Sterling Technical Price Outlook: GBP/USD Weekly Trade Levels

- Sterling technical trade level update – Weekly Chart

- GBP/USD plunges to multi-decade lows as Coronavirus global pandemic spreads

- Pound testing weekly downtrend support- broader risk remains lower sub-1.2278

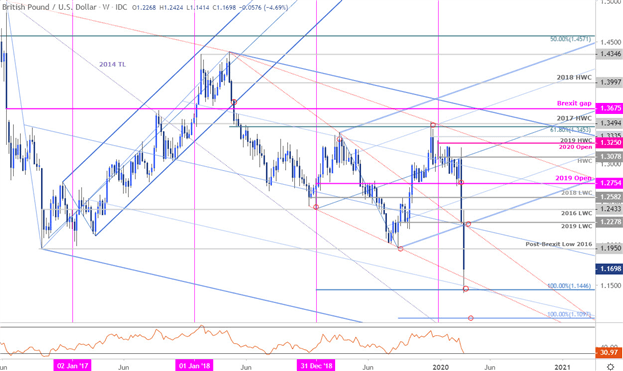

The British Pound plunged nearly 5% against the US Dollar this week with Sterling trading to lows not seen since 1985. The decline marks the second consecutive weekly loss with the March range now larger than then entire 2019 yearly trading range. Risk-off flows have taken root as the Coronavirus global pandemic deepens, fueling demand for dollar amid plummeting equity markets. Cable tested confluence downtrend support this week and the focus is on a reaction off this mark heading into next week. These are the updated targets and invalidation levels that matter on the GBP/USD technical chart. Review my latest Weekly Strategy Webinar for an in-depth breakdown of this Cable trade setup and more.

Sterling Price Chart - GBP/USD Weekly

Chart Prepared by Michael Boutros, Technical Strategist; GBP/USD on Tradingview

Notes:In our last Sterling Weekly Price Outlook we noted that the GBP/USD had rebounded, “off lateral support and IF price is indeed heading lower, near-term advances should be capped by the median line.” Cable rebounded off the 2019 yearly open at 1.2754 but respected the median-line on a weekly close basis as resistance before reversing sharply lower last week. The losses carried over with Cable poised to mark the largest weekly range since the October 2016 low.

Weekly confluence support rests at with the 100% extension at 1.4446- this level converges on the 25% parallel of the descending pitchfork formation- the immediate short-bias may be vulnerable while above this threshold with a close below needed to keep the focus on subsequent support objectives at 1.1097. Initial resistance now back at the 2016 post-Brexit swing low at 1.1950 with broader bearish invalidation now lowered to the 2019 low-week close at 1.2278.

For a complete breakdown of Michael’s trading strategy, review his Foundations of Technical Analysis series on Building a Trading Strategy

Bottom Line: The Sterling outlook remains weighted to the downside after broking below significant technical support- that said, the decline is now approaching downtrend technical confluence around 1.1446. From a trading standpoint, a good area to reduce short-exposure / lower protective stops. Look for possible downside exhaustion into the start of the week – ultimately a recovery may offer more favorable entries closer to downtrend resistance. We’ll reassess a rebound IF price holds here. Review my latest Sterling Price Outlook for a closer look at the near-term GBP/USD technical trade levels.

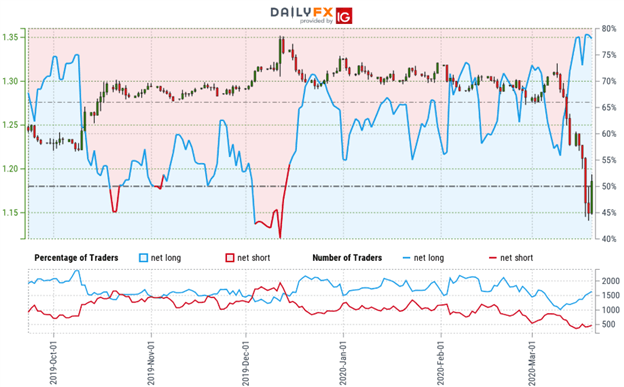

Sterling Trader Sentiment (GBP/USD)

- A summary of IG Client Sentiment shows traders are net-long GBP/USD - the ratio stands at +2.65 (72.62% of traders are long) – bearish reading

- Long positions are13.64% lower than yesterday and 13.16% higher from last week

- Short positions are12.20% higher than yesterday and 2.56% higher from last week

- We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests GBP/USD prices may continue to fall. Traders are less net-long than yesterday but more net-long from last week. The combination of current positioning and recent changes gives us a further mixed GBP/USD trading bias from a sentiment standpoint.

| Change in | Longs | Shorts | OI |

| Daily | 3% | -7% | -3% |

| Weekly | 4% | -10% | -5% |

---

Previous Weekly Technical Charts

- S&P 500 (SPX500)

- Canadian Dollar (USD/CAD)

- Gold (XAU/USD)

- Mexican Peso (USD/MXN)

- Australian Dollar (AUD/USD)

- Euro (EUR/USD)

--- Written by Michael Boutros, Technical Currency Strategist with DailyFX

Follow Michael on Twitter @MBForex