DAX/CAC Technical Highlights:

- DAX bounce nearing first test of resistance around 12600

- CAC trading at confluence of resistance

- Tactical considerations outlined

To see our analysts’ Top Trading Opportunities for 2018, check out the DailyFX Trading Guides page.

DAX nearing first test of resistance around 12600

The DAX continues to trade higher in a sluggish manner, most recently taking out a steep trend-line off the record high, however; the first real test of resistance may not be far off around 12600, a peak carved out late last month.

If the market doesn’t trade much higher from here a lower-high could carve itself out in what may be a developing sequence of lower-highs, lower-lows starting in January. Overall, the price action for the DAX still looks corrective, with more work needed before the bounce can be considered anything more.

In the near-term, on weakness keep an eye on a pair of intra-day lows as both days resulted in solid swings higher once the DAX bottomed; 12177, 12020. A break below both will have another leg lower well in sight. Hold above and the chop higher can continue.

For ideas on how to build or restore confidence, check out Building Confidence in Trading

DAX Daily Chart

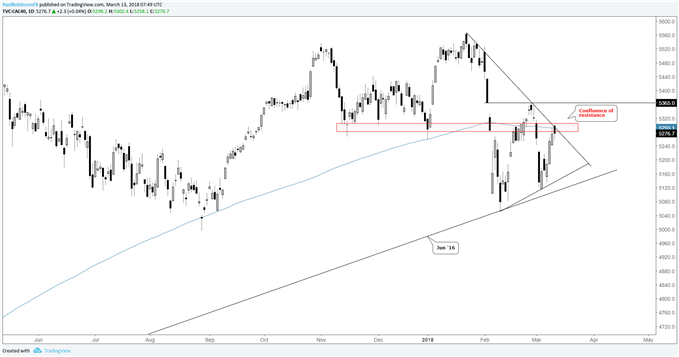

CAC trading at confluence of resistance

The CAC is currently trading at resistance by way of a trio of levels and lines. There is price resistance dating back to November, the 200-day MA, and the trend-line off the January high. Should we see a turn down from around the current vicinity, a wedge dating back towards the beginning of last month could begin to come into view.

A push through confluent resistance is needed to further along the bounce, but a swing high beyond 5365 will need to be overcame first. The French index has been broadly stronger than its German counterpart, but in the short-term has a bigger hurdle to overcome.

CAC Daily Chart

Forex & CFD Trader Resources

Whether you are a new or experienced trader, we have several resources available to help you; indicator for tracking trader sentiment, quarterly trading forecasts, analytical and educational webinars held daily, trading guides to help you improve trading performance, and one specifically for those who are new to forex.

---Written by Paul Robinson, Market Analyst

To receive Paul’s analysis directly via email, please SIGN UP HERE

You can follow Paul on Twitter at @PaulRobinsonFX