What’s inside:

- Silver struggling at July trend-line

- Supported by low 17s, neckline

- Trading considerations from both sides of the tape

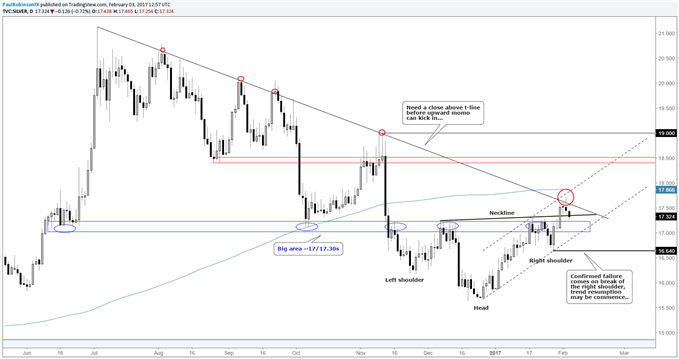

On Wednesday, we were looking at silver as it traded above the neckline of an inverse H&S formation, but was facing off with important trend-line resistance extending back to the July high. Yesterday, as the US dollar reversed, so did silver off this important line-in-the-sand. The decline off the Thursday high is putting silver back down towards the low 17s, an area the metal previously struggled to overcome since November. This barrier (now support) dating back to June roughly coincides with the neckline. The zone from the current price (17.32) down to ~17 is big support and a break below and the trend-line extending higher from the December low would quickly expose the possibility that the bullish bottoming pattern is on the verge of failing. If this were the case, confirmation would come on trade back below the right shoulder low created on 1/27 at 16.64.

But before we go jumping the gun, again, silver is challenging support and will be treated as a potential floor until broken. With that said, right now there isn’t much to the upside to get excited about until a solid closing bar above the July trend-line takes shape. This could come on a daily basis or even better, on the weekly time-frame.

Silver: Daily

Created with Tradingview

Traders looking out over the short-term are caught between strong support and strong resistance. This makes for a difficult situation to trade in either direction. Those looking out over a longer-term horizon – weeks or longer – are faced with a decision here. Aggressive traders may look for ‘best prices’ by establishing a short position along the July trend-line, with stops not far above. However, there is the conflicting bullish inverse H&S formation to take into consideration. With that in mind, waiting for a break of the right shoulder low looks like the safer way to play this at the moment. For those looking to establish a long position, yes there is the bullish pattern in play on your intended side of the market, but the steadfast downtrend line needs to give-way first before upward momentum can set in. On that idea, waiting for silver to break above the trend-line first looks like the more prudent move on this end.

Whether bull or bear, the current technical landscape offers a roadmap to follow in the event of a resolution in either direction.

See the Webinar Calendar for a schedule of upcoming live events with DailyFX analysts.

---Written by Paul Robinson, Market Analyst

You can receive Paul’s analysis directly via email by signing up here.

You can follow Paul on Twitter at @PaulRobinonFX.