S&P 500, Nasdaq and EURUSD Talking Points:

- GameStop continued to dominate the financial news cycle this past session as its rally was further accelerated after hours by another Midas market mover: Elon Musk

- Despite the charge in heavily shorted shares, the broader indexes like the Dow and the S&P 500 are spinning their tires looking for conviction

- GDP will continue to play a key role ahead as will the FOMC decision and earnings from the likes of the Tesla – is that enough for the Dollar and Dow?

Volatility in Speculative Assets Concentrates in a Few Immediate Favorites

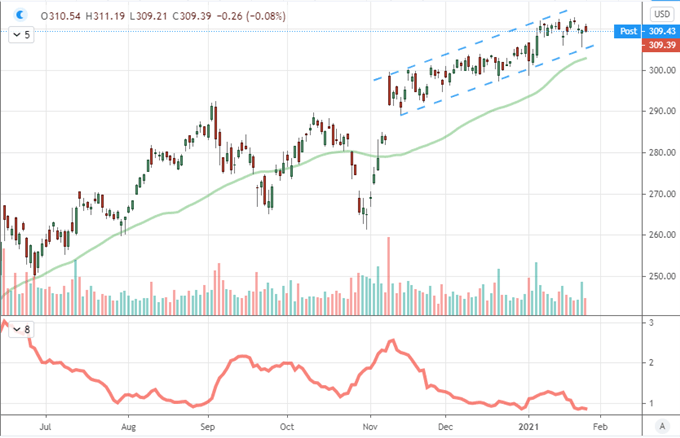

Depending on where you looked this past session, you could be left with either a sense that markets were supercharged by speculative appetite or otherwise treading water waiting for a systemic development to occur. In the former camp, the extraordinary performance for a select group of trader-pursued stocks seemed to draw all of the confidence in the entire market and focus it into a heavy run to record highs. Unlikely fan favorite GameStop qualifies for that category. Yet, outside of the narrow group of speculatively amplified stocks, the picture was far more reserved. Amid the listless carry trade, crude oil, emerging market and global stock measures; the US indices – prone to outperformance – were little moved and certainly off the default bullish pace. The foundation of growth and markets, the Dow Jones Industrial Average was actually down a fourth consecutive trading day. Yet, even the more speculatively charged S&P 500 and tech-led Nasdaq 100 were struggling. Perhaps that may change though as more critical fundamental developments like the Fed rate decision or key earnings wrest focus away from battles between hedge funds and speculative collaborations.

Chart of DIA Dow Jones Industrial Average Index with Volume and 20-Day ATR (Daily)

Chart Created on Tradingview Platform

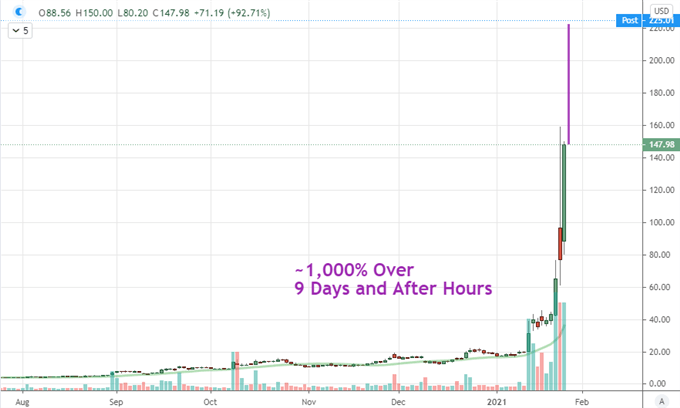

Through this past session, attention held firmly on the epic battle being fought out over the US equity market’s most heavily shorted shares. Continuing to lead the charge is GamesStop which has become a focal point among groups like Reddit’s Wall Street Bets as they squeeze the most heavily shorted stock to an incredible rally. A week ago, the stock was saddled with short interest tallying 138 percent of its total float which seemed to rouse activists in the social trading groups. With the founder of Chewy.com, Ryan Cohen, building a large position through the end of 2020; the WSB crowd started to dial in. As GME has taken off, hedge fund titans Citadel and Point72 reinforced key short seller Melvin Capital with a $2.8 billion infusion to keep it in the game. Yet, that didn’t prevent a further 93 percent gain through Tuesday and an incredible, further afterhours rally charged by none other than Elon Musk who merely direct his twitter followers to the Wall Street Bets group. What is even more remarkable than this isolated battle of wills is the spillover in interest in other heavily shorted stocks like Blackberry, Bed Bath and Beyond and AMC Theaters.

