EURGBP TECHNICAL ANALYSIS

- EURGBP retreated from consecutive 11-week climb

- Brexit news may have contributed to pair’s pullback

- How far will EURGBP fall and where might it land?

See our free guide to learn how to use economic news in your trading strategy !

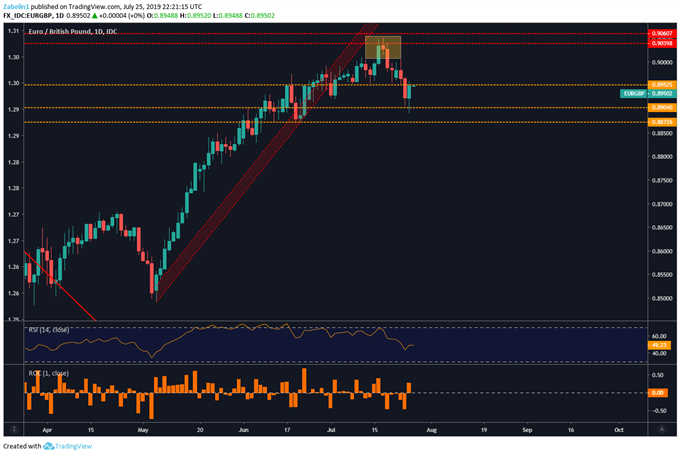

As forecasted, EURGBP pulled back after attempting to break past the seven-month resistance range between 0.9039-0.9060 (red dotted lines). The pair retreated to a familiar floor at 0.8952 (yellow dotted line), which in the past acted as resistance before becoming support. It appears the fickle price level is now reprising its role as the former although it is not entirely convincing it will be a formidable barrier to overcome.

EURGBP Shies Away From 7-Month High

Recent Brexit developments may have been behind EURGBP’s decline. The appointment of Boris Johnson as Prime Minister removed the risk of uncertainty over who will take over from the beleaguered Theresa May. The Pound has been modestly stronger against most of its counterparts for the past few days. While normally, fundamentals would be kept out of a technical article, for GBP crosses this is difficult because:

“Performing technical analysis on a pair whose counter currency is linked to a fundamentally volatile environment makes it unusually difficult and unpredictable. There is no telling when a sudden political development will cross the headlines and what the respective magnitude of the price swing will be.”

If you’re interested in learning more about political risks impacting financial markets, be sure to follow me on Twitter @ZabelinDimitri.

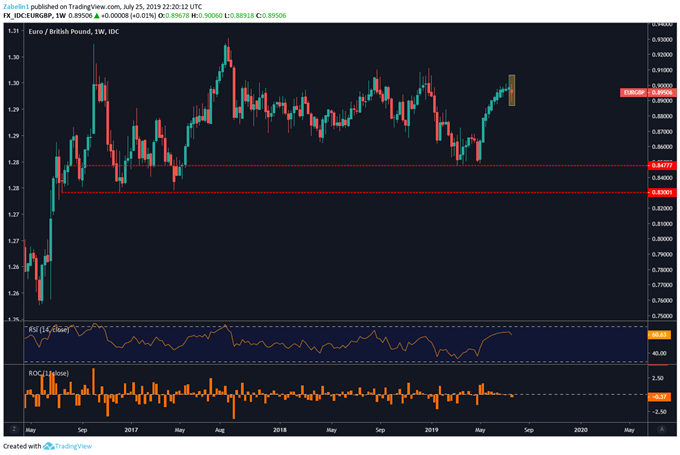

The extent of EURGBP’s decline may be limited by the price parameters that have been in place since the 2016 referendum. Zooming out to a weekly chart shows the pair has been somewhat range-bound for a little over two years. EURGBP’s retreat may reflect markets’ hesitation to break one of these barriers, coupled with a slightly less uncertain fundamental backdrop.

Sugar Rush Wears Off: EURGBP 11-Week Uptrend Takes a Turn

Looking ahead, the pair may hover between 0.8952 and 0.9060, barring any Brexit developments that offer traders the luxury of feeling a fleeting moment of hope over a resolution for the political entanglement. A break below support at 0.8874 could lead to a selloff, though Fibonacci retracement suggests the downward move may be limited with the pair hitting a possible floor at the 0.382 percent level.

EURGBP TRADING RESOURCES

- Join a free webinar and have your trading questions answered

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

--- Written by Dimitri Zabelin, Jr Currency Analyst for DailyFX.com

To contact Dimitri, use the comments section below or @ZabelinDimitri on Twitter