USD/MXN Highlights:

- USD/MXN stuck in sideways meander

- Stock market/risk appetite a big factor

USD/MXN stuck in sideways meander

USD/MXN hasn’t gone anywhere of recent, but that has generally been the case throughout the USD-sphere. One of the biggest factors in play right now is risk appetite, and as long as it remains strong (i.e. stocks firm to up) then it will continue to be a boon for the Peso.

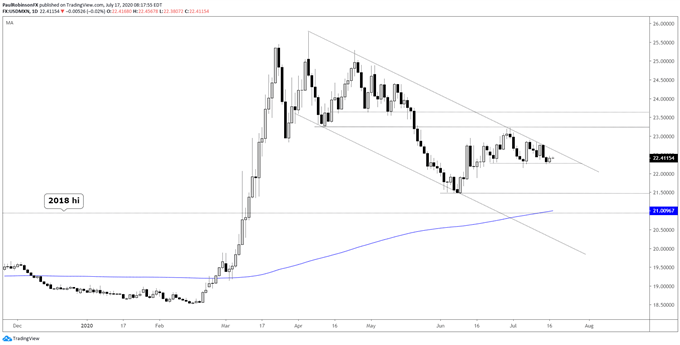

If the upside in stocks persists then we could see USD/MXN succumb to selling that pushes it below the June low at 21.46 towards the 200-day and 2018 high that are currently in confluence around the 21-mark.

On the top-side there is work to be done if we are to see a rally in the pair develop, and contrary to the stocks up/MXN up theme we will likely have to see stocks down to get MXN down. But looking at USD/MXN in a bubble, it needs to cross above the upper parallel from the April high, then above the June high at 23.28 if it is to turn the ship around.

Whether it can happen from here or after another round of selling is of course to be seen, but longer-term it is quite possible the weakness we have seen in recent months will turn out to be merely a correction in an ongoing long-term uptrend.

For now, risk/reward in either direction isn’t particularly appealing, making the sidelines potentially the best place to be. With time greater clarity should present itself.

USD/MXN Daily Chart (rangebound for now)

Resources for Forex Traders

Whether you are a new or experienced trader, we have several resources available to help you; indicator for tracking trader sentiment, quarterly trading forecasts, analytical and educational webinars held daily, trading guides to help you improve trading performance, and one specifically for those who are new to forex.

---Written by Paul Robinson, Market Analyst

You can follow Paul on Twitter at @PaulRobinsonFX