EUR/USD TECHNICAL ANALYSIS: BEARISH

- Euro back on the defensive after sellers neutralize upside breakout

- Immediate support below 1.10, key resistance just under 1.12 mark

- Near-term chart setup warns against over-extrapolating downside

Get help building confidence in your EUR/USD strategy with our free trading guide!

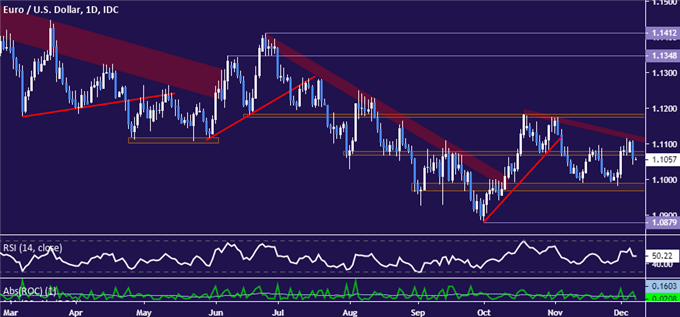

The Euro snapped lower, undoing what looked like a bullish breakout. Signs of ebbing bullish momentum noted last week proved prescient, suggesting that long-term bearish trend resumption signaled by November’s breakdown remains in play.

The single currency has slipped back below the 1.1069-80 price inflection zone, seemingly opening the door for another test of the 1.0968-90 area. Breaking below that on a daily closing basis would expose the October 1 low at 1.0879 next.

Near-term resistance is marked by a downward-sloping barrier connecting swing highs over the past two months.Pushing above its outer layer – now at 1.1124 – would put double top resistance in the 1.1176-83 region back in.

Daily EUR/USD chart created with TradingView

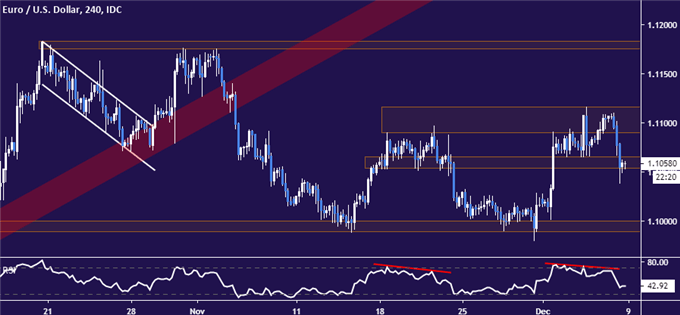

Zooming in to the four-hour chart to size up nearer-term positioning warns against over-extrapolating downside follow-through for now. EUR/USD conspicuously fell short of breaching the 1.1054-65 congestion area on the way lower, warning that a rebound may precede any further weakness.

4-hour EUR/USD chart created with TradingView

EUR/USD TRADING RESOURCES

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

- Join a free webinar and have your questions answered

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

To contact Ilya, use the comments section below or @IlyaSpivak on Twitter