Silver Price Forecast Overview:

- Gains by the US Dollar ahead of the holiday may dim the near-term outlook for precious metals, including silver prices.

- But long-term technical studies still suggest that a bottoming process has commenced, suggesting that year-end profit taking won’t disrupt the overarching bullish narrative for silver prices.

- Recent changes in sentiment suggest that silver prices have a bearish outlook in the short-term.

Silver Prices Dim as Christmas Star Shines

Silver prices are down by over -3% in one of the final full trading days ahead of the Christmas-New Year’s holiday stretch, thanks in part to what may be a pre-holiday round of profit taking. After all, the top performing asset classes – like equities and precious metals – are generally lagging in recent days, while the underperformers – like the US Dollar – are faring well. Unlike the Christmas Star, which shined brightly yesterday, silver prices have a dimmer outlook in the near-term.

Silver Price Fundamentals Remain Strong

It’s still the case that “with government deficits rising and interest rates staying low – much like the 2009 to 2011 window – now that the global economy is looking ahead to a period of significant growth post-pandemic, silver prices have a recent historical precedent to suggest that they are likely to lead gold prices for the foreseeable future.” Along these lines, the silver/gold ratio remains at its highest level since mid-September.

Furthermore, long-term technical studies still suggest that a bottoming process has commenced, suggesting that year-end profit taking won’t disrupt the overarching bullish narrative for silver prices.

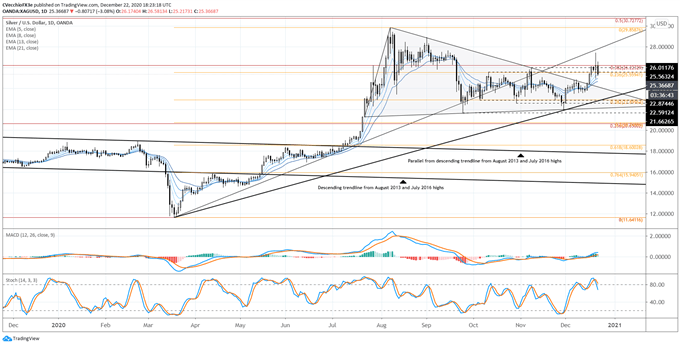

SILVER PRICE TECHNICAL ANALYSIS: DAILY CHART (DECEMBER 2019 TO DECEMBER 2020) (CHART 1)

An extremely volatile day to start the week yielded little but for a doji candle. Contextually, doji candles suggest a pause in trend, and with the prevailing move having been higher, the doji warns of a potential reversal. Coupled with the bearish inside day bar forming today, one may squint and see an evening star candle cluster taking shape – a bearish topping formation.

Having dropped below the 23.62% Fibonacci retracements of the 2020 low/high range at 25.5594, silver prices have failed at the area that produced the October and November highs. The range, as it were, is holding, between 21.6627 and 26.2233. Silver prices are now back to their daily 5-EMA, and the daily 5-, 8-, 13-, and 21-EMA envelope remains in bullish sequential order. Daily Slow Stochastics are dropping from overbought condition, and daily MACD is still above its signal line.

A deeper pullback can’t be ruled out, but won’t draw into question the potential bullish breakout attempt unless the July-December triangle is reentered.

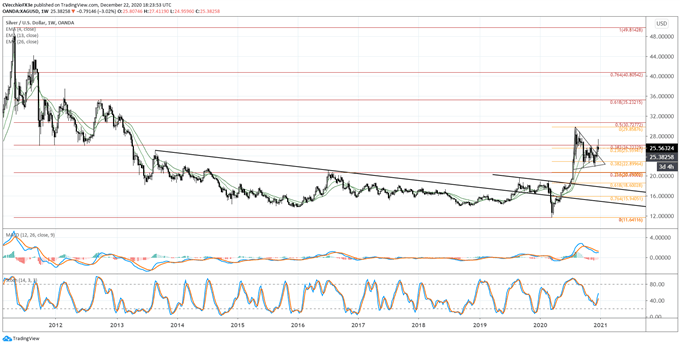

SILVER PRICE TECHNICAL ANALYSIS: WEEKLY CHART (DECEMBER 2010 TO DECEMBER 2020) (CHART 2)

Our long-term bullish view on silver prices remains. “The recent triangle consolidation is occurring in context of the breakout from the downtrend dating back to the August 2013 and July 2016 highs, suggesting that a long-term bottoming effort is still under way. If the silver price triangle were to breakout to the topside, there would be good reason to suspect that the move had meaningful technical tailwinds pushing prices higher.” The bullish breakout in silver prices may be in question, but the technical structure remains clear from this strategist’s perspective.

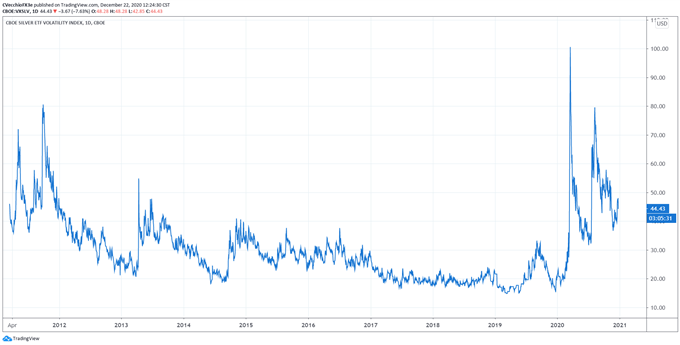

Silver Prices, Silver Volatility in Lockstep

Both gold and silver are precious metals that typically enjoy a safe haven appeal during times of uncertainty in financial markets. While other asset classes don’t like increased volatility (signaling greater uncertainty around cash flows, dividends, coupon payments, etc.), precious metals tend to benefit from periods of higher volatility as uncertainty increases silver’s safe haven appeal. The latest bout of concern around the surging coronavirus numbers in the United States and the revelations about the mutated strain in UK have fostered more uncertainty into year end.

VXSLV (SILVER VOLATILITY) TECHNICAL ANALYSIS: DAILY PRICE CHART (MARCH 2011 TO DECEMBER 2020) (CHART 3)

Silver volatility (as measured by the Cboe’s gold volatility ETF, VXSLV, which tracks the 1-month implied volatility of silver as derived from the SLV option chain) was trading at 44.43 at the time this report was written. The 5-day correlation between VXSLV and silver prices is +0.80 and the 20-day correlation is +0.91. One week ago, on December 15, the 5-day correlation was +0.80 and the 20-day correlation was +0.37.

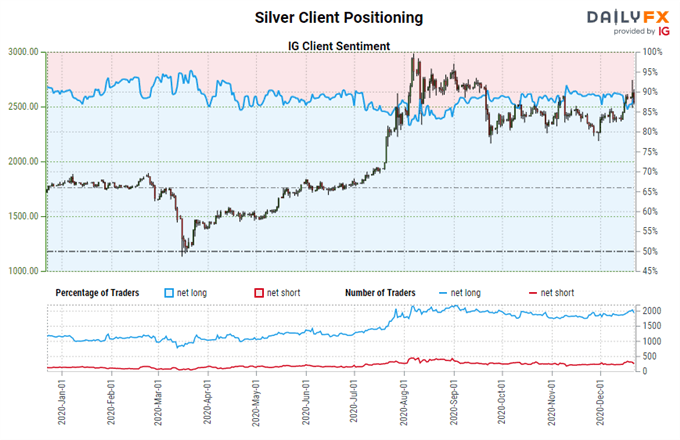

IG Client Sentiment Index: Silver Price Forecast (December 22, 2020) (Chart 4)

Silver: Retail trader data shows 88.95% of traders are net-long with the ratio of traders long to short at 8.05 to 1. The number of traders net-long is 7.78% higher than yesterday and 4.87% higher from last week, while the number of traders net-short is 1.20% lower than yesterday and 4.65% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests Silver prices may continue to fall.

Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger Silver-bearish contrarian trading bias.

--- Written by Christopher Vecchio, CFA, Senior Currency Strategist