Canadian Dollar Rate Forecast Key Takeaways:

- The ONE Thing: Technical picture shows strength after possible ‘bull trap.’ The week is littered with key economic data like CPI & Retail Sales on Friday, which if strong could lift CAD further against weaker currencies.

- The US Dollar Index will be a difficult way to play potential CAD strength due to the recent jump in USD after in-line retail sales and March’s upward revision has boosted confidence in the Fed and lifted the implied probability of four rate hikes this year now comfortablyabove 50%. UST 10-Year Yield jumped as high as 3.07% with Treasury market volatility at the highest level since February.

- Crude oil remains broadly strong though is lower on the session as signs of physical market tightness via backwardation has lessened. Crude oil will likely see some volatility on the weekly EIA Crude Oil Inventory Report that has recently shown persistent drawdowns and broad demand.

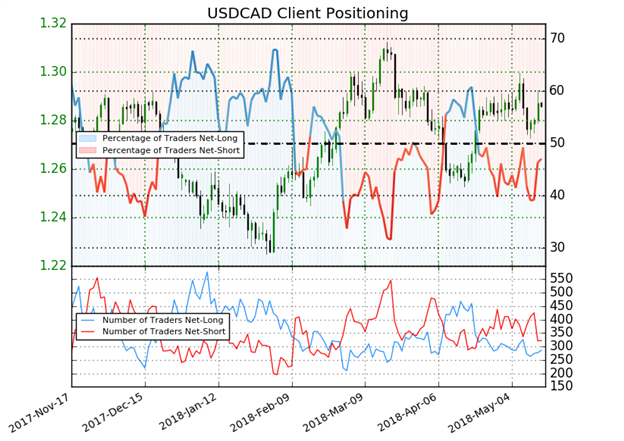

- IG UK Client Sentiment Highlight: Recent changes in sentiment warn that the current USDCAD price trend may soon reverse lower despite the fact traders remain net-short.Retail Sentimentis utilized as a contrarian technical trading tool, an insight derived from our Traits of Successful Traders research.

Key Technical Levels for Canadian Dollar Rate to US Dollar:

- Resistance: C$1.2925 May 15 High

- Spot: C$1.2798

- Support: C$1.2730 – May 11 Low / C$1.2527 – April low

USD/CAD Daily Chart: Canadian Dollar Strengthens From Lower High

Chart Source: IG Charting Package, IG UK Price Feed. Created by Tyler Yell, CMT

The Canadian Dollar rate has held up well against the strengthening US Dollar. On Tuesday, the entire G10FX space lost ground to the US Dollar as US Treasury yields jumped through 2014 highs to the highest level since 2011 on bets that inflation was coming and the Fed would hike four times in 2018 to contain the inflation.

After Tuesday’s standout performance, the Canadian Dollar strengthened toward the 50-DMA at C$1.2802. A break below the May 11 low at C$1.2730 would likely validate the view that broader CAD strength is about to develop, but not likely against the US Dollar or as significantly against the US Dollar.

Bearish targets currently sit at C$1.2628 and C$1.2400 as Fibonacci Expansion targets.

Not familiar with Fibonacci analysis, check out this insightful article

Traders looking for lower hanging fruit may want to try CAD/JPY if CAD strength is material. 3-Day RSI on CADJPY is a G10-leading 85 showing significant strength. Such JPY weakness makes sense given USD/JPY recently broke aggressively higher on higher UST yields.

Valuable Insight from IG Client Positioning for USD/CAD: Retail selling activity drops, biased lower

Data source: IG Client Positioning

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests USDCAD prices may continue to rise. Yet traders are less net-short than yesterday and compared with last week. Recent changes in sentiment warn that the current USDCAD price trend may soon reverse lower despite the fact traders remain net-short (emphasis mine.)

More For You:

Are you looking for longer-term analysis on the U.S. Dollar? Our DailyFX Forecasts for Q2 have a section for each major currency, and we also offer a excess of resources on USD-pairs such as EUR/USD, GBP/USD, USD/JPY, AUD/USD. Traders can also stay up with near-term positioning via our popular and free IG Client Sentiment Indicator.

Forex Trading Resources

DailyFX offers a surplus of helpful trading tools, indicators and resources to help traders. For those looking for trading ideas, our IG Client Sentiment shows the positioning of retail traders with actual live trades and positions.

Our trading guides bring our DailyFX Quarterly Forecasts and our Top Trading Opportunities; and our real-time news feed has intra-day interactions from the DailyFX team. And if you’re looking for real-time analysis, our DailyFX Webinars offer numerous sessions each week in which you can see how and why we’re looking at what we’re looking at.

If you’re looking for educational information, our New to FX guide is there to help new(er) traders while our Traits of Successful Traders research is built to help sharpen the skill set by focusing on risk and trade management.

---Written by Tyler Yell, CMT

Tyler Yell is a Chartered Market Technician. Tyler provides Technical analysis that is powered by fundamental factors on key markets as well as t1rading educational resources. Read more of Tyler’s Technical reports via his bio page.

Communicate with Tyler and have your shout below by posting in the comments area. Feel free to include your market views as well.

Discuss this market with Tyler in the live webinar, FX Closing Bell, Weekdays Monday-Thursday at 3 pm ET.

Talk markets on twitter @ForexYell