What’s inside:

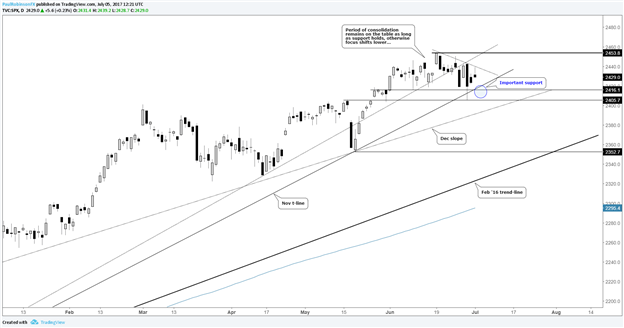

- S&P 500 testing low-end of range, November trend-line

- Stay above support outlook remains neutral to bullish

- A close below noted support shifts focus towards a decline

Looking to improve your trading? Check out our Trading Guides.

The question asked in the last post regarding the S&P 500 was, “consolidating or topping?” At the time the lean was towards consolidating, giving support and trend the benefit of the doubt. On Thursday, the market took a hit, and on an intra-day basis the trend-line from November and recent range was violated, but still maintained on a closing basis. The outlook is becoming increasingly precarious, though.

However, continuing to run with ‘support is support until it isn’t’, the market is still holding up and a neutral to bullish posturing remains intact. The market may just be undergoing a healthy consolidation which will lead to another leg higher down the road.

But should we see a clean closing daily break below the Thursday low and subsequently the bottom of the range and November trend-line, the bias will quickly shift to bearish. In this case, the first potential line of support is a slope rising up from December under the May low. How much the market leans on it as support is unclear. Price action around a test of this line, should we see a drop, will determine whether we should pay mind to it. If it were to give-way then there isn’t anything significant until the May low at 2352, and then the important February 2016 trend-line which lies not far below.

Heads up: Later today we have June FOMC minutes at 18:00 GMT, then Friday the June jobs report will be released. Both have market-moving potential over the short-term, with the minutes likely holding the largest implications.

S&P 500: Daily

Paul conducts webinars every week from Tuesday-Friday. See the Webinar Calendar for details, and the full line-up of all upcoming live events.

---Written by Paul Robinson, Market Analyst

You can receive Paul’s analysis directly via email by signing up here.

You can follow Paul on Twitter at @PaulRobinonFX.