Chart of GameStop Shares and After Hours (Daily)

Chart Created on Tradingview Platform

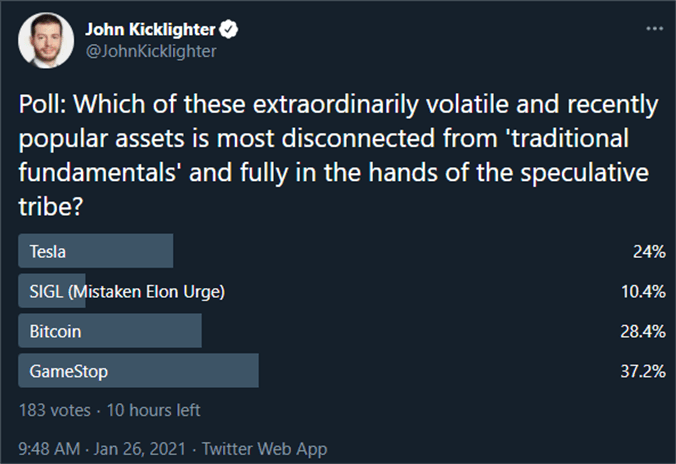

Given the scale of the rally, speculative attention is naturally hitting unprecedented levels. Yet, this attention is only recently registering on the trading Richter Scale. Not a few weeks ago, the attention was on Tesla and Bitcoin. Before that it was the FAANG constituents. With so much concentrated volume, I conducted a poll asking traders which asset they felt was most acutely disconnected from ‘traditional’ fundamentals. Not surprisingly, GameStop toped the list while Bitcoin and Tesla were splitting the second spot. Interestingly, the stock that was mistaken as an Elon Musk recommendation (he was supporting messaging app Signal, not the Texas company with a similar name), SIGL is still trading up over 800 percent above its pre-misinterpretation level.

Twitter Poll: Which Asset is Most Disconnected from Traditional Fundamentals

Poll from Twitter.com, @JohnKicklighter

Amid the Froth, The Potential for Risk Aversion Lingers

Though the performance of GameStop recently and the relentless drive of the S&P 500 over months and years can foster a belief that markets remain impervious to traditional speculative breaks, it is important to remain balanced when evaluating the possibilities going forward. The split between the performance of the indices and most heavily shorted shares is only a modest sign of the discrepancy. There are far more engrained disparities in speculative reality. One of my preferred barometers of lingering risk remains the VIX volatility index. As of Tuesday, it has run 233 trading days above its historical average at 20 with a rapidly deteriorating wedge likely to lead to at least a modest break. Keep track.

Chart of VIX Volatility Index (Daily)

Chart Created on Tradingview Platform

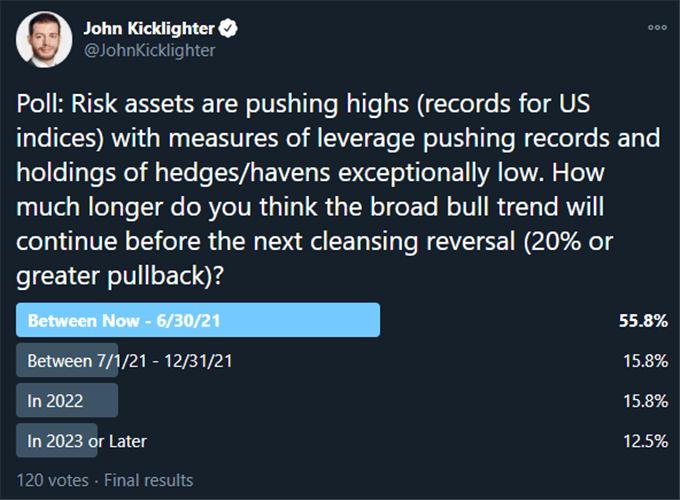

With the prospect of a risk reversal in mind, it is worth reiterating the ‘awareness’ with which the market seems to have around its stretched position. My Twitter poll this week asking when traders believed the bull trend will give over to a bearish correction (20 percent or greater retreat from highs) has the majority projecting within a six month time frame. It may be that the skeptics were just more interested in participating, but this doesn’t seem to be uncommon.

Twitter Poll: When Will Capital Markets Put in for the Next Bear Market

Poll from Twitter.com, @JohnKicklighter

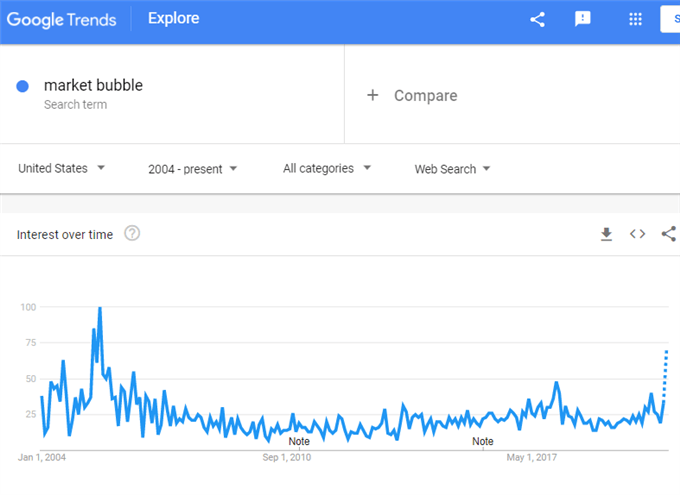

Further sign of a broader group’s appreciation of largesse in the markets is the Google search interest for “market bubble” (read more about bubbles here). Though targeted on US traffic, the swell in attention (fear?) is the highest since 2005. Now, it should be said that recognition of a problem is not evidence that participants are ready to address and rectify it. Nevertheless, admitting you have a problem is the first step.

Google Trend Search Interest for ‘Market Bubble’ in the US

Chart from trends.google.com/trends

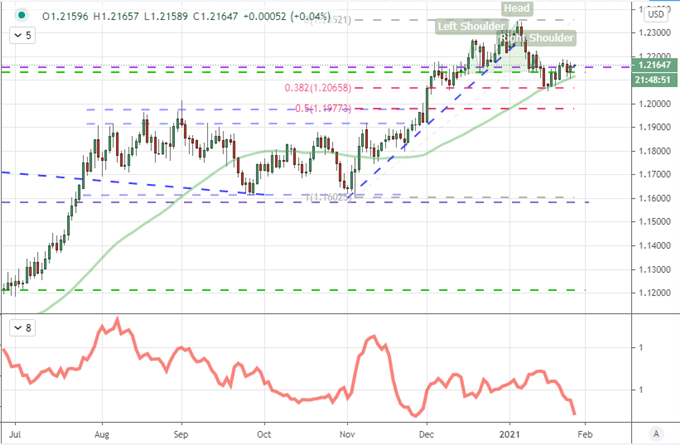

Top Tangible Themes Keeps EURUSD in the Crosshairs If Not Top Volatility Depth Chart

As we move continue to mull over the battle between the small traders and the largest hedge funds, those navigating the deeper waters should keep tabs on the more systemic themes. This past session, the IMF updated its WEO (World Economic Outlook) to dole out growth forecasts. Notably, the US 2021 outlook was reinforced by the $1.9 trillion stimulus program proposed to the tune of a 5.1 percent tempo; while the Eurozone’s outlook was slashed by one percentage point to 4.2 percent. Furthermore, it was reported that the ECB was going to look into why the Dollar was so ‘weak’ despite the strength of the economy – what seems like a precursor to action should the Euro continue to appreciate. And yet, EURUSD was still up Tuesday. Perhaps the FOMC rate decision will exert some influence or even the run of top market cap earnings releases (Apple, Tesla and Facebook) over the Greenback’s safety status.

Chart of EURUSD with 50-Day Moving Average and 20-Day ATR (Daily)

Chart Created on Tradingview Platform

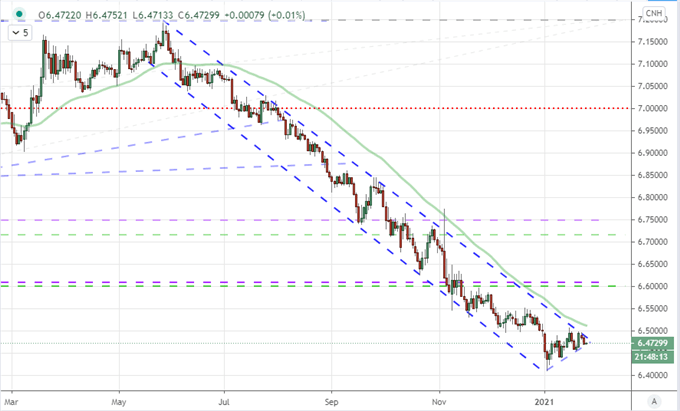

One last mention is the distracted picture in the broader market as it has pulled away from otherwise remarkable developments. A noteworthy contender in this category was the PBOC’s drain of approximately $12 billion in liquidity through open market operations amid remarks from an adviser to the bank warning that if policy didn’t change, the risk of asset bubbles would climb. I’m keeping a close eye on USDCNH. While not likely to abide simply be the textbook of technicals, there is no denying how remarkably consistent its channel has been.

Chart of USDCNH with 50-Day Moving Average (Daily)

Chart Created on Tradingview Platform

.