EUR/GBP PRICE OUTLOOK: EURO & POUND STERLING TURN ATTENTION TO ECONOMIC DATA ON DECK, ECB & BOE EVENT RISK

- Expected currency volatility in EUR/GBP churns higher ahead of heavy-hitting data releases scheduled on the economic calendar in addition to reports due from the ECB and BOE

- The Euro stands to swing in response to German GDP data as well as ECB minutes from its latest monetary policy update slated for release over the coming trading sessions

- British Pound price action will likely be fixated on UK inflation figures and the Bank of England credit conditions survey as members of its MPC hint at potential for future dovish action

Spot EUR/GBP price action could be elevated over the coming trading sessions according to implied currency volatility derived from forex options contracts. Activity in the Euro and British Pound is expected to rise likely owing to the string of high-impact data releases and latest insight from the European Central Bank (ECB) and Bank of England (BOE) expected to cross the tape.

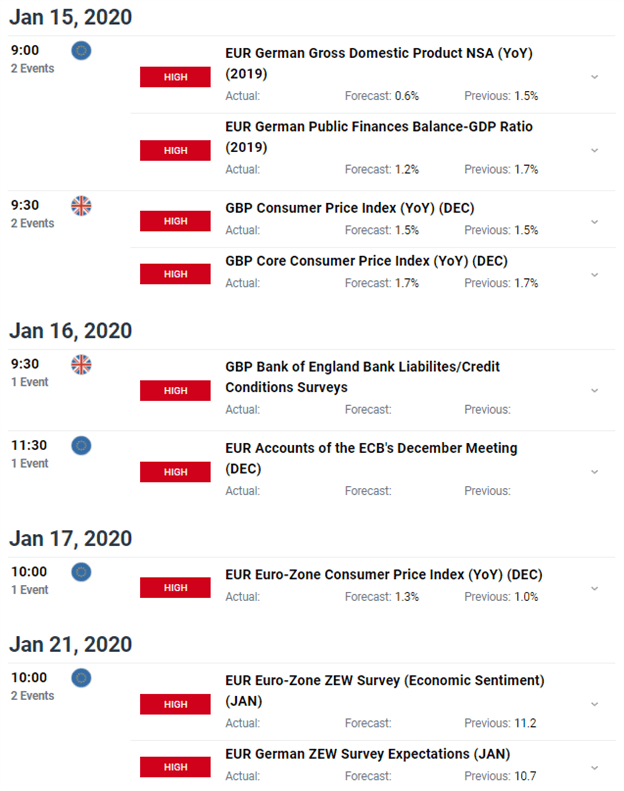

According to the DailyFX Economic Calendar, the most immediate scheduled event risk threatening EUR/GBP is the upcoming publication of German GDP and UK inflation data, which are expected to cross the wires Wednesday, January 15 at 9:00 GMT and 9:30 GMT respectively.

EURO & POUND STERLING – FOREX ECONOMIC CALENDAR HIGHLIGHTS GERMAN GDP, UK INFLATION, BOE CREDIT CONDITIONS SURVEY, ECB MEETING MINUTES, EUROZONE CPI & SENTIMENT

Shortly thereafter, the Euro and Pound Sterling have potential to respond violently to the BOE credit conditions survey due Thursday, January 16 at 9:30 GMT and will be followed by the release of ECB meeting minutes from the central bank’s most recent monetary policy update at 11:30 GMT.

Eurozone inflation figures will top off this week’s series of high-impact economic data releases on Friday, January 17 at 10:00 GMT. Looking forward a full 7 calendar days brings to focus the latest report on Eurozone economic sentiment from the monthly ZEW survey of expectations due next Tuesday, January 21 at 10:00 GMT.

EUR/GBP PRICE CHART: DAILY TIME FRAME (JULY 2019 TO JANUARY 2020)

Correspondingly, forex traders may want to keep spot EUR/GBP price action on the watchlist in light of its above-average potential for volatility in response to the aforementioned fundamental catalysts.

According to EUR/GBP implied volatility readings of 7.3% and 5.7% for the overnight and 1-week contracts, spot prices are estimated to remain within a 66-pip and 136-pip trading range over the stated time frames.

| Change in | Longs | Shorts | OI |

| Daily | 33% | -26% | 4% |

| Weekly | 6% | 4% | 5% |

This 1-standard deviation band around spot EUR/GBP is calculated using the overnight implied volatility reading of 7.3% and 1-week implied volatility reading of 5.7%, which results in an implied trading range of 0.8574-0.8508 and 0.8473-0.8609 for their respective tenors.

Mathematically speaking, spot EUR/GBP price action should be contained within the options-implied trading range over the specified period with a 68% statistical probability.

-- Written by Rich Dvorak, Junior Analyst for DailyFX.com

Connect with @RichDvorakFX on Twitter for real-time market insight