USD/MXN Highlights:

- USD/MXN is rising sharply on climb in financial market uncertainty

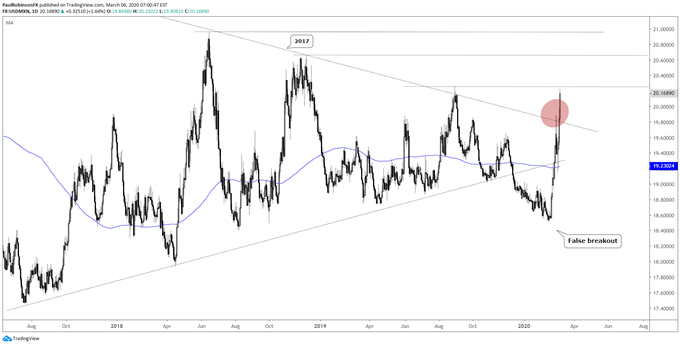

- The reversal of the long-term macro-wedge nearly in play

USD/MXN is rising sharply on climb in financial market uncertainty

Markets are volatile and emerging market currencies are reeling against the Dollar. It’s an interesting dynamic, the Dollar is rallying strongly against EMFX, but getting crushed against the G10, like the Euro. USD/MXN is right in the mix of all of this. It is on the verge of reversing a false breakdown triggered at the end of last year and confirming a bullish breakout from a multi-year triangle pattern.

This is a situation we have been monitoring closely for some time now, with USD/MXN sneaking down out of the triangle in December. The momentum was weak and hinted at a possible false-break, and within three weeks-time since hitting a low we have seen price rise to the highest levels of September, but…

More importantly, price is at the top of the wedge dating back to 2017. The false break, then confirm on the top-side in-line with the long-term trend could bring another major bull-leg higher in the months ahead. The size and duration of the pattern imply that a 20% move or greater could be in the cards.

The final touch of confirmation that the triangle is broken will be a push above the August high at 20.25. This not only puts USD/MXN clearly out of the triangle but will also turn the intermediate-term trend in favor of higher levels.

USD/MXN Daily Chart (working on a breakout)

USD/MXN Weekly Chart (could lead to massive move higher)

***Updates will be provided on the above thoughts and others in the trading/technical outlook webinars held at 1030 GMT on Tuesday and Friday.

Resources for Forex & CFD Traders

Whether you are a new or experienced trader, we have several resources available to help you; indicator for tracking trader sentiment, quarterly trading forecasts, analytical and educational webinars held daily, trading guides to help you improve trading performance, and one specifically for those who are new to forex.

---Written by Paul Robinson, Market Analyst

You can follow Paul on Twitter at @PaulRobinsonFX