June 30 Deadline, Brexit, British Pound, GBP/USD, GBP/NZD, GBP/CAD – TALKING POINTS

- GBP/USD has been relatively directionless for over two months – is that about to change?

- Technical cues, recent price action in GBP/NZD suggest a turnaround may be in the cards

- GBP/CAD may retest descending resistance, but failure to clear it could accentuate losses

GBP/USD Outlook

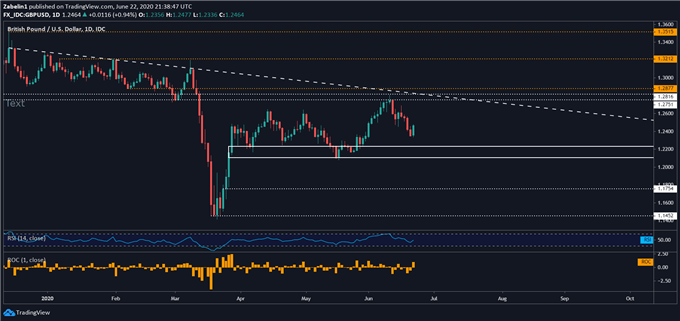

GBP/USD appears to have been condemned to another period of relatively directionless trading after the pair was rejected at the first of three layers of resistance at 1.2751, 1.2816 and 1.2877, respectively. Following the interim of upside friction, the pair subsequently declined approximately three percent, but is now showing signs of bottoming out.

GBP/USD – Daily Chart

GBP/USD chart created using TradingView

If a recovery subsequently ensues, the pair could challenge that lowest ceiling again, but GBP/USD may also end up retesting a moderate slope of depreciation dating back to December 2019. If the pair is unable to clear that again, it could inspire additional sellers to enter the market and cause GBP/USD to retrace – what would have been at that point – its recent gains.

GBP/NZD Forecast

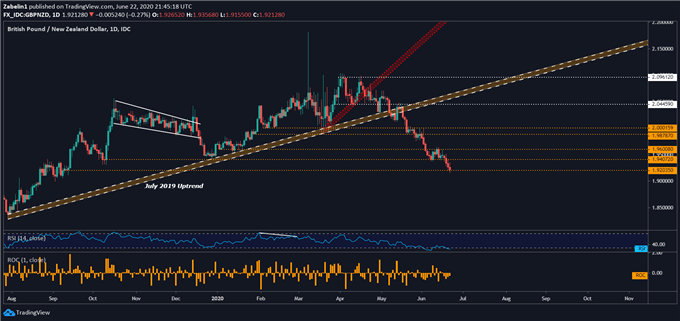

After breaking below the July 2019 uptrend, GBP/NZD declined almost five percent, but recent price action at key technical levels suggest a recovery may be ahead. The pair is currently hovering just on the cusp of support at 1.9203, the weakest exchange rate since September of last year. If the pair is able to avoid closing below this floor with follow-through, it could mark the beginning of a recovery.

GBP/NZD – Daily Chart

GBP/NZD chart created using TradingView

Furthermore, signs of positive RSI divergence suggest downside momentum is slowing, support the notion of a possible turnaround. Having said that, it should be noted this indicator does not guarantee the pair will nurse its losses. Conversely, if selling pressure persists and GBP/NZD closes below this floor with follow-through, it could catalyze an aggressive selloff and extend the pair’s losses.

GBP/CAD Analysis

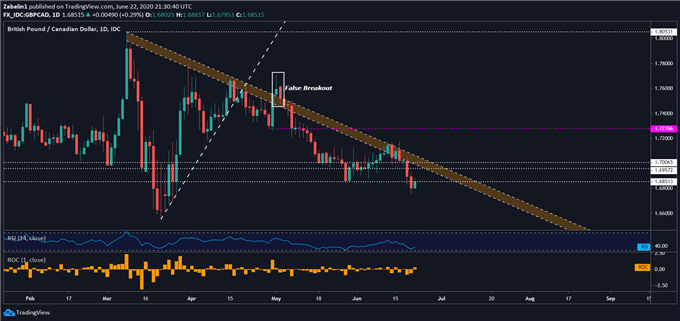

GBP/CAD recently declined over one percent after the pair was rejected at descending resistance dating back to the March 15 swing-high. The pair is trading just below a familiar support level at 1.6851, which could drag the pair further down if it closes below it again. Conversely, clearing it will mean retesting steep resistance, opening the door for another potential decline if the slope of depreciation holds.

GBP/CAD – Daily Chart

GBP/CAD chart created using TradingView

Brexit Deadline: June 30

June 30 is a point of no return: it is the last day the government of the United Kingdom has to ask for an extension to the transition period beyond the December 31 deadline this year. Speculation about a disorderly Brexit and the inability to ratify an agreement with the EU before then has pressured the British Pound earlier this year. A resurrected fear of that specter could haunt GBP and elicit higher-than-usual volatility.

--- Written by Dimitri Zabelin, Currency Analyst for DailyFX.com

To contact Dimitri, use the comments section below or @ZabelinDimitri Twitter