Australian Dollar Technical Forecast: Bullish

- It was a week of strength for the Aussie as AUD set fresh highs against all of the US Dollar, Japanese Yen and the Euro.

- AUD/JPY broke out from a long-term inverse head and shoulders pattern that was looked at in an Analyst Pick in the prior week. AUD/USD has shown similar strength, and a recent gust of weakness in the Euro has helped to push EUR/AUD down to fresh yearly lows.

- The analysis contained in article relies on price action and chart formations. To learn more about price action or chart patterns, check out our DailyFX Education section.

It was a forceful show of strength for the Australian currency this week as AUD hit fresh yearly-highs against the major currencies of USD, JPY and the Euro. In a backdrop where loose for longer rules the day, the hues of optimism around Australia have helped to bring buyers to the bid, driving the currency so far for much of early-2021 trade and, bigger picture, since the pandemic lows were set last March.

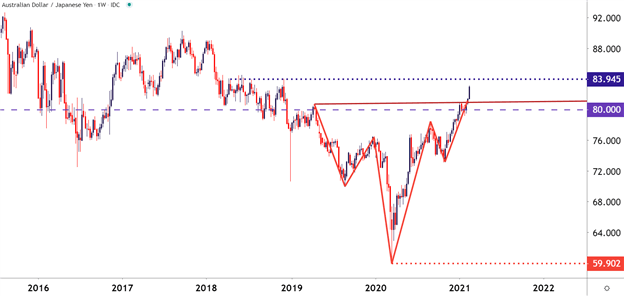

This story could probably be told best in AUD/JPY

The pair was already on its back foot coming into 2020 trade, reeling from a combination of weakness in the Australian economy along with a general hint of risk aversion that had helped to bring upon a stronger Japanese Yen. Of course, with looming trade wars in the background, ‘risk on’ sentiment was difficult to muster at the time, and as the coronavirus began to get priced-in to markets early last year, risk aversion reared its ugly head as AUD/JPY tested below the 60.00 level for the first time since the 2008 Financial Collapse.

That test was fleeting, however, as the psychological level helped to bring buyers back to the bid; and initially, this helped to slow the sell-off.

To learn more about how psychological levels can function as support/resistance, check out DailyFX Education

As the risk trade started to return with gusto in April and May, AUD/JPY moved along with it, reversing those prior losses and beginning to show signs of strength. And that theme largely continued through the 2021 open, at which point AUD/JPY began to find resistance around another psychological level at the 80.00 handle.

This led into back-and-forth price action in January and through the February open, and when I wrote up the Analyst Pick on this setup last week, that gyration had just begun to give way on short-term charts as the inverse head and shoulders pattern that had built on long-term charts began to give way. That breakout has continued to run through this week as AUD/JPY now trades at fresh two-year-highs.

To learn more about the head and shoulders pattern, and how it can lead to breakouts check out DailyFX Education

AUD/JPY Weekly Price Chart: Inverse Head and Shoulder Breakout

Chart prepared by James Stanley; AUDJPY on Tradingview

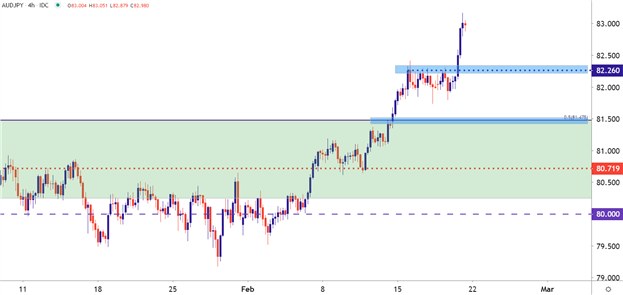

At this point, traders not long AUD/JPY have the complicated conundrum of trying to work with an overbought trend after a fresh breakout. And while there’s been ample motive for the development of this trend, there could be pullback potential into next week, and on the four-hour chart below, I’ve identified two possible areas of higher-low support that can keep the door open for bullish trend scenarios.

AUD/JPY Four-Hour Price Chart

Chart prepared by James Stanley; AUDJPY on Tradingview

AUD/USD Drives Towards .8000 Big Fig

A similar conundrum presents itself in AUD/USD where a red-hot bullish trend has moved into an overbought state, making for a challenging backdrop to those looking to continue that move. But, similarly, pullbacks could be a possible way of moving forward here, looking to institute trend trading logic after the fresh breakout; and below I look into three different areas of possible higher-low support in AUD/USD. The nearest runs from .7820-.7836, with the deeper zone showing around .7708-.7728.

AUD/USD Four-Hour Price Chart

Chart prepared by James Stanley; AUDUSD on Tradingview

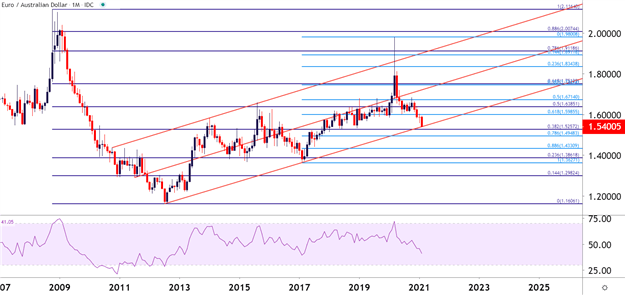

EUR/AUD Moves Towards Long-Term Trendline

While the Euro hasn’t been as generally weak as the US Dollar or the Japanese Yen since the pandemic began, more recently, the Euro has been seeing an increasing amount of pressure. But from this week the big takeaway was just how strong the Australian Dollar was and this reflects well in the EUR/AUD chart.

From the monthly variety below, we can see where a long-term trendline has come into play this week as the pair has pushed down to fresh two-year-lows. If EUR/AUD does hold this line of support into next week, it could make for an interesting reversal play, particularly for those that are looking to fade this recent round of Aussie strength.

EUR/AUD Monthly Price Chart

Chart prepared by James Stanley; EUR/AUD on Tradingview

--- Written by James Stanley, Strategist for DailyFX.com

Contact and follow James on Twitter: @JStanleyFX