DAX 30 Technical Highlights

- DAX macro outlook is quite bearish, but…

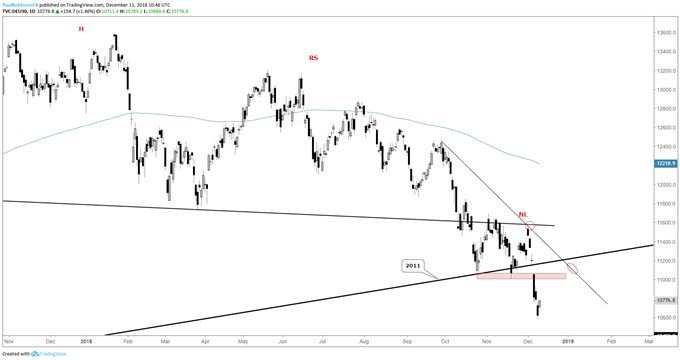

- Selling may be at or very near a short-term extreme

We’ve got forecasts, trading ideas, and educational content on the DailyFX Trading Guides page.

DAX macro outlook is quite bearish, but may go into bounce mode

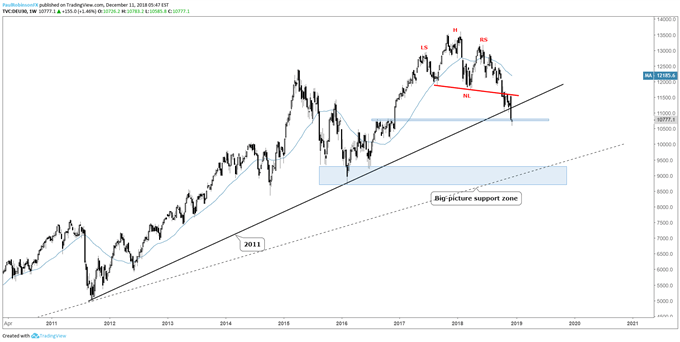

Yesterday, the DAX traded lower for the 5th day in a row since gapping and failing around the neckline of the long-term head-and-shoulders pattern, which now has the broad topping pattern fully tested and validated. There should be no more testing, especially since the only good level of long-term support is also behind us – the 2011 trend-line.

This leaves plenty of room to decline towards the next major level of support around the 2009 to current trend-line and lows from the last major correction in 2015/16. Those levels are a good distance lower and barring a massive event-driven meltdown will take some time to be reached.

In the near-term, the market is oversold but lacking good support to lean against. This makes playing a bounce tricky despite volatility offering some back-and-forth opportunities (U.S. indices displaying better volatility-trading characteristics).

Laying off shorts until a bounce works off oversold conditions looks like a prudent approach at this juncture. But might not be long before the market looks ready for new gearing back into new shorts. Keep an eye on how the U.S. plays out as it put in key-reversals yesterday.

For market sentiment and to learn more about how to use it in your analysis, check out the IG Client Sentiment page.

DAX Daily Chart (Oversold bounce)

DAX Weekly Chart (macro-techs are quite negative)

Want to learn more about trading the DAX? Check out ‘How to Trade the DAX’, and join me weekly for technical updates in the Indices and Commodities webinar.

Forex & CFD Trader Resources

Whether you are a new or experienced trader, we have several resources available to help you; indicator for tracking trader sentiment, quarterly trading forecasts, analytical and educational webinars held daily, trading guides to help you improve trading performance, and one specifically for those who are new to forex.

---Written by Paul Robinson, Market Analyst

You can follow Paul on Twitter at @PaulRobinsonFX