Nasdaq 100 Highlights:

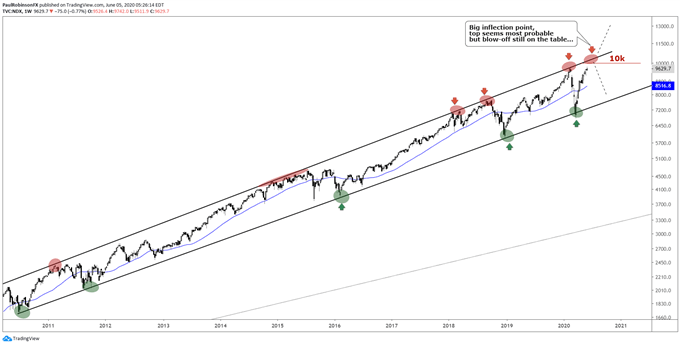

- Nasdaq 100 nearing top of bull market channel, and…

- A new high to 10,000 is in the works at the same time

- Could mean another major top or we go off the rails

Nasdaq 100 nearing top of bull market channel/10k

The Nasdaq 100 is defying logic they will tell you, and perhaps this is the case – but the defiance may be either coming to an end and things will start to ‘make sense’ again, or the market may go off the rails as it enters a blow-off stage.

Back in February we looked at a very similar set-up as the Nasdaq approached the top of the bull market channel spanning back a decade and the 10k threshold. The top of the channel was met, 10k was not. The channel has kept things pretty well contained the last few years, with it acting as a top twice in 2018, a low that same year, the top in February, and the low in March.

With the market rising vertically into the top-side line and it also roughly matching the psychological 10k threshold (10100/200), we have the perfect recipe for a significant inflection point. Currently leaning towards this turning into another top, but should price action accelerate on through then we could see the market go vertical in blow-off style.

The next few weeks could turn out to be another pivotal point in a historical year of market gyrations. Either way traders should gear up for some fireworks soon. It seems unlikely there won’t be some kind of large moves to come given where we are and the environment we are in.

The NDX is largely run by FANMAG (Facebook, Apple, Netflix, Microsoft, Amazon, Google), the bull market darlings that have weathered the coronavirus storm and are being snatched up by retail and professional traders alike. So goes the NDX goes the SPX goes the rest of the world. Until that stops being the case I will continue to follow that sequence.

Nasdaq 100 Weekly Log Chart (Upper Parallel, 10k)

Nasdaq 100 Chart by TradingView

Resources for Forex Traders

Whether you are a new or experienced trader, we have several resources available to help you; indicator for tracking trader sentiment, quarterly trading forecasts, analytical and educational webinars held daily, trading guides to help you improve trading performance, and one specifically for those who are new to forex.

---Written by Paul Robinson, Market Analyst

You can follow Paul on Twitter at @PaulRobinsonFX