US Dollar Technical Price Outlook: DXY Weekly Trade Levels

- Dollar technical trade level update – Daily & Intraday Charts

- USD reverses sharply off 2016 high-close; risk for further losses while below 100

- DXY sell-off approaching initial support objectives

The US Dollar plummeted more than 2.4% off fresh multi-year highs this week with DXY threatening a false-breakout of uptrend resistance. This week’s volatility continues a string of massive swings in the greenback with USD marking ranges in excess of 2% for the past four consecutive weeks. The recent price collapse is testing initial support here and the focus is on a the weekly close with respect to the 100-handle for guidance. These are the updated technical targets and invalidation levels that matter on the US Dollar Index (DXY) weekly price chart. Review my latest Strategy Webinar for an in-depth breakdown of this US Dollar trade setups and more.

US Dollar Index Price Chart – DXY Weekly

Chart Prepared by Michael Boutros, Technical Strategist; US Dollar Index on Tradingview

Notes: In my last US Dollar Weekly Price Outlook our bottom line cited that the DXY sell-off had, “covered the entire yearly range in under three weeks with the decline now approaching the first major support hurdle.” We noted that, “Ultimately, a break / close below last year’s low at 95.03 is needed to fuel the next leg lower in the Dollar...” The index briefly probed below to register a low at 94.65 before reversing sharply higher with the dollar failing at the 2016 high-close / parallel resistance at 102.95. Another sharp reversal this week takes price back below the initial yearly opening-range highs with price paring half the entire yearly range in one week.

Initial weekly support here at 98.81 backed by confluence a 61.8% Fibonacci confluence at 97.83/87 - look for a bigger reaction there IF reached with a close below needed to suggest a more significant high was registered this week. Such a scenario would shift the focus back towards 97.35 and yearly open support at 96.50. Initial resistance now back at 98.98- a close above this threshodl would be needed to keep the broader long-bias viable heading into next week with key resistance now at the yearly high-week close at 101.95.

For a complete breakdown of Michael’s trading strategy, review his Foundations of Technical Analysis series on Building a Trading Strategy

Bottom line: The US Dollar price reversal is attempting to pullback below uptrend resistance and while the broader focus remains higher, the risk is mounting for a larger correction IF price closes the week at these levels. Form a trading standpoint, look for topside exhaustion while below 100 with a break sub-97.87 needed to keep the immediate short-bias in play. Keep in mind we’re heading into the close of the month/quarter early next week – stay nimble into the April open with Coronavirus headlines likely to continue driving broader market sentiment.

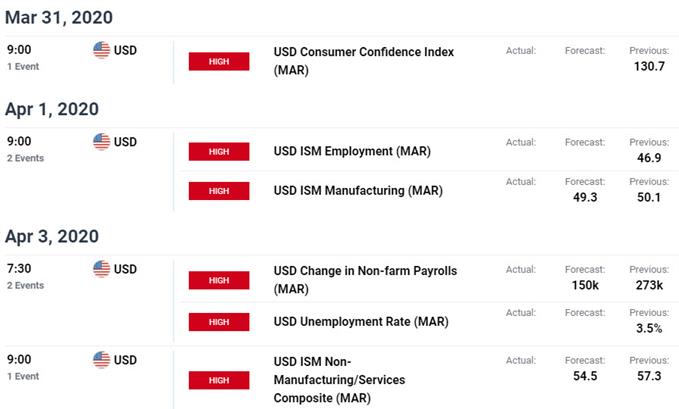

Key US Data Releases

Economic Calendar - latest economic developments and upcoming event risk.

Previous Weekly Technical Charts

- S&P 500 (SPX500)

- British Pound (GBP/USD)

- Canadian Dollar (USD/CAD)

- Gold (XAU/USD)

- Mexican Peso (USD/MXN)

- Australian Dollar (AUD/USD)

- Euro (EUR/USD)

--- Written by Michael Boutros, Technical Strategist with DailyFX

Follow Michael on Twitter @MBForex