GBP/USD Talking Points:

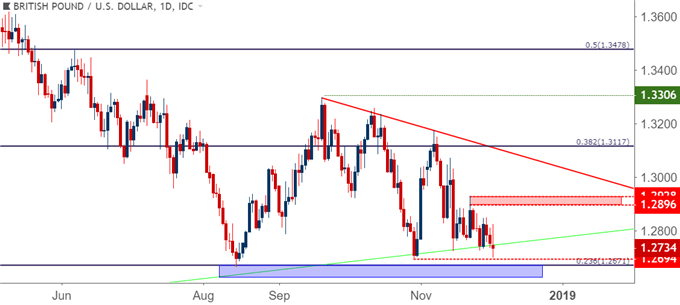

- GBP/USD set fresh lows shortly after this week’s open; but sellers pulled up shy of the October swing-low at 1.2694, and just below that is the yearly low at 1.2662. This led into a quick bounce that erased the bulk of the earlier-session losses; but the fact that November support was tested through should not be summarily discounted by those looking to trade bullish reversals in the Pound.

- The bearish backdrop around GBP/USD is similarly complicated by a lack of movement below 1.2700 over the past few months. While the upcoming House of Commons vote is widely-expected to fail, the question persists as to how much downside run may exist below the August swing at 1.2671; making short-side approaches less attractive from the scope of potential risk-reward.

- DailyFX Forecasts on a variety of currencies such as the US Dollar or the Euro are available from the DailyFX Trading Guides page. If you’re looking to improve your trading approach, check out Traits of Successful Traders. And if you’re looking for an introductory primer to the Forex market, check out our New to FX Guide.

Do you want to see how retail traders are currently trading the US Dollar? Check out our IG Client Sentiment Indicator.

The week has started off negatively for the British Pound as the currency posed an initial drop against the US Dollar. The higher-lows that built-in throughout November were quickly taken out, and prices found a bit of support just ahead of a test of the October swing-low around 1.2694. That support has thus far led into a bounce to give the net of a doji for today’s price action; but the fact that sellers were able to test this deeply is something that should be taken into account by those looking to work with what’s become a tumultuous backdrop around a volatile currency pair.

GBP/USD Two-Hour Price Chart

Chart prepared by James Stanley

Brexit Looking Increasingly Negative as House of Commons Vote Nears

At the source of the selling is continued negativity around Brexit dynamics, and as the vote in the House of Commons nears next week, sellers have continued to push despite the mass of support sitting underneath price action. This was discussed by our own Martin Essex earlier this morning; and the vote in the House of Commons is widely-expected to fail, leaving for a series of negative options ranging from a new Prime Minister to ‘No Deal Brexit’ scenarios.

The big question is whether any of these options would bring enough motivation for sellers to take-out the mid-August swing-low. That swing-low came in at the 23.6% Fibonacci retracement of the Brexit move; and since that support test more than three months ago, bears haven’t been able to make much ground below 1.2700. This includes the higher-low set in late-October, followed by the series of higher-lows that printed in November.

GBP/USD Daily Price Chart

Chart prepared by James Stanley

GBP/USD Moving Forward

With GBP/USD now testing through that November support, the operative question is whether bears can continue to push through for a re-test at 1.2671. And even if this does happen, how much more room might there be to the downside? This can be a difficult space for establishing fresh exposure in the pair, particularly if looking at the short-side of GBP/USD.

Bullish strategies are similarly complicated by a lack of decisive drivers. If there is any relief to come into GBP/USD, USD-weakness would likely be a primary source; and at that point, the trader should question whether selling US Dollars against a weak GBP is the best way of anticipating that theme. More likely there are and will be more attractive options for that theme, such trading USD-weakness against currencies that have shown strength of recent, such as Australian or New Zealand Dollars.

Outside of that, Cable bulls will likely be looking for some spark of optimism to show ahead of the House of Commons vote that is widely-expected to fail. Starting tomorrow, there will be five days of eight-hour debates (with a break from December 7-9). If there are any major breakthroughs, or if expectations begin to shift towards a more-positive outcome at that vote, we will likely see that filter through price action. A bullish break-above the 1.2850 level would begin to make that potential theme look a bit more attractive.

To read more:

Are you looking for longer-term analysis on the U.S. Dollar? Our DailyFX Forecasts for Q4 have a section for each major currency, and we also offer a plethora of resources on USD-pairs such as EUR/USD, GBP/USD, USD/JPY, AUD/USD. Traders can also stay up with near-term positioning via our IG Client Sentiment Indicator.

Forex Trading Resources

DailyFX offers a plethora of tools, indicators and resources to help traders. For those looking for trading ideas, our IG Client Sentiment shows the positioning of retail traders with actual live trades and positions. Our trading guides bring our DailyFX Quarterly Forecasts and our Top Trading Opportunities; and our real-time news feed has intra-day interactions from the DailyFX team. And if you’re looking for real-time analysis, our DailyFX Webinars offer numerous sessions each week in which you can see how and why we’re looking at what we’re looking at.

If you’re looking for educational information, our New to FX guide is there to help new(er) traders while our Traits of Successful Traders research is built to help sharpen the skill set by focusing on risk and trade management.

--- Written by James Stanley, Strategist for DailyFX.com

Contact and follow James on Twitter: @JStanleyFX