Silver Price Outlook:

- Silver prices have stabilized after hitting fresh yearly lows last week, but maybe not for long with a strong US jobs report expected tomorrow.

- The ongoing rise in Fed rate hike odds and elevated US Treasury yields make for a difficult fundamental environment for silver prices.

- Recent changes in sentiment suggest that silver prices have a bearish bias in the near-term.

Winds Still Blowing South

Silver prices recovered after their late-September wash out to fresh yearly lows, returning to their narrow trading range established ahead of the September Fed meeting. In part, silver’s safe haven appeal may have been boosted by concern around China’s Evergrande and the US debt ceiling debate.

But now that both of those fears have receded into the background, silver has lost near-term fundamental bonafides. Coupled with rising US Treasury yields amid expectations for Fed tapering to begin soon, the environment is quickly looking rockier for silver prices.

With the September US NFP report due tomorrow – one which looks like it could beat expectations handily after the September US ADP employment change report and the most recent weekly US jobless claims figures – silver may soon swoon shortly.

Silver Prices and Silver Volatility Relationship Normal Again

Both gold and silver are precious metals that typically enjoy a safe haven appeal during times of uncertainty in financial markets. While other asset classes don’t like increased volatility (signaling greater uncertainty around cash flows, dividends, coupon payments, etc.), precious metals tend to benefit from periods of higher volatility as uncertainty increases silver’s safe haven appeal. Declining volatility in a period of positive correlations suggests more downside may be ahead for silver prices.

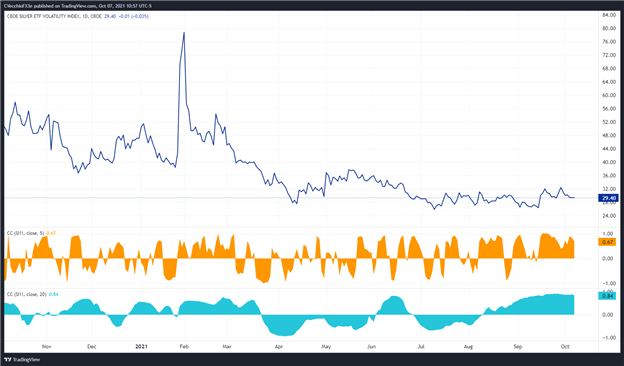

VXSLV (SILVER VOLATILITY) TECHNICAL ANALYSIS: DAILY PRICE CHART (October 2020 to October 2021) (CHART 1)

Silver volatility (as measured by the Cboe’s gold volatility ETF, VXSLV, which tracks the 1-month implied volatility of silver as derived from the SLV option chain) was trading at 29.96 at the time this report was written. The 5-day correlation between VXSLV and silver prices is +0.55 and the 20-day correlation is +0.83. One week ago, on September 30, the 5-day correlation was +0.69 and the 20-day correlation was +0.86.

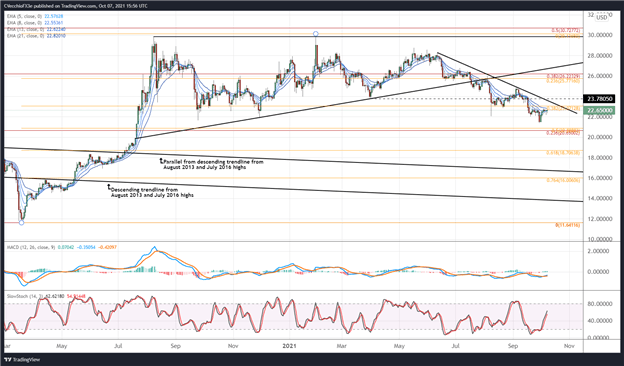

SILVER PRICE TECHNICAL ANALYSIS: DAILY CHART (February 2020 to October 2021) (CHART 2)

Momentum has recovered, but without a corresponding rise in prices. Silver prices are above their daily 5-, 8-, and 13-EMAs, but remain below its daily 21-EMA (one-month moving average). Daily MACD has turned higher, but remains below its signal line, even as daily Slow Stochastics have advanced through their median line.

Moreover, silver prices are still holding below the 38.2% Fibonacci retracement of the 2020 low/2021 high range at 23.0713, a level that has keep the rally at bay for several weeks. A strong US jobs report could facilitate the next leg lower in silver prices, back towards the yearly low set on September 29 at 21.4238.

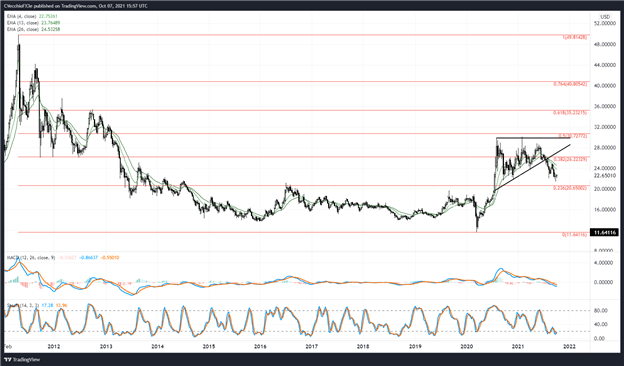

SILVER PRICE TECHNICAL ANALYSIS: WEEKLY CHART (November 2010 to October 2021) (CHART 3)

It was noted in September that a “failure to return into the ascending triangle this week would increase the likelihood of a deeper setback, potentially as far as the 23.6% Fibonacci retracement of the 2011 high/2020 low range at 20.6500. A loss of the August low at 22.1020 would increase the odds of a return to the 23.6% Fibonacci retracement.” Having already breached the August lows, the series of lower highs and lower lows remains, suggesting more downside is still likely.

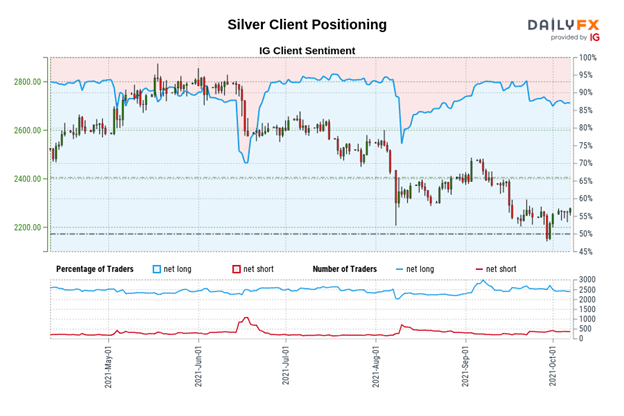

IG CLIENT SENTIMENT INDEX: SILVER PRICE FORECAST (October 7, 2021) (CHART 4)

Silver: Retail trader data shows 87.77% of traders are net-long with the ratio of traders long to short at 7.18 to 1. The number of traders net-long is 2.34% higher than yesterday and 9.54% lower from last week, while the number of traders net-short is 12.11% lower than yesterday and 10.97% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests Silver prices may continue to fall.

Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger Silver-bearish contrarian trading bias.

--- Written by Christopher Vecchio, CFA, Senior Strategist