Silver Price Outlook:

- Bond yields have steadied, stocks are climbing, and the US Dollar is down – has a window opened for silver prices to rally?

- Silver prices appear to be attempting to climb out of the downtrend from the February and March highs, which could give a near-term technical reason to throw doubt on the viability of the double top.

- Recent changes in sentiment suggest that silver prices have a bearish bias in the near-term.

Silver Prices Gain as Dollar Falls

Silver prices have had a rough go of things in recent weeks, in a steady downturn since hitting their 2021 high on the first trading day of February (and incidentally, the highest since 2013). In part, asset allocation churn provoked by a rise in long-end global bond yields have eroded the relative appeal of precious metals like silver, which has been hampered by the rebound in US real yields. But at the start of April and 2Q’21, so too has a potential change in seasons for silver’s near-term outlook.

Global bond yields have been moving sideways for a few weeks, and as so often has been the case in recent years, it’s the pace at which yields rise that causes unease among market participants, not necessarily the level of yields. Steady bond yields have emerged at a time when stocks are in one of their most seasonally bullish times of the year, coincidentally the worst time of the year for the US Dollar. Silver prices may find a seasonal tailwind helping them higher as the yearly downtrend comes into focus.

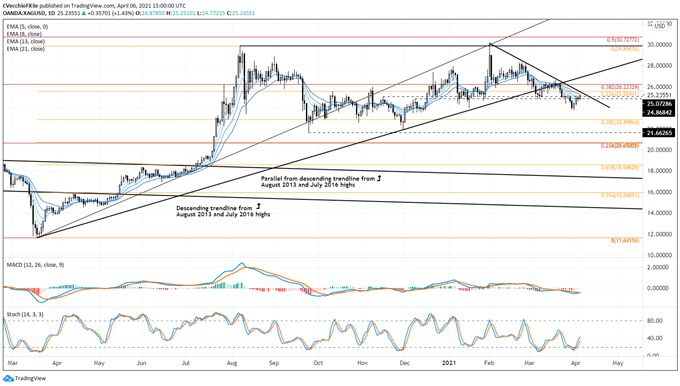

SILVER PRICE TECHNICAL ANALYSIS: DAILY CHART (March 2020 to April 2021) (CHART 1)

In the previous silver price forecast update, it was noted that “silver prices are weathering the rise in US yields and remain technically well-positioned for further gains.” In truth, despite trading both higher and lower thereafter, silver prices are trading at the same level today as they were when that comment was written in early-March. But at that time, it was also noted that, “in context of the early-February spike that produced a brief break of the 2020 high, traders shouldn’t dismiss a potential double top coming together.”

In breaking the uptrend from the March and November 2020 low, a double top is now potentially in play. Before that takes shape, however, silver prices appear to be attempting to climb out of the downtrend from the February and March highs, which could give a near-term technical reason to throw doubt on the viability of the double top.

Despite losing ascending triangle support from the March and December 2020 lows, momentum is starting to turn the corner in a bullish manner. Silver prices are above their daily 5-, 8-, 13-, and 21-EMA envelope, which is in bullish sequential order. Daily MACD is trending higher (as of today) but remains below its signal line, while daily Slow Stochastics have already started to rebound above their median line.

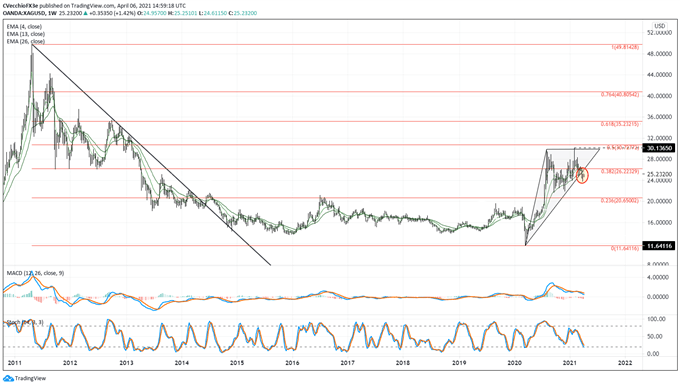

SILVER PRICE TECHNICAL ANALYSIS: WEEKLY CHART (November 2020 to April 2021) (CHART 2)

The long-term bullish technical outlook for silver prices has taken a hit in recent weeks, but the morning star candle cluster coming together on over the past three weeks suggests that the tenets of a bullish turn are coming together; this weekly candle close is critical. Recapturing the uptrend from the March and December 2020 lows would bring silver prices back into its multi-month ascending triangle, putting it back on path for a return to its yearly high at 30.1365.

Silver Prices Tracking Silver Volatility Closely

Both gold and silver are precious metals that typically enjoy a safe haven appeal during times of uncertainty in financial markets. While other asset classes don’t like increased volatility (signaling greater uncertainty around cash flows, dividends, coupon payments, etc.), precious metals tend to benefit from periods of higher volatility as uncertainty increases silver’s safe haven appeal.

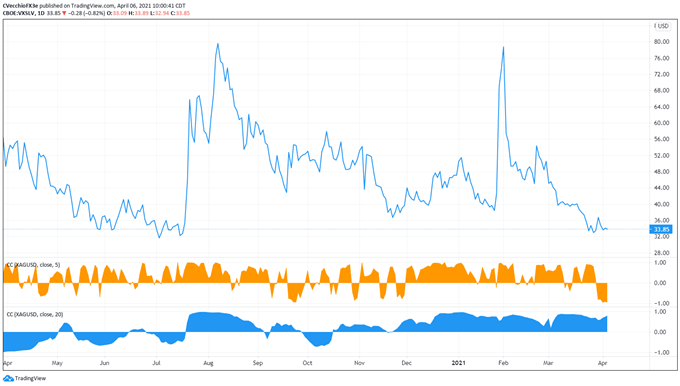

VXSLV (SILVER VOLATILITY) TECHNICAL ANALYSIS: DAILY PRICE CHART (April 2020 to April 2021) (CHART 3)

Silver volatility (as measured by the Cboe’s gold volatility ETF, VXSLV, which tracks the 1-month implied volatility of silver as derived from the SLV option chain) was trading at 33.85 at the time this report was written (notably down from the monthly high of 137.95, which is now the new all-time intraday high). The 5-day correlation between VXSLV and silver prices is -0.80 and the 20-day correlation is +0.79. One week ago, on March 30, the 5-day correlation was -0.81 and the 20-day correlation was +0.59.

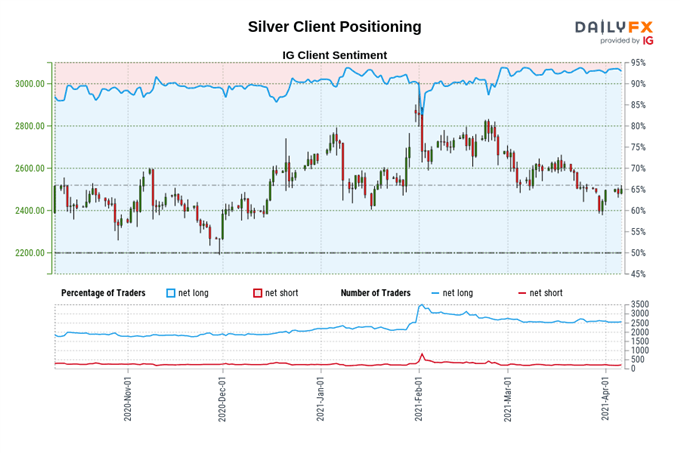

IG Client Sentiment Index: Silver Price Forecast (April 6, 2021) (Chart 4)

Silver: Retail trader data shows 93.39% of traders are net-long with the ratio of traders long to short at 14.14 to 1. The number of traders net-long is 2.13% higher than yesterday and 0.69% lower from last week, while the number of traders net-short is unchanged than yesterday and 16.06% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests Silver prices may continue to fall.

Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger Silver-bearish contrarian trading bias.

--- Written by Christopher Vecchio, CFA, Senior Currency Strategist