Bitcoin, Ethereum, Cardano Talking Points:

- Crypto markets pulled back over the weekend as risk began to spread on the Evergrande scenario in China.

- Both Bitcoin and Ethereum are testing big spots of support; while Cardano has slid back for a re-test of the psychological level at $2.00.

- The analysis contained in article relies on price action and chart formations. To learn more about price action or chart patterns, check out our DailyFX Education section.

This week opened with a bang as global markets started to tighten up around the brewing scenario taking place in China with Evergrande. Throw the prospect of contagion on the taper topic, which was already in the headlines for this week as the Federal Reserve meets for their September rate decision, and there’s been a potent cocktail of selling that’s so far driven a number of risk assets to fresh lows.

I had looked into stocks a little earlier today, but crypto markets were similarly met with a wall of sell orders to kick off the week. Big levels are in play in both Bitcoin and Ethereum; and possibly in Cardano, as well.

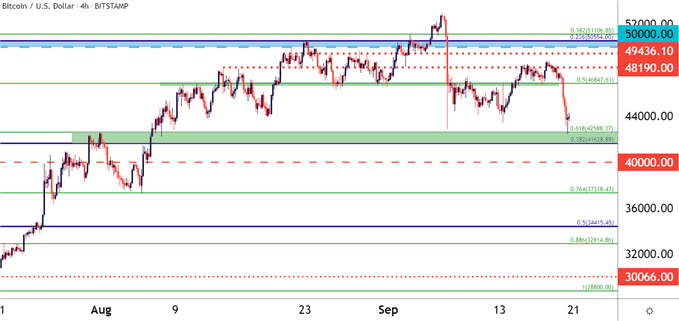

In Bitcoin, prices are testing the support zone that I had looked into last week, taken from around the 42,588 level on the chart. This is the 61.8% Fibonacci retracement of the Jan 22 – April major move and this same price had come into play as resistance on August 1st.

To learn more about Fibonacci, check out DailyFX Education

Bitcoin Four-Hour Price Chart

Chart prepared by James Stanley; Bitcoin on Tradingview

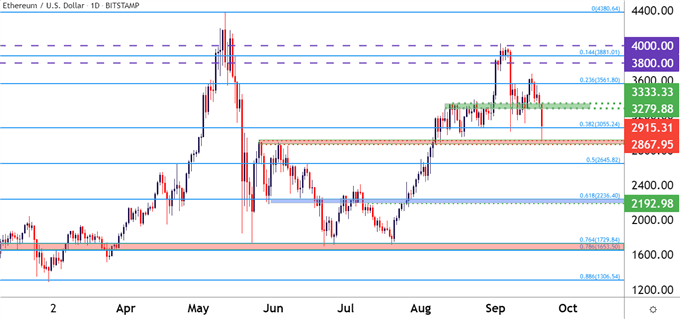

Ethereum Tests Support at Prior Resistance

Similarly a big zone is in-play in Ethereum. This support can be taken from a group of swing-highs in late-May, spanning from around 2867-2915, and this area had caught a quick swing low back in August after prices had broken above; and so far today the topside of that zone is cauterizing the low, coupled with a quick bounce back above the 38.2% retracement at 3055.

Ethereum Daily Price Chart

Chart prepared by James Stanley; Ethereum on Tradingview

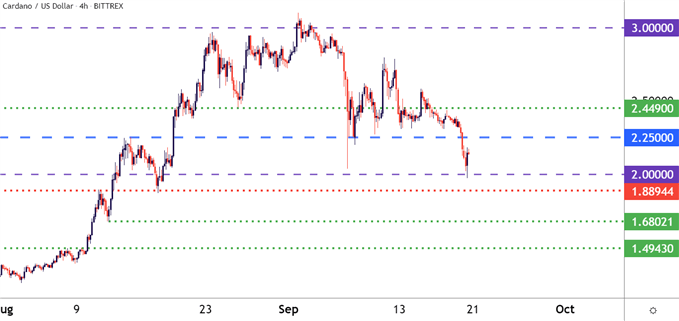

Cardano Back Down to the 2.0000 Handle

While both Bitcoin and Ethereum are holding support provided by prior price action structure, Cardano is spilling lower and testing below the 2.0000 psychological level. Given the more recent focus on the coin, combined with the more speculative nature of an alt-coin versus Ethereum and Bitcoin above, and there could possibly be even more force should this recent round of risk aversion continue.

The next spot of support on my Cardano chart is the swing around 1.8895, and below that is a swing around 1.6802 after which another appears around 1.4843. On the bearish side, a push up to and hold of resistance around 2.2500 could re-open the door for bearish trend scenarios in the coin.

Cardano Four-Hour Price Chart

Chart prepared by James Stanley; Bitcoin on Tradingview

--- Written by James Stanley, Senior Strategist for DailyFX.com

Contact and follow James on Twitter: @JStanleyFX