What's inside:

- Continued selling yesterday pushed the DAX below prior swing lows

- Trend off the 2015 highs looks set to reassert itself

- Favored approach is selling failed rallies, preferably at resistance

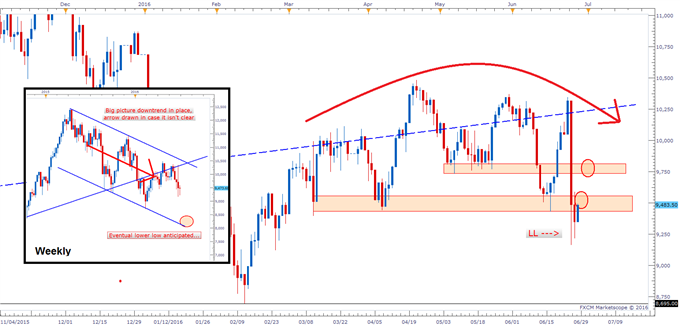

The DAX sell-off (-3%) spilled over yesterday from Friday’s shocking ‘Brexit’ outcome. The choppy price action since early March was virtually engulfed in a single day. Even though on Friday the DAX took out the April and June swing lows on an intra-day basis, it managed to finish out closing above this support on the daily time-frame. Yesterday’s additional selling pressure took the index below those support levels on a closing basis, which marks an important event, tilting the charts downward with a lower low from both April and June.

On Thursday, when we last discussed the DAX, we noted that the daily chart from March up until last week was ‘rounding out’. As long as no new swing highs above the April peak took shape, then the whole period from February up until the April high was viewed as a bounce within the constructs of the downtrend which began more than a year ago. Obviously, the DAX never made the higher high or is even close to it at this juncture in light of recent events.

The German index appears to be poised for a run at creating a lower low on the weekly chart in the weeks ahead. But it doesn’t mean it will do so in straight-line fashion, nor do we want it to. Today’s bounce is taking shape back into the first noted zone of resistance in the 9450/550 vicinity. If the DAX doesn’t find sellers at this first reaction zone, then we will turn a bit higher to the area between ~9730 and 9825.

DAX Daily [Weekly]

In any event, the strong sell-off looks to have kicked off a new macro-leg lower, and with that in mind we favor establishing short positons on failing rallies, preferably at resistance levels.

Start improving your analytical and trading skills today with of our many free trading guides.

---Written by Paul Robinson, Market Analyst

You can follow Paul on Twitter at @PaulRobinsonFX, and/or email him at instructor@dailyfx.com.