Dow, Dollar, GBPUSD Talking Points:

- Though the Dow and other risk benchmarks ended the week off their lows, volatility was an uncomfortable marker to consider for the weekend

- Sentiment will be the driving factor in the week ahead, acting as the throttle for bullish or bearish event risk and themes

- Top themes ahead include coronavirus second wave recession fears while data will center on rate decisions like an expected BOE stimulus upgrade

Watch Risk Trends First, Catalysts Second

Capital markets heaved this past week. Following 10 weeks of fairly consistent climb, there was finally a serious shutter in speculative benchmarks. With a run of troubling headlines clouding the backdrop, the Dow and S&P 500 suffered their worst single-day losses since the worst of the pandemic collapse. Even the seemingly unflappable tech-heavy Nasdaq took a nasty spill. The question we should consider as we move into the new trading week is whether there is a particular fundamental thread unraveling the markets or whether sentiment itself is faltering under its own bloated weight. I am of the opinion that we are witnessing something more aligned to the latter condition. That would paint the more troubling path forward. If there were a particular theme or event to focus on, a favorable turn on the headlines could revive bulls. Yet, if confidence continues to fracture, the favorable can be discounted while the troubling leads markets lower.

| Change in | Longs | Shorts | OI |

| Daily | -18% | 18% | 7% |

| Weekly | -19% | 14% | 4% |

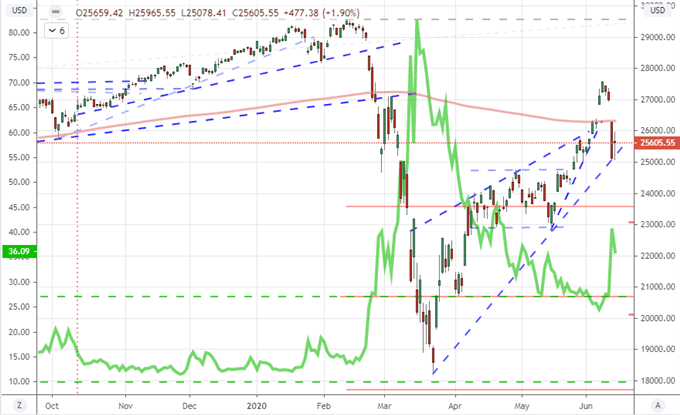

Chart of the Dow Index with 200 Moving Average and VIX Volatility Index (Daily Chart)

Chart Created on Tradingview Platform

The Dow is an appropriate technical example of the uncertain position in which the markets find themselves. The blue chip index reversed the milestone of overtaking its 200-day moving average during the peak of its retreat. And, that exceptional hit notably overshadows the uneven effort to stem the bleeding on Friday – resulting in a prominent doji candle. While Friday offered up a bullish performance over the previous day, the backdrop of elevated volatility will place the markets at risk for another tremor. The VIX volatility reflects persistent uncertainty for what’s ahead and the convergence of ‘risk’ assets recently suggests momentum once set can endure.

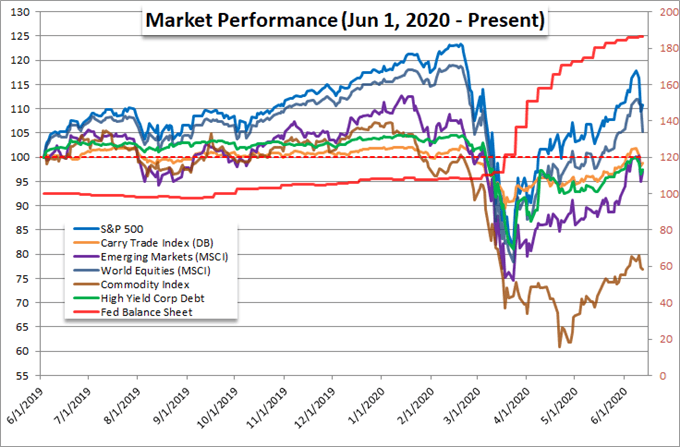

Year-Over-Year ‘Risk Asset Benchmark’ Performance (Daily)

Chart Created by John Kickighter with Data from Bloomberg

Top Themes on My Radar for Next Week

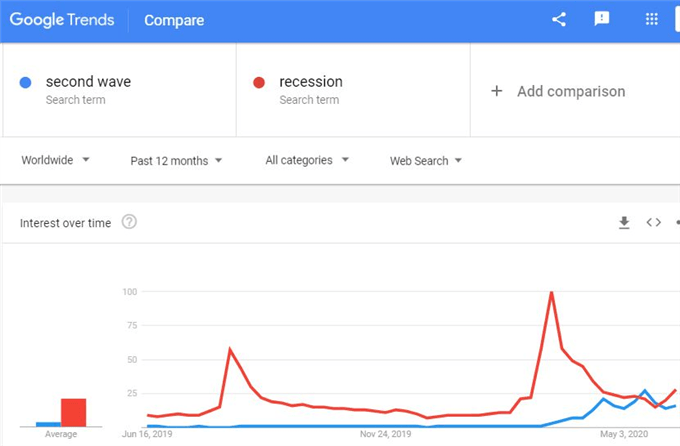

While risk appetite itself is my focus for committed market movement, there is no denying that fundamental themes can both trigger the avalanche and be used as justification for keeping the pyroclastic flow rolling downhill. Through the height of Thursday’s tumble, the financial headlines seized on the reports that cases of coronavirus were rising in many American states and the risk of a return to lockdown had risen materially. This is a matter of life and death, but the amoral markets are perhaps more motivated by the impact on the fragile effort to mount an economic recovery. Another serious consideration is the agitation to geopolitical flash points like trade wars. If interest in (concern over) a second wave gains traction, watch for the spill over to the growth outlook.

Graph of Global Search Ranking of ‘Second Wave’ and ‘Recession’ (Daily)

Chart from Google Trends

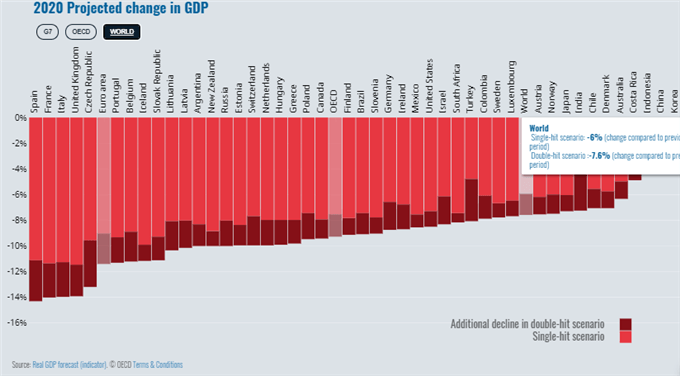

There were a number of economic updates this past week, and there were few silver linings. The NBER christened the official US recession as of February, regional Fed GDP projections waded through extreme territory, UK GDP posted a record -20.4 percent contraction for the month and the world bank lowered its global growth outlook. That said, the most troubling update as I saw it was the OECD’s disquieting 2020 forecast – a 6.0 percent contraction for the globe which would be the worst slump during peacetime in a century. Yet, where the update really hit home was their warning that a second wave of the pandemic was likely and such a situation could lead to a -7.6 percent plunge for the year. There are central bank forecasts, sentiment surveys and more that can offer tangible data on economic activity next week; but I remain focused on the headlines.

OECD 2020 Growth Forecast

Graph from OECD.org

As for the Event Risk: Powell Testimony; Rate Decisions; and a Sterling Run

Aside from the systemic, there are some notable events on the docket moving forward. This past week’s FOMC decision may have very well urged the risk aversion that took full flight the following day. We will delve further into the group’s anxiety about the future with Chairman Jerome Powell delivering his monetary policy update to both houses of Congress. That will make for an interesting week for a charged Dollar. Another set of key updates will come through monetary policy decisions. There a range of developed and developing economy bank updates on tap. That said, I will focus on the Bank of Japan and Swiss National Bank updates as they are two exceptionally accommodative groups with negative rates and exceptional stimulus. The question of whether the Fed should follow suit in negative rates owing to its questionable effectiveness would do well to consider these examples.

| Change in | Longs | Shorts | OI |

| Daily | -1% | -4% | -3% |

| Weekly | 4% | -10% | -5% |

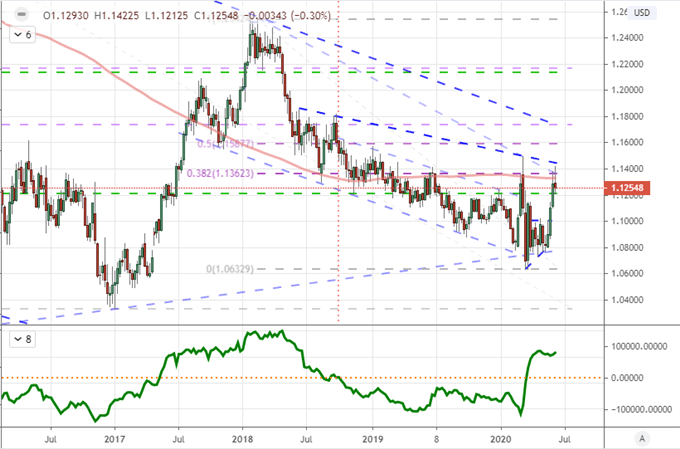

Chart of EURUSD with COT Net Speculative Futures Positioning (Daily)

Chart Created on Tradingview Platform

Of the three major central bank updates though, the Bank of England (BOE) rate decision will be the most loaded. The group is not expected to ease rates, but there is a consensus for more stimulus. After last week’s incredible contraction in UK GDP, it isn’t difficult to justify more support. That won’t be the only fundamental matter for the Sterling to digest. Event risk like the UK retail sales aside, the UK and European Union are due to restart high-level trade talks. With a fast approaching deadline for any requested extensions to negotiations, we may be nearing an inflection point for another strong Sterling swing.

Chart of EURGBP with 100-Day Moving Average (Daily)

Chart Created on Tradingview Platform

If you want to download my Manic-Crisis calendar, you can find the updated file here.

.