Highlights:

- USD/JPY trades above 114 as BoJ announces unlimited front-end bond purchases

- EUR/USD finds temporary resistance near 1.1450 and GBP/USD at 1.30

- CAD surges to 2017 highs despite Oil trading at extreme range of November low

- Sentiment Highlight: USD/JPY trend appears undeterred as retail Bears' arise the trade

To many FX traders, selling JPY against whatever you please has been the only game in town for the last few weeks. After a headline beat of US NFP, which came in at 222k new jobs while average hourly earnings disappointed, JPY selling continued. USD/JPY traded above 114 for the first time since May where it traded as high as 114.36 and could soon make a run for 115.50, the March high. The fundamental catalyst came from the BoJ announcement that they offered to buy an unlimited amount of front-end Japanese Government Bonds at a fixed rate to keep a lid on the front-end of the yield curve as part of their Yield Curve Control arm of their monetary policy approach.

Good news! Our quarterly forecasts are fresh and ready for you. Click here to access for FREE.

Two key stories that traders will digest over the weekend is the ever-steepening European Bond curve and German Chancellor Merkel’s tough stance on trade at this week’s G20 summit Hamburg. While a steepening yield curve, (widening between the front end and long end yields) is not unique to Europe, there is a lot of focus on the European Bond market as the extreme positioning could lead to exacerbated volatility on an unwind that European rates would stay lower for longer. Higher European (specifically, German) yields have historically correlated with a strong EUR, a theme I expect to extend.

The other focus is likely to be the verbal battle of Hamburg, the site of this week’s G20 summit. While Merkel said that finding a G20 agreement on trade is proving difficult, it’s worth noting that Merkel is also sitting on near historical extremes of a German trade surplus that is near 8% of GDP. A trade surplus, which German is experiencing, indicates excess national savings that are not being sent abroad in the spirit of globalization that is often preached. This dynamic could set up a war of words if US President Trump feels threatened, which may act as a spark for more volatility.

The Price action in focus will continue to be whether EUR/USD can make a move above 1.1450 or shy away like it recently did at 1.13 before breaking higher. Additionally, on Friday’s weak UK factory data, traders will keep an eye on 1.3000 for GBP/USD. If GBP weakness persists, which data like this would favor, traders may prefer to watch EUR/GBP higher or GBP/CAD lower.

Join Tyler in his Daily Closing Bell webinars at 3 pm ET to discuss tradeable market developments.

Lastly, the Canadian Dollar is on a tear, and the Bank of Canada is the culprit. On Friday, USD/CAD broke below 1.29 to trade at a low of 1.2860 after an employment report pushed the odds of a BoC rate hike to 94% and the CAD to 10-month highs. For perspective, while the US was without the much-needed wage inflation per AHE, Canadian employers added ~4X the number of jobs expected on Friday morning. When the BoC meets next week, a provided rate hike will likely be quickly digested only for the focus to be honed on their policy outlook going forward.

You may like this analyst pick if you think JPY weakness will prevail.

Closing Bell’s Top Chart: July 07, 2017, has the course changed for the US 10Yr Yield?

Chart Created by Tyler Yell, CMT

Next Week's Main Event: USD Consumer Price Index (YoY) + Advance Retail Sales (JUN)

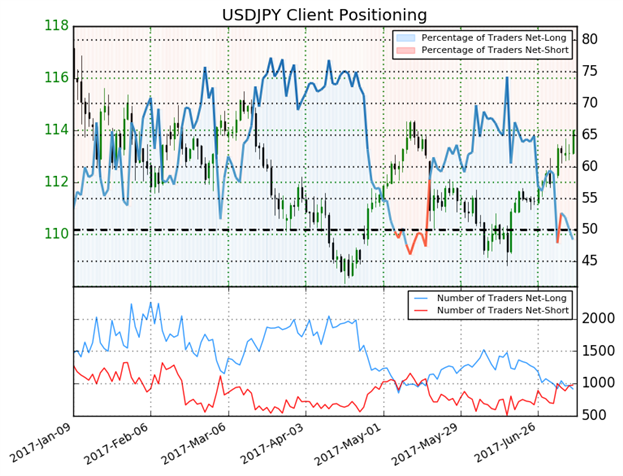

IG Client Sentiment Highlight: US Dollar Remains a Buy versus Japanese Yen per IGCS

The sentiment highlight section is designed to help you see how DailyFX utilizes the insights derived from IG Client Sentiment, and how client positioning can lead to trade ideas. If you have any questions on this indicator, you are welcome to reach out to the author of this article with questions at tyell@dailyfx.com.

USDJPY: Retail trader data shows 46.8% of traders are net-long with the ratio of traders short to long at 1.14 to 1. The number of traders net-long is 10.5% lower than yesterday and 20.3% lower from last week, while the number of traders net-short is 0.1% higher than yesterday and 40.8% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests USDJPY prices may continue to rise. Traders are further net-short than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger USDJPY-bullish contrarian trading bias. (Emphasis mine)

---

Written by Tyler Yell, CMT, Currency Analyst & Trading Instructor for DailyFX.com

To receive Tyler's analysis directly via email, please SIGN UP HERE

Contact and discuss markets with Tyler on Twitter: @ForexYell