals. Speaking of conditions, we are looking at a shortened trading week ahead for the US and Canada which will translate into a very quiet Monday for those markets that are open. Referencing the SPX again for a speculative milestones, volume historically picks up materially after the holiday (even though the week is only four trading days).

Chart of S&P 500’s Volume in the Weeks Before and After the Labor Day Holiday Per Year

Chart Created by John Kicklighter with Data from Bloomberg

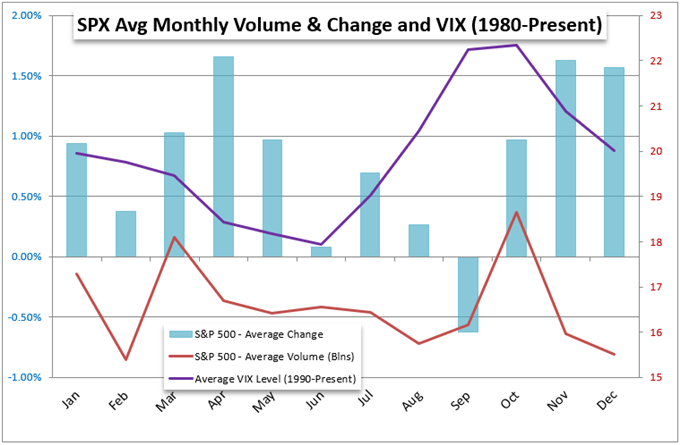

The Big Picture as We Move Into September

When it comes to the week of the Labor Day holiday, the markets commitment to restored trends – whether bearish or bullish – is spotty. However, the month-at-large bears out the averages that we see below. Back to 1980, this is the only month of the calendar year that the S&P 500 has averaged a loss. It should surprise few with this slide that volatility tends to crest through this same period and into October – risk assets and the volatility tend to have a strong, inverse correlation.

Chart of Change in NFPs and ADP Private Payrolls with Difference Between Both (Monthly)

Chart Created by John Kicklighter with Data from BLS and ADP

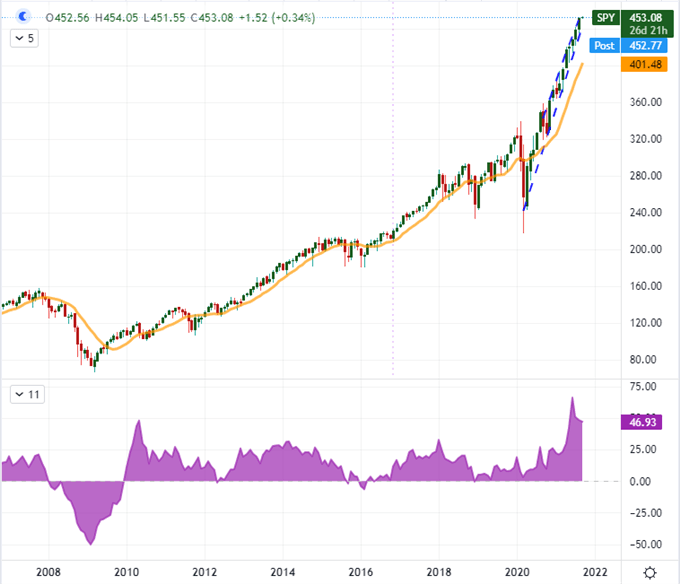

For September 2021, the gravity of complacency will be strong given the market’s ability to weather fundamental troubles – taper chatter, a rise in covid cases, a sharp slump in consumer sentiment surveys – however these risks are adding up and the backing for moral hazard is fundamentally at risk. Recognition that the world’s largest central banks are attempting to withdrawal from their position as foundational pillars of excess risk-taking compound a growing fear of the record scale of leverage (eg debt) and the sheer scale of benchmarks like the S&P 500. Should the mutual bullish hold break, there is little fundamentally or technically that makes a compelling argument to hodl on measures like SPX. And, if these are sliding down the mountain, they are likely to sweep everything along with them.

Chart of SPY S&P 500 ETF with 10-Month Moving Average and 15-Month Rate of Change (Monthly)

Chart Created on Tradingview Platform

What to Watch for Next Week: Fed Speculation, ECB, BOC and RBA Rate Decisions

If we are transitioning from drained to more active market conditions, what should we monitor in the way of catalysts? While there will no doubt be new developments that are on and off the docket, I think the same important considerations of the past few months will still carry significant weight moving forward. That includes the importance of the Federal Reserve’s contemplation of a timetable for its taper decision. We don’t have the official FOMC rate decision until September 22nd and there aren’t any key US events that would speak to policy on the docket, but when does that hold back speculation. The NFPs through this past week was a pretty substantial miss, but one could argue that 235,000 jobs added is still very significant historically and could be used to argue a curb on the hefty asset purchases are warranted. Of course, the better argument is to be made through inflation pressures which held remarkably high in the ISM service sector price component. On the other hand, doves could make that case that we are still more than 5 million jobs below the pre-pandemic peak and consumer confidence has slipped this past month. What camp will market participants identify with?

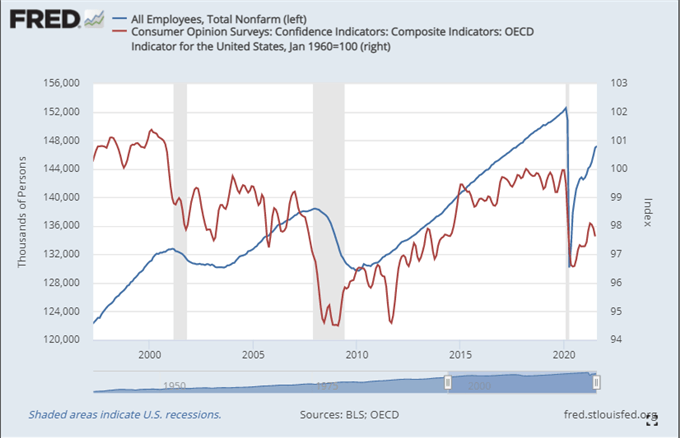

US Total Nonfarm Payrolls and Consumer Opinion Surveys Composite (Monthly)

Chart Created on FRED with Data from BLS and OECD

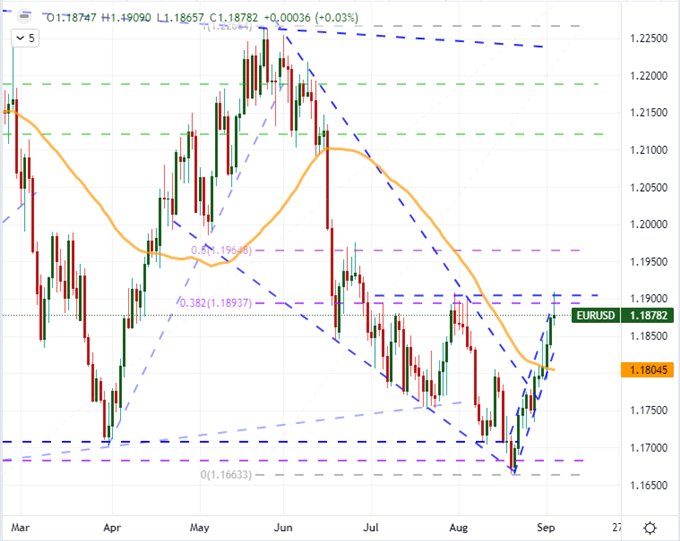

While the Dollar is still a focal point of mine into the coming week for both Fed speculation and its ties to risk trends (it has been a suffering safe haven), there are perhaps some more pointed event risks ahead for some of the major pairs. Take EURUSD for example which has turned its trend (wedge) reversal into a run up to the 1.1900 mark – a range resistance and the 38.2 percent Fib of the past three-months’ bear leg. Here, the top known threat seems the ECB rate decision on Thursday. This pair’s climb hasn’t been solely a work of Greenback weakness as the Euro has gained across the board amid speculation that the European Central Bank is considering its own taper timeline. That said, this group has positioned itself as being the apex of dovishness, so a build up in Euro does not bode well.

Chart of EURUSD with 50-Day SMA and Disparity Index 50-Day (2 Hour)

Chart Created on Tradingview Platform

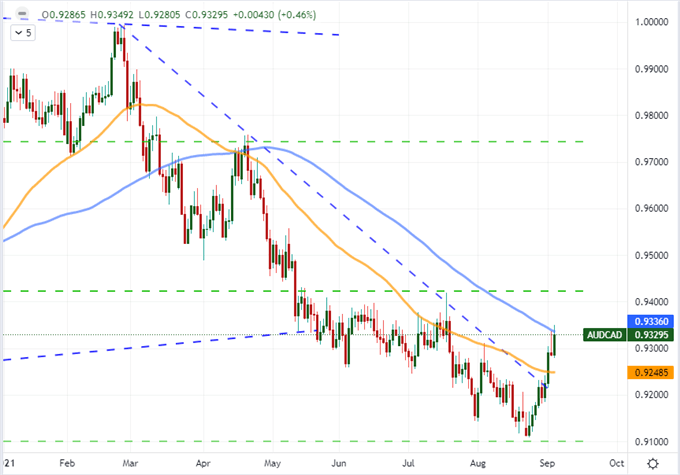

The ECB isn’t the only central bank due to deliberate on monetary policy in the coming week. Setting aside emerging market central banks (the Russian central bank is expected to cut rates 25bps), there are scheduled meetings and announcements from the Reserve Bank of Australia and Bank of Canada. The RBA has slowly moved towards easing off the gas on stimulus, but has hesitated amid the rise on Delta-variant Covid cases. Language from policy members hasn’t exactly laid the ground work for enthusiasm to reverse course. As for the BOC, they have already tapered twice in the past three months, so a subsequent move would seem unlikely as it would definitively position the central bank as being remarkably hawkish amid many hesitant doves. That has serious ramifications both for local borrowers but also for the currency. These two meetings naturally makes AUDCAD an interesting pair.

Chart of AUDCAD with 50 and 100-Day SMAs (Daily)

Chart Created on Tradingview Platform