What’s inside:

- The DAX reverses off resistance

- Pattern still in play

- Important support and resistance outlined

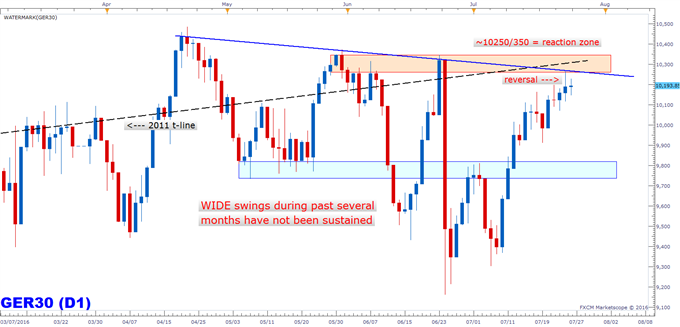

The last time we discussed the DAX was on Friday, and the index was attempting to close yet again above the high of the pivotal reversal day created on 7/18. Yesterday’s close was above, but it occurred with the formation of another reversal bar – this time at the lower end of a resistance zone between ~10250 and 10350. This zone represents a trend-line off the 4/21 peak, in addition to a back-side retest of the long-term trend-line (2011) and tops created in recent months.

The fact a reversal bar took shape doesn’t mean the market must turn lower, but when it happens from a pivotal area odds are certainly increased as it is evidence of sellers showing up where you might ‘expect’ them to.

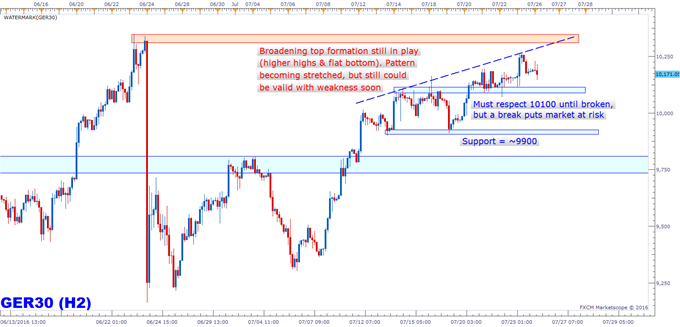

The broadening top formation we had been discussing is still alive as well, despite its shape becoming stretched. A break below support around 10100 is important, as it not only was a level we used previously as resistance on the daily, but it had become important from both a resistance then support standpoint in the past week-and-a-half. (The 'old-resistance-turns-new-support' thing.)

Looking out over the past few months, all sizable swings higher and lower have been reversed, making the current run following the EU referendum into resistance more favorable for sellers once it decisively pushes back lower. Upward momentum in recent sessions has been lacking, resistance of size is in view, a clean break below 10100 will likely bring the bearish broadening pattern into play. Should this be the case, then 9900 and lower quickly become the risk. But, until support is broken it needs to continue to be treated as such.

Start improving your trading today with one of our numerous guides designed to help you learn how to better navigate the markets regardless of your experience level.

---Written by Paul Robinson, Market Analyst

You can follow Paul on Twitter at @PaulRobinsonFX.

He can be reached via email at instructor@dailyfx.com.