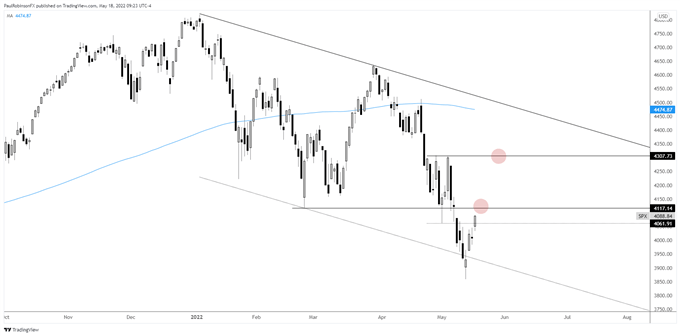

S&P 500 Technical Outlook:

- S&P 500 trading around resistance, have to see how things play out

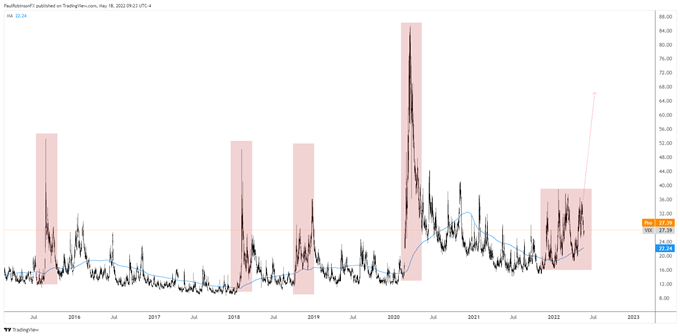

- VIX to remain elevated, likely to see a big spike before significant low is in

The market is bouncing right now, but that is all it looks like it is doing. While the S&P 500 is far off its record highs in a relatively short period of time, there has yet to be a major spike in fear that suggests a low is in.

The VIX has been high as volatility has been elevated since the start of the year. We are in a regime of high levels of volatility where even moves to the high 30s in the VIX aren’t signaling any kind of real panic and capitulation that suggests a sustainable low is in.

It appears that we will need to see a spike to 50-60+ before that happens, and that it is possible much higher. In the past that would have seemed almost unrealistic, but given how volatility itself has become a highly traded asset class, moves in vol are exasperated. The new normal for vol, if you will.

The S&P 500 is trading around the Feb low where a bounce also developed earlier this month. The area around 4100 is the first important spot to look for the market to struggle at. We have yet to see a thorough testing, but looks likely to happen in the days ahead.

Volatility and ceiling put in at that juncture could mark an important bounce high. But even if the market can recapture that level it doesn’t change the broader outlook, much more work will be needed to do that. With that said, a bounce shouldn’t develop much beyond 4300 if the market is in the process of weakening before another big leg lower.

S&P 500 Daily Chart

VIX Daily Chart

Resources for Forex Traders

Whether you are a new or experienced trader, we have several resources available to help you; indicator for tracking trader sentiment, quarterly trading forecasts, analytical and educational webinars held daily, trading guides to help you improve trading performance, and one specifically for those who are new to forex.

---Written by Paul Robinson, Market Analyst

You can follow Paul on Twitter at @PaulRobinsonFX