GBP/USD Talking Points:

- The British Pound is heading lower to start a big week for the currency, as a number of data releases are on the calendar to go along with more twists and turns on the Brexit front. To read more about Brexit dynamics and impact on the British Pound, our own Justin McQueen discussed this in the article entitled, GBPUSD Vulnerable to Larger Losses as PM May Looks into the Brexit Abyss.

- Last week saw strength in GBP/USD as the pair re-claimed ground above the 1.3000 handle; but that theme began to reverse last Thursday ahead of the FOMC rate decision and sellers have been in-control ever since. This continues three months of rather aggressive mean reversion in the pair.

- Quarterly Forecasts have just been updated, and the Q4 forecast for GBP/USD is available from the DailyFX Trading Guides Page. If you’re looking to improve your trading approach, check out Traits of Successful Traders. And if you’re looking for an introductory primer to the Forex market, check out our New to FX Guide.

Want to see how retail traders are currently trading GBP/USD? Click here for GBP/USD Sentiment.

GBP/USD Gap and Go

Another week, and yet another twist has shown up in the ongoing Brexit saga. While last week brought positivity and optimism around a Brexit deal with the British Pound re-claiming the 1.3000-handle, this week has seen the return of worry and skepticism, and this has pushed GBP/USD right back below the key psychological level. The currency is now extending a three-day sell-off that started last week ahead of the Thursday FOMC rate decision. This includes a gap-lower to start this week’s trading which, at this point, remains unfilled as sellers have been so actively pushing the offer that they wouldn’t allow for prices to retrace back to last week’s close.

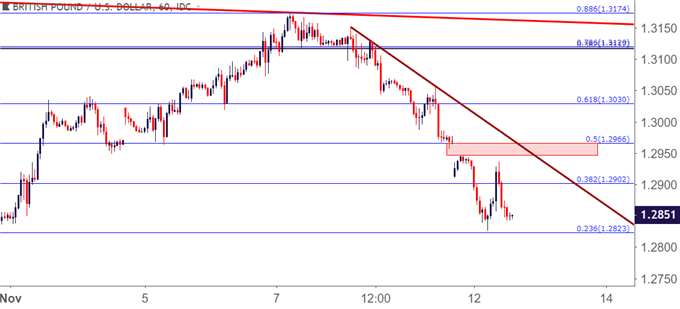

GBP/USD Hourly Price Chart: Gap and Go

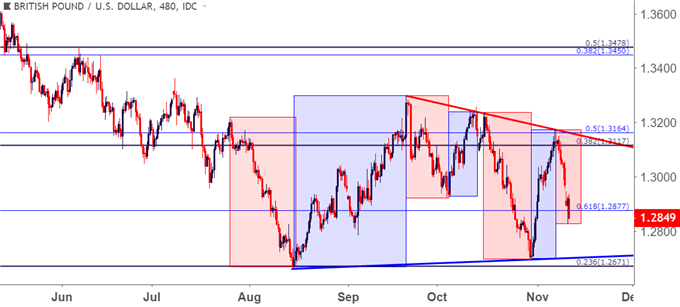

On a longer-term basis, this extends the frenetic mean reversion that’s been playing out in GBP/USD since mid-August. To be sure, the US Dollar has some blame here as well as the US currency has gone through its own fits and starts over the past three months. But a large portion of the drive in the pair is coming from dynamics in the British Pound which are, of course, being driven by the continued lack of certainty on the Brexit-front.

GBP/USD Eight-Hour Price Chart

This Week is Big for the British Pound

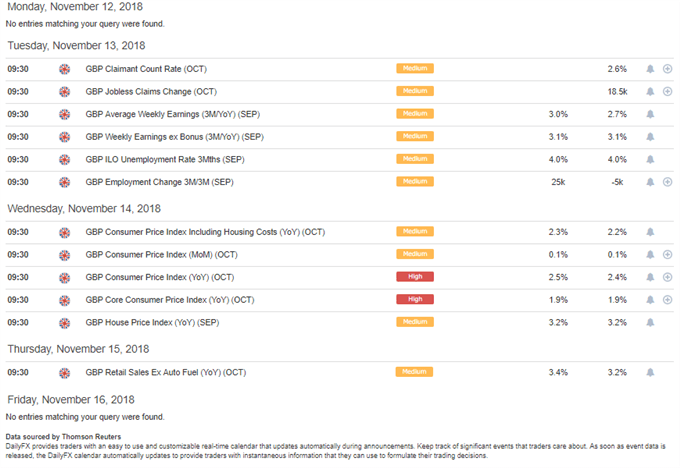

It’s a big week for British data on top of what’s taking place around Brexit, and this will likely keep the Pound on the move in the near-term. Tuesday brings jobs and wage numbers, Wednesday brings October inflation data and Thursday brings retail sales figures.

On the Brexit front, last week brought hopes of a deal being near and this week has seen that hope take a step back. The impasse over the Irish border backstop remains, and despite sources indicating that a deal was close last week, negotiators worked until late this morning and as yet, no resolution has been found. This puts the planned EU-UK summit that was being set for later this month in jeopardy, and tomorrow’s cabinet meeting that was originally being expected to hammer out the fine points of the UK’s negotiating position will likely be re-purposed to discuss no-deal planning.

DailyFX Economic Calendar: A Busy Week for British Data

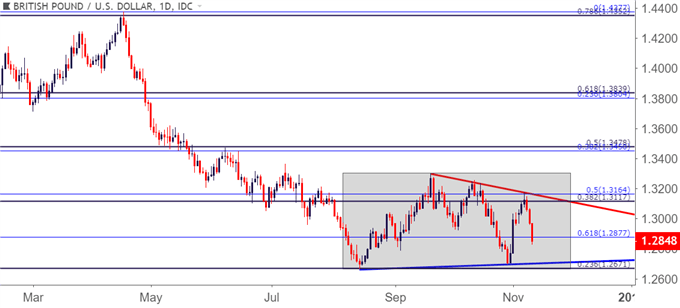

As discussed in the prior GBP/USD technical article, the longer-term setup here remains sub-optimal as prices have been caught in this bout of mean reversion for more than a quarter of this year. This type of environment can normally bring on the potential for trading ranges but, as can be seen from the below chart, even that theme has had little consistency, as driven or pushed by headlines, as the pair has put in very little formality in the way that mean reversion has played out.

GBP/USD Daily Price Chart

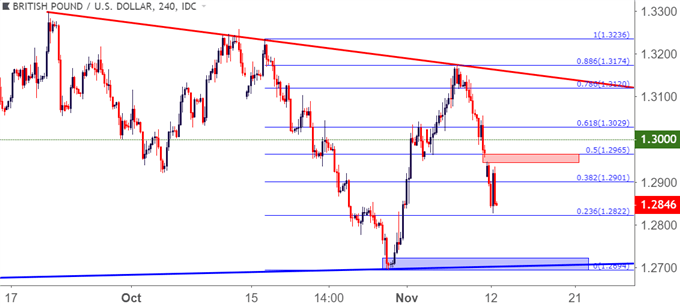

GBP/USD Near-Term Strategy

On a near-term basis, with the pair displaying as much volatility as it has, there may be some workable themes for short-term traders. This morning’s gap represents an area of interest for lower-high resistance potential for those looking to take on short exposure. This area comes in right around the 50% marker of the prior major move, focusing on the down-trend in the pair from the second half of October. And on the long side, the area around 1.2700 may be interesting depending on how prices perform on a re-test. This area had helped to provoke a higher-low during the October deluge; and until that low is taken out, it brings support potential upon another failed test to break down to fresh lows.

GBP/USD Four-Hour Price Chart

Chart prepared by James Stanley

To read more:

Are you looking for longer-term analysis on the U.S. Dollar? Our DailyFX Forecasts for Q1 have a section for each major currency, and we also offer a plethora of resources on USD-pairs such as EUR/USD, GBP/USD, USD/JPY, AUD/USD. Traders can also stay up with near-term positioning via our IG Client Sentiment Indicator.

Forex Trading Resources

DailyFX offers a plethora of tools, indicators and resources to help traders. For those looking for trading ideas, our IG Client Sentiment shows the positioning of retail traders with actual live trades and positions. Our trading guides bring our DailyFX Quarterly Forecasts and our Top Trading Opportunities; and our real-time news feed has intra-day interactions from the DailyFX team. And if you’re looking for real-time analysis, our DailyFX Webinars offer numerous sessions each week in which you can see how and why we’re looking at what we’re looking at.

If you’re looking for educational information, our New to FX guide is there to help new(er) traders while our Traits of Successful Traders research is built to help sharpen the skill set by focusing on risk and trade management.

--- Written by James Stanley, Strategist for DailyFX.com

Contact and follow James on Twitter: @JStanleyFX