Canadian Dollar Technical Forecast: Neutral

- USD/CAD fell to critical support as sentiment remained mixed

- Rising oil prices may further support a stronger Canadian Dollar

- USD/CAD eyes key levels with breakout potential in either direction

To learn more about how to trade USD/CAD, check out our DailyFX Education section.

USD/CAD Fundamentals Weigh on Risk Sentiment

After an eventful week in markets, USD/CAD rates have fallen back towards the critical level of support currently holding firm at 1.262.

With the FOMC and BoC rate announcements now priced into the markets, the collapse of Evergrande and supply constraints remain key factors that could potentially assist in a breakout of the Loonie towards either direction.

Trading Strategies and Risk Management

Global Macro

Recommended by Tammy Da Costa

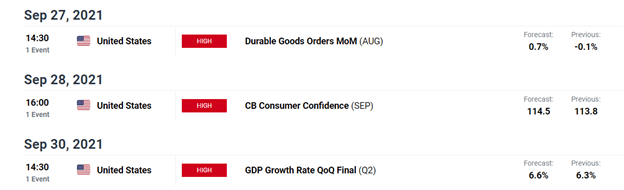

Although US Dollar weakness may continue to support the bearish trend for now, rising geopolitical tensions combined with next week’s fundamentals, which include US CPI (consumer price index), consumer confidence and manufacturing data, may still result in heightened volatility, driving prices in either direction.

DailyFX Economic Calendar

USD/CAD Technical Analysis

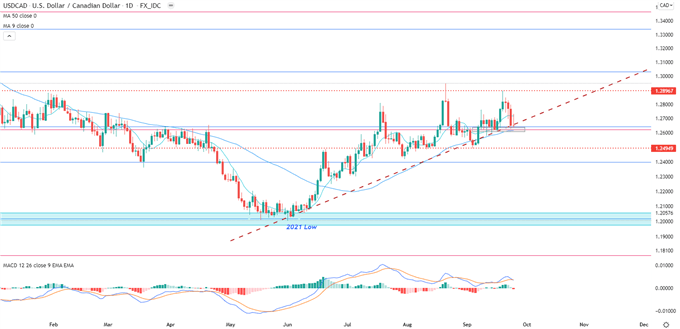

On the daily chart below, USD/CAD has been trading in a well-defined range between the levels of 1.25 and 1.29. With price action currently trading above the 50-period moving average(MA), the moving average convergence/divergence (MACD) remains above the zero-line.

At the time of writing, USD/CAD currently remains bound to a critical level of support holding firm at 1.263. On the technical front, this level coincides with key Fibonacci levels of major historical moves.

To learn more about price action or chart patterns, check out our DailyFX Education section.

The rangebound momentum currently prevalent in the major currency pair could also be a warning of a potential breakout once the systemic trend has been identified.

USD/CAD Daily Chart

Chart prepared by Tammy Da Costa using TradingView

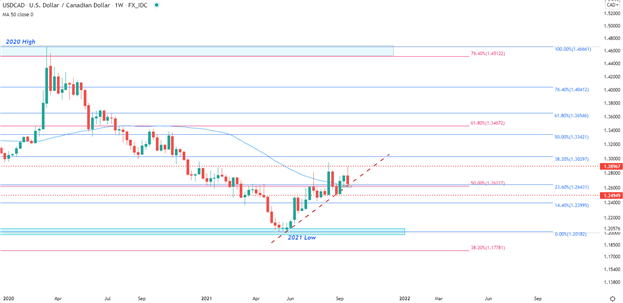

With price action currently threatening to break below trendline support on the weekly time-frame, the developments of Evergrande and commodity prices will likely contribute to both the momentum and volatility for USD/CAD over the next few weeks.

Introduction to Technical Analysis

Technical Analysis Tools

Recommended by Tammy Da Costa

USD/CAD Weekly Chart

Chart prepared by Tammy Da Costa using TradingView

USD/CAD – Key Levels

Given that price action has been range bound and there's a lack of discernible trend, the forecast will be set to neutral, looking for a breach of the range that could occur in either direction.

For now, the critical level of support may continue to hold at the key psychological level of 1.26. A break below this level could see bears retesting the September 2021 low at 1.25, followed by a possible retest of 1.24.

On the contrary, a break above 1.27 could see bulls driving prices back towards 1.28 and a possible retest of the September 2021 high at 1.289.

| Change in | Longs | Shorts | OI |

| Daily | -2% | 7% | 5% |

| Weekly | -30% | 38% | 13% |

--- Written by Tammy Da Costa, Analyst for DailyFX.com

Contact and follow Tammy on Twitter: @Tams707