The Euro broke the important 11300 level yesterday and with it opens up room for more weakness. USD/JPY is looking to make a push on an area it has had a difficult time with since last year, how will it respond on another attempt to break through? EUR/CAD wedge gaining appeal as it forms within the context of a generally weak trend. Gold is pushing down on trend support off the August low, how it reacts here could be important for the foreseeable future.

Technical Highlights:

- EUR/USD 11300 break opens up for more losses

- USD/JPY has big resistance just ahead in mid-11400s

- EUR/CAD wedge coming to light in context of weak trend

- Gold price trading on important trend support

See the DailyFX Q4 Forecasts to find out where our team of analysts think your favorite markets and currencies are headed as the year quickly draws towards its conclusion.

EUR/USD 11300 break opens up for more losses

In the weekly Euro technical forecast I made note of the 11300 line and its importance given its significance starting back on the night of the U.S. Presidential election in 2016. Yesterday’s clean break has EUR/USD pressed on an underside trend-line, but giving the 11300 break more weight and with the underside trend-line also pointing lower it is not viewed as significant support. The next swing level beneath the t-line is around 11118, a swing level from last year. Overall, the burden of proof still weighs heavily on longs.

EUR/USD Daily Chart (underside t-line support at the moment)

See what key fundamental and technical factors are expected to drive EUR/USD through year-end in the Q4 Euro Forecast

USD/JPY has big resistance just ahead in mid-11400s

USD/JPY is grinding its way back towards a big test of a formidable zone of resistance. The area around 11430/74 has been in play since May of last year. The powerful rejection last month validated its importance in the shorter-term. Another rejection will favor another pullback while a firm break through will have momentum favoring a move higher. Could be an important test this week.

USD/JPY daily chart (big resistance)

See what key fundamental and technical factors are expected to drive the Japanese Yen through year-end in the Q4 JPY Forecast

EUR/CAD wedge coming to light in context of weak trend

EUR/CAD continues to be on the radar as a short. The wedging price action within the confines of the downtrend since March suggests a breakdown could take shape at some point soon, but there may be a bit more coiling up before that happens. In the event of another leg lower, multi-year trend-lines in the vicinity of 14500/300 will be targeted.

EUR/CAD Daily Chart (Wedge forming)

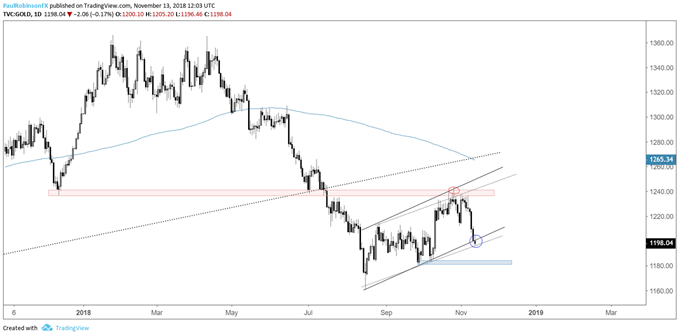

Gold price trading on important trend support

Gold is testing the trend-line (lower parallel) off the August low. It’s a big spot to hold if gold is to at least continue its tepid trend higher, although it looks like a corrective move so far from the sell-off leading up to the August low. A breakdown will have 1183/82 or worse in focus.

See what key fundamental and technical factors are expected to drive Gold through year-end in the Q4 Gold Forecast

Gold Daily Chart (Trading at channel support)

Resources for Index & Commodity Traders

Whether you are a new or an experienced trader, DailyFX has several resources available to help you; indicator for tracking trader sentiment, quarterly trading forecasts, analytical and educational webinars held daily, trading guides to help you improve trading performance, and one specifically for those who are new to forex.

---Written by Paul Robinson, Market Analyst

You can follow Paul on Twitter at @PaulRobinsonFX