USD/IDR, USD/MYR, USD/SGD, USD/PHP – ASEAN Technical Analysis

- US-China trade deal weakens USD against ASEAN currencies

- USD/IDR touches levels form early 2018, USD/MYR may rise

- USD/SGD and USD/PHP may see upside technical pressures

Indonesian Rupiah, Malaysian Ringgit, Singapore Dollar, Philippine Peso Fundamental Recap

ASEAN currencies such as the Indonesian Rupiah, Malaysian Ringgit, Singapore Dollar and Philippine Peso have generally been gaining against the US Dollar. From a fundamental perspective, this has come against the backdrop of the US-China “phase one” trade deal signing. In this week’s report, I take a look at where some of the exotic FX can go from here using technical analysis.

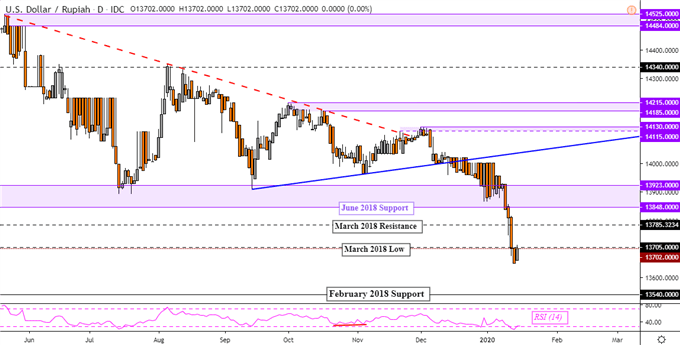

Indonesian Rupiah Technical Outlook

The Indonesian Rupiah has pushed to levels not seen against the US Dollar since March 2018 after clearing through key support at 13848. That has opened the door to resuming the dominant downtrend in USD/IDR since November 2018. Prices are sitting right around lows from March 2018 with the pair eyeing 13540, former support from February 2018. Immediate resistance sits above at 13785 on the chart below.

USD/IDR Daily Chart

USD/IDR Chart Created in TradingView

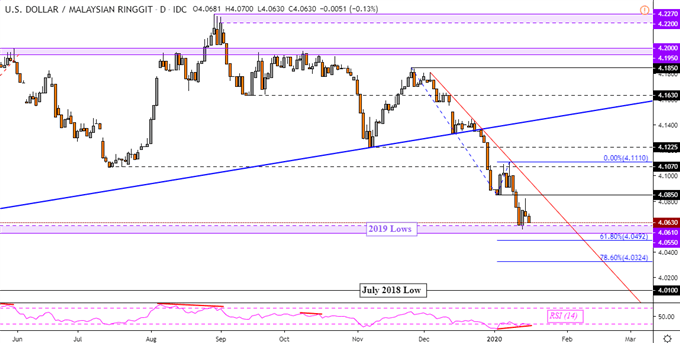

Malaysian Ringgit Technical Outlook

The Malaysian Ringgit has extended its rise against the US Dollar, gains may be at risk. As USD/MYR approached lows from 2019, positive RSI divergence emerged. This shows fading downside momentum which can at times precede a turn higher. That would place the focus on near-term falling resistance from December. Otherwise resuming the downtrend exposes the 61.8% Fibonacci extension at 4.0492 followed by the 78.6% level at 4.0324.

To stay updated on fundamental developments for ASEAN currencies, follow me on Twitter here @ddubrovskyFX

USD/MYR Daily Chart

USD/MYR Chart Created in TradingView

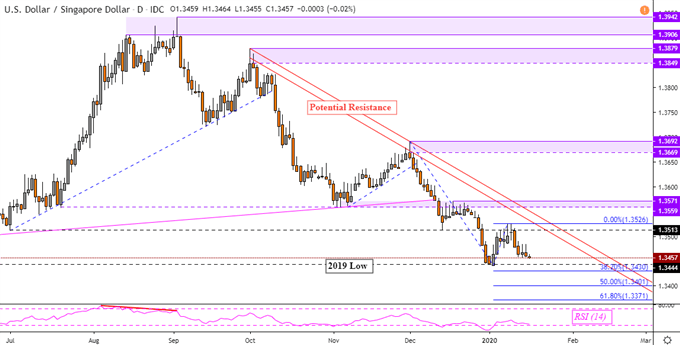

Singapore Dollar Technical Outlook

The Singapore Dollar reversed course against the US Dollar, appreciating in the near-term. This has sent USD/SGD in the direction of the key downtrend since late August. At the time of this writing, the currency pair has yet to clear lows from the beginning of January. Taking out 1.3444 exposes the 38.2% Fibonacci extension at 1.3430 followed by the 50% midpoint at 1.3401. Keep a close eye on RSI which seems to be on the verge of developing positive divergence. That may place the focus on near-term gains towards 1.3513.

Learn more about how the MAS conducts monetary policy and what matters for the Singapore Dollar !

USD/SGD Daily Chart

USD/SGD Chart Created in TradingView

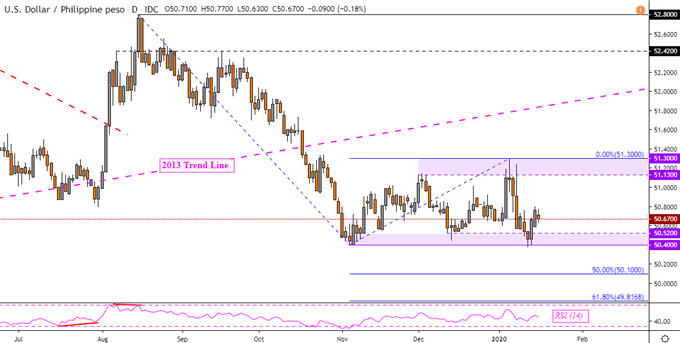

Philippine Peso Technical Outlook

The Philippine Peso has paused its ascent against the US Dollar after failing to breach key support. That is a range between 50.40 to 50.52. This prolongs USD/PHP’s consolidation since November with resistance at 51.13 – 51.30. From here, support holding may pave the way for a retest of the upper range. Otherwise, pushing through immediate support exposes the 50% Fibonacci extensions at 50.10.

USD/PHP Daily Chart

USD/PHP Chart Created in TradingView

--- Written by Daniel Dubrovsky, Currency Analyst for DailyFX.com

To contact Daniel, use the comments section below or @ddubrovskyFX on Twitter