ECB Talking Points:

- Chinese and US officials attempted to spur enthusiasm around pained trade wars with China announcing waivers and the US a late-day delay

- Meanwhile, recession concerns are spreading in market performance, surveys and search habits - and a Trump response is a serious risk

- Today's ECB rate decision is top event risk with uneven market moving scenarios and heavy implications for the Franc, Dollar, risk and more

See what live coverage is scheduled to cover key event risk for the FX and capital markets on the DailyFX Webinar Calendar.

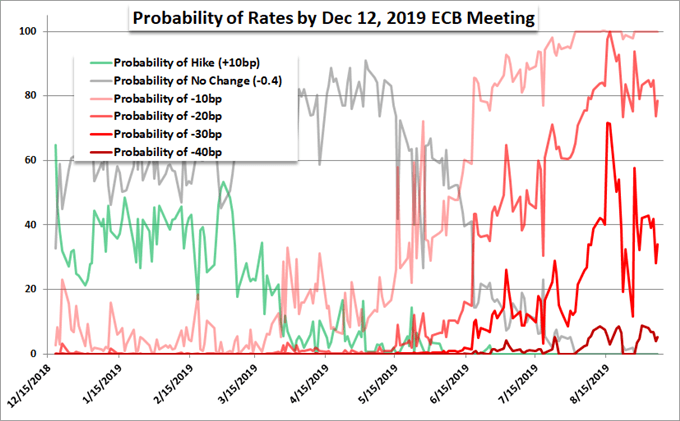

The ECB Scenarios for the Euro

This week's top event risk is on tap and the market is paying attention. The European Central Bank (ECB) rate decision is heavily expected to end with a return to rate cuts that pushes one of the lowest benchmarks in the developed world even further into negative territory. It is easy to price the herd's expectations on the yield, but it is significantly more difficult to account for the conviction for a return to quantitative easing (QE) and/or other unorthodox policy aimed at leveraging the perception of the group's influence - and thereby earn some economic and financial relief. Nonetheless, a suite of accommodation is expected from this central bank, and that anticipation has translated into Euro depreciation and European capital market advance these past weeks.

In general, it would be more difficult for the ECB to 'best' expectations - in other words to provide more support than the market is already accounting. It is not impossible however. If the group lowers rates further, introduces an open-ended stimulus and provides further unseen efforts all while President Mario Draghi reassures that they are fully willing to do even more; then the Euro could continue its slide. More likely, the group will 'meet' or fall short of expectations which could more readily render the Euro substantially devalued relative to where speculators believe it should be. When faced with level of influence and anticipation that the ECB faces, such authorities usually attempt to walk a tightrope to exactly 'meet expectations'. That will prove very difficult given pressure of global health fears and external risks like trade wars building the dependency on these overused 'last resorts'.

Chart of Equally Weighted Euro Index (Daily)

Chart Created on Tradingview Platform

In looking at Euro pairs that would be better positioned for technicals with non-conflicting cross fundamental themes, there are more pairs that look better suited for a bullish response even though the currency isn't particularly extreme in its retreat over the past months or even the last years. However, avoiding fundamental storms from the cross cuts the list down. A rebound for the Euro would best be served through EURCHF, where the SNB is looking for exactly such an outcome. On the alternative outcome, selling in EURUSD is a favorite among many, but it is loaded for unpredictable President Trump retaliation. I am more partial to EURAUD where the technicals are clear and the RBA's recent remarks would draw more stark contrast to their European counterpart's actions.

Chart of EURAUD and 200-day Moving Average (Daily)

Chart Created on Tradingview Platform

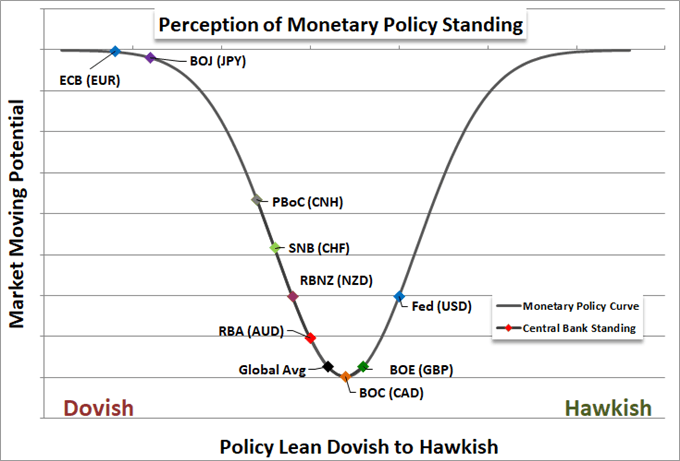

What Europe's Central Bank Does Will Steer Risk Trends and Recession Fears

As we have been talking about consistently this week, it will be important to evaluate the monetary policy event ahead for its global implications rather than just the hit it delivers to local assets. The FX implications will be particularly acute. What the market expects from the ECB would put it in a position to rival even the Bank of Japan (BOJ) for dovishness That could shift the entire global curve for monetary policy. If Draghi and company are willing to pull out all the stops in a supposed bid to fend off economic and financial pain, other governments and populations will demand their own groups provide the same. Unfortunately, at these extremes, global policies become more competitive in their effectiveness - leading to situations like diverted capital or a currency war at the extremes. Particularly important in this equation will be EURUSD. President Trump already remarked this past session that the "boneheaded" Fed should cut rates to zero or negative. What happens if the ECB ups its game even further?

As troubling as a full dovish policy outcome would be, there is not much relief to find in a central bank that throttles its intentions. Not only will the market feel it has misjudged support with a certain excessive exposure review, but it will cast into doubt the willingness of other authorities. When these authorities reiterate that they are attempting to reserve some solutions for actual crises, it will call into question the actions of those that are already diving in while others hesitate. Further, that concern has come hand-in-hand with the warning by the same groups that they are increasingly concerned about the effectiveness of their policies moving forward. It seems only government leaders and risk traders seem to be in denial of this limitation.

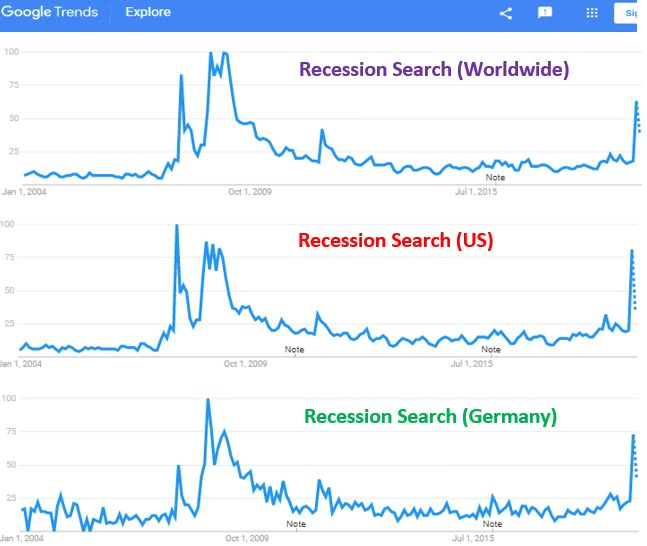

Officials Attempt to Leverage Some Low Hanging Trade War Enthusiasm

Appetite for stimulus naturally follows assumptions over the questionable health of economic expansion. This past session, the more closely watched 10y2y and 10y3m Treasury yield spreads eased higher. That doesn't exactly absolve us of the global pressure though. As we await the next meaningful round of data, there are surveys that are taking up the torch. An ABC-WaPo poll released recently showed 43 percent of respondents believed President Trump's trade fight would raise the risk of recession while a troubling 60 percent believe a recession is 'likely' in 2020. Further, Google traffic in 'recession' searches shows that there is growing fear (as morbid curiosity doesn't fit the term) of a stalled economy worldwide as well as key economies like the US and Germany.

I believe that there is keen awareness as to the state of the economy around the world, but the US and China in particular. As US campaigning for the Presidential election in November 2020 heats up - and it will heat early - there will be a stark focus on the direction of the economy. The pressure on the Fed by Trump is no doubt a bid to safe guard growth while the trade wars exert the pressure the administration intends. Yet, with the central bank unrelenting - and likely to fail to stem the tide if conditions truly worsen - there is a fair chance that they back off the trade wars in an attempt to right the ship. This past session, China announced it was waiving tariffs on 16 products, not a large effort but the first move to pull back in this venue since the standoff began. Supposedly looking to match the 'goodwill', the US announced that it would delay the implementation of $250 billion in tariffs on China from October 1st to October 15th. We have had our confidence built up and crushed far too many times before unfortunately.

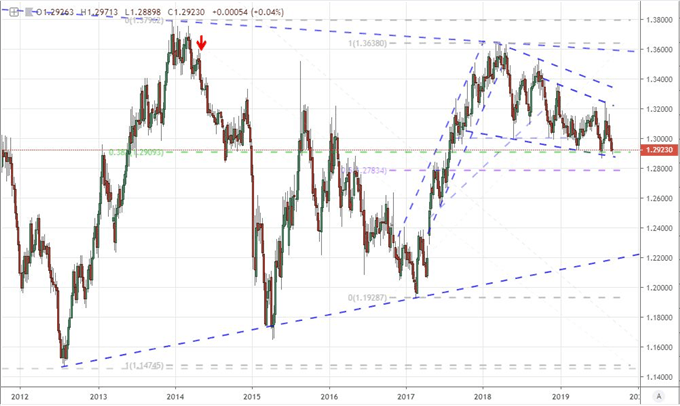

Chart of USDCNH and 20-Day Moving Average (Daily)

Chart Created on Tradingview Platform

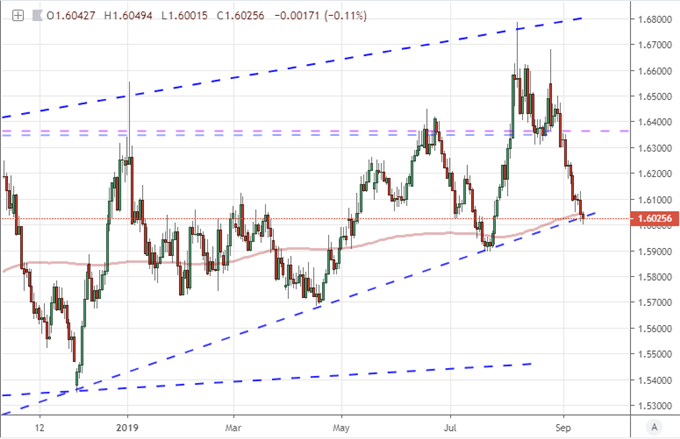

Pound and Oil Among the Few Markets Not In Direct Line of Sight

If you are attempting to get away from the influence of today's ECB decision or the subsequent wave of important monetary policy events next week, the list will be particularly small. Crude oil may not be generous with establishing trends as of late, but it has certainly disconnected from the more popular themes. Following the news that John Bolton was no longer advising the President, we learned Wednesday that Trump was considering easing sanctions on Iran. That is an abstract supply crimp that eases - supposedly enough to offset a 6.9 million barrel drop in crude oil inventories reported in the US as the commodity did drop heavily on the day.

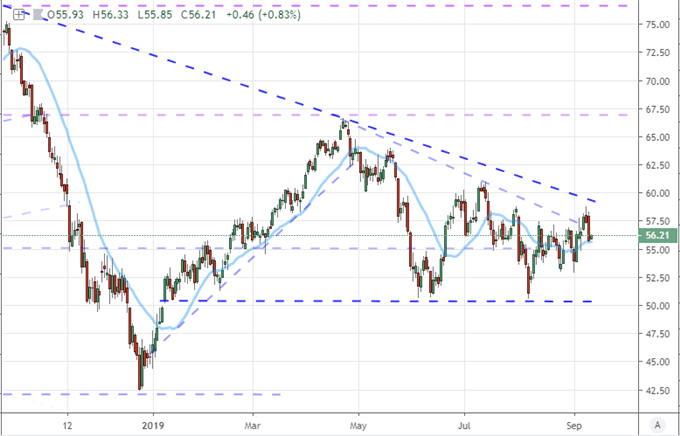

Chart of US Crude Oil and 20-Day Moving Average

Chart Created on Tradingview Platform

Sterling is another market that continues to occupy its own world. Given that Parliament has been suspended for five weeks, it would seem that we were due for less drama - even if a 'no deal' Brexit is a more likely event under these circumstances. Instead, the drama continues. This past session, a Scottish court found that the 'proroguing' was "unlawful because it had the purpose of stymying Parliament." That would suggest that Parliament would be called back to session, but that is not yet explicitly clear. Further, it reminds that MPs signed into law a requirement that Prime Minister Johnson would have to ask for an extension on negotiations if no deal was in hand by mid-October. While significant news, it is not enough to give clarity as to next steps. That is even further the case given the documents showing the government's 'worst case scenario' Brexit evaluation were released and consumed as scary bed time stories.

If you want to download my Manic-Crisis calendar, you can find the updated file here.

What do you think of DailyFX? We would appreciate if you take 5 minutes for a survey to provide us with feedback !