What's inside:

- A little time needed to identify new levels and trading opportunities in the short-term

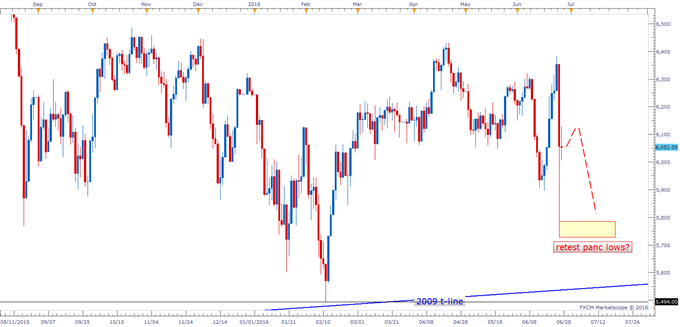

- Retest of panic low a potential scenario

- Big picture outlook still points to lower prices not only in the FTSE, but global stock markets as a whole

The initial reaction to the vote outcome on Friday was quite strong as the FTSE 100 traded lower by as much as 8% in the very early part of the session, but proved to be an overreaction as the UK index ended up taking back more than half of those losses to close out the day lower by a little over 3%. Financial and housing stocks took the brunt of the punishment, finishing down with double-digit negative returns. The British Pound failed to muster much of a recovery, ending the day down a substantial 8%. To start off the week, continued selling pressure is hitting GBP/USD (-2.4%), while the FTSE is currently off by about 1.3%.

The first thought which comes to mind is the FTSE is likely to try and make a run on those Friday spike lows at 5727 at some point in the days/weeks ahead, and whether it immediately clears through towards the February lows, or holds for a rebound will depend on how it reacts upon such a retest should it get to that point.

Broadly speaking, global stock markets look headed for a period of risk aversion or choppy side-ways price action at best, as trends which began off the 2015 peaks look to reassert themselves towards new lower lows on the weekly/monthly time-frames.

FTSE (UK100) Daily

Finding a clear trade in here for a few days might be difficult as we need to see how the market will digest Friday’s outcome, and with that in mind we will exhibit patience in finding a good risk/reward opportunity. New price levels to work with will evolve in the days ahead, and once they better present themselves we can better assess how to approach the market.

Watch trader positioning in real-time via the ‘Speculative Sentiment Index’.

---Written by Paul Robinson, Market Analyst

You can follow Paul on Twitter at @PaulRobinsonFX, and/or email him at instructor@dailyfx.com.