DAX 30 Technical Highlights

- DAX 30 has clean short-term levels for traders to watch

- Should we see another swoon, big backstop to watch

DAX 30 has clean short-term levels for traders to watch

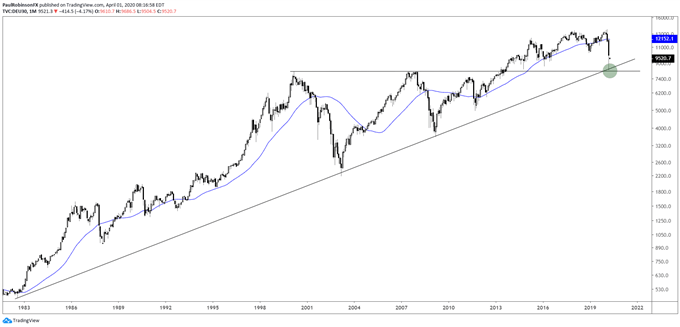

The recent low in the DAX came at a major set of long-term levels, dating all the way back to the early 1980s. A trend-line from 1982 intersects with the tops from 2000 and 2007. This combo provides a really strong level of confluent support.

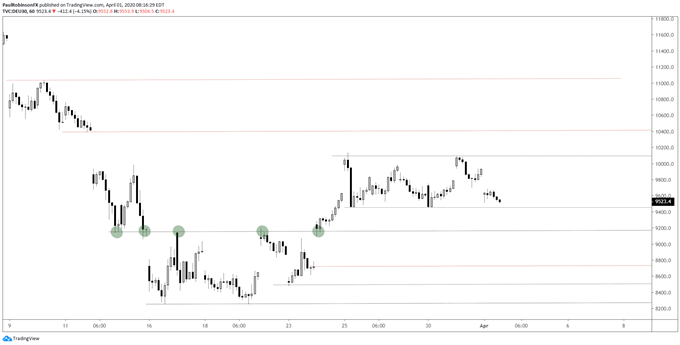

Looking at the short-term picture, the DAX is starting to roll over again after stalling back on March 25. The stalling price action has created a range that goes along with a few other clear levels to help guide traders through volatile trading conditions.

The thinking is that there is still some more upside left before selling potentially turns aggressive again. If this is to be the case, then the bottom of the range at 9453 should hold on weakness here before price rallies beyond 9951 in an attempt to fill the March 12 gap at 10412 (red line), and possibly higher.

If, however, the bottom of the range fails, then the next level of support around 9150 is likely to be met. This is a fairly substantial short-term threshold with its numerous touch points (green circles) since March 12. A drop through there opens up a path for more weakness to the March 24 gap down to 8717 (red line), followed by a minor pivot at 8480.

A reach down into those depths around the double-bottom low at 8255 will have the long-term confluent support back into play, and a likely spot for the DAX to hold for another rebound. For now, though, not thinking we will see those depths tested. The more likely outcome appears to be either hold the range, or probe a little lower before trying to trade higher.

DAX Hourly Chart (levels to watch)

DAX 30 Monthly Chart (log-scale)

Want to learn more about trading the DAX? Check out ‘How to Trade the DAX’, and join me weekly for technical updates in the Indices and Commodities webinar.

Forex & CFD Trader Resources

Whether you are a new or experienced trader, we have several resources available to help you; indicator for tracking trader sentiment, quarterly trading forecasts, analytical and educational webinars held daily, trading guides to help you improve trading performance, and one specifically for those who are new to forex.

---Written by Paul Robinson, Market Analyst

You can follow Paul on Twitter at @PaulRobinsonFX