Euro Technical Price Outlook: EUR/USD Near-term Trade Levels

- Euro updated technical trade levels – Daily & Intraday Charts

- EUR/USD testing multi-year Fibonacci resistance- bulls vulnerable sub-1.1823/52

- Trade remains constructive while above 1.15- topside breach exposes 1.1961

Euro is poised to snap a six-week winning streak with EUR/USD down 0.27% since the Sunday open. The breakout has now responded to a critical long-term resistance zone we’ve been tracking for months now and leaves the broader rally vulnerable near-term. These are the updated targets and invalidation levels that matter on the EUR/USD price charts heading into the close of the week. Review my latest Weekly Strategy Webinar for an in-depth breakdown of this Euro trade setup and more.

Euro Price Chart – EUR/USD Daily

Chart Prepared by Michael Boutros, Technical Strategist; EUR/USD on Tradingview

Technical Outlook: In our last Euro Technical Price Outlook we noted that EUR/USD was probing resistance into the October 2018 high at 1.1621 with breach / close above needed to, “mark resumption towards subsequent resistance objective at 1.1712 and 1.1815/22.” A breakout the following day fueled a sharp rally into the close of July trade with price registering a high at 1.1909 before reversing off pitchfork resistance to settle the week / month below this key resistance range.

The focus remains on the 61.8% Fibonacci retracement of the 2018 decline / June 2018 high at 1.1822/52 with the broader advance vulnerable while below this threshold near-term. Initial support rests at the 1.17-handle backed by 1.1621. Bullish invalidation now raised to the 2019 high-day close at 1.15. Ultimately, a breach / close above the upper parallel is needed to mark resumption towards the November 2017 swing high at 1.1961 and the 2018 yearly open at 1.2005.

Euro Price Chart – EUR/USD 120min

Notes: A closer look at Euro price action sees EUR/USD trading within the confines of a proposed descending pitchfork formation extending off last week’s highs. It’s too early to rely on this slope but the gradient does highlight levels of interest. Initial support at the weekly opening-range lows at 1.17 backed closely by 1.1621/41- look for a reaction there IF reached with a break / close below needed to suggest a larger correction is underway. Weekly open resistance stands at 1.1771 backed by 1.1822 & 1.1852- both levels of interest for possible topside exhaustion.

Bottom line: Euro is pulling back from confluence resistance at multi-year highs and leaves the broader rally vulnerable near-term while below. From a trading standpoint, a good region to reduce long-exposure / raise protective stops – look for a breakout of the weekly opening-range for guidance. Ultimately, a larger setback may offer more favorable opportunities closer to trend support with a breach above the highs needed to mark resumption of the broader uptrend. Review my latest Euro Weekly Price Outlook for an in-depth look at the longer-term EUR/USD technical trade levels.

For a complete breakdown of Michael’s trading strategy, review his Foundations of Technical Analysis series on Building a Trading Strategy

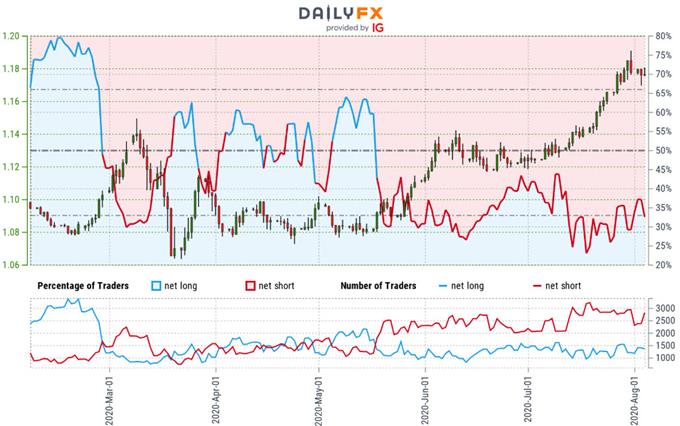

Euro Trader Sentiment – EUR/USD Price Chart

- A summary of IG Client Sentiment shows traders are net-short EUR/USD - the ratio stands at -1.79 (35.79% of traders are long) – bullish reading

- Long positions are 12.31% higher than yesterday and 9.39% higher from last week

- Short positions are8.47% higher than yesterday and 3.81% higher from last week

- We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests EUR/USD prices may continue to rise. Yet traders are less net-short than yesterday and compared with last week. From a sentiment standpoint, recent changes in positioning warn that the current EUR/USD price trend may soon reverse lower despite the fact traders remain net-short.

| Change in | Longs | Shorts | OI |

| Daily | -1% | -4% | -3% |

| Weekly | 4% | -10% | -5% |

---

Key Euro / US Data Releases

Economic Calendar - latest economic developments and upcoming event risk.

Active Trade Setups

- Australian Dollar Forecast: AUD/USD Breakout at Risk Below 2019 High

- Gold Price Outlook: XAU/USD Technical Breakout Eyes 2011 Record Highs

- Dollar vs Mexican Peso Price Outlook: USD/MXN Range Contraction

- Canadian Dollar Price Outlook: USD/CAD Returns to Range Support

- Japanese Yen Price Outlook: USD/JPY Recovery at Risk into Resistance

- S&P 500 Technical Analysis: Stock Rally Vulnerable- Breakout Levels

- Written by Michael Boutros, Currency Strategist with DailyFX

Follow Michael on Twitter @MBForex