What’s inside:

- BoC expected to raise rates for first time since September 2010

- One-day implied volatility balloons to over 19%

- Projected range overlaid with key daily price levels

Looking for a longer-term view on USDCAD? Check out our Q3 Forecast.

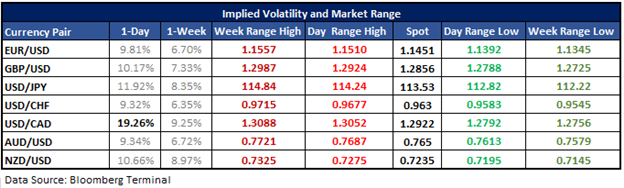

Below, you’ll find implied volatilities for the major USD-pairs we track looking out over one-day and one-week time-frames. Utilizing these levels, we’ve calculated the projected range-low/high prices from the current spot price within one-standard deviation for specified periods. (Statistically speaking, 68% of the time price should remain within the lower and upper-bounds.)

USDCAD short-term implied volatility ramps up ahead of expected BoC rate hike, central bank outlook

At 14:00 GMT, the Bank of Canada (BoC) is expected to raise rates for the first time since September 2010, and while it anticipated that they do so, the options market is still pricing in substantial volatility to follow the meeting’s outcome. Currently, one-day implied volatility is at 19.26% which, based on a one-standard deviation move, projects the intra-day range for USDCAD to be between 12792 and 13052 from the current spot price. A move to either bound would be in excess of 1%.

Given the market is already expecting the central bank to raise rates, the biggest surprise would come if they didn’t raise rates by the expected 25 bps. In this event, CAD would almost certainly sell off sharply, bringing into question strength we’ve seen for the past couple of months.

For live coverage of the BoC announcement, join analyst David Song at 13:45 GMT.

But going with the expectation that the BoC raises, attention will be on the central bank’s intentions moving beyond today. This is where things could get interesting and volatility could surge. The day-range high is projected at 13052, which aligns with the top of a resistance zone extending back to September. A move to those levels may offer traders in the days ahead to join the downtrend off the May high should we see any spike higher only prove to be short-lived. Looking lower, should we see USDCAD decline sharply following the meeting outcome, the projected low of 12792 aligns with support from August, and may act as a short-term floor as the trend becomes exhausted. Sell the rumor, buy the news.

In any event, expect out-sized volatility, and depending on what the BoC has to say (assuming they raise rates) USDCAD could move into either key support or resistance.

Other key event risk this week for FX markets is Fed Chairwoman, Janet Yellen, testifying in Washington today and tomorrow. For details on times, see the economic calendar.

For other currency volatility-related articles please visit the Binaries page.

USDCAD: Daily

See the Webinar Calendar for a schedule of upcoming live events with DailyFX analysts.

---Written by Paul Robinson, Market Analyst

You can receive Paul’s analysis directly via email by signing up here.

You can follow Paul on Twitter at @PaulRobinonFX